Currently this Newsletter goes out around 5:30 AM and with a guaranteed free piece on Thursdays in February.

There are some moves that define an era in technology. I will try and keep this short. This week I noticed two of them in public markets and AI startups:

-

xAI are in talks to merge with SpaceX in the June IPO with a market cap of $1.5 Trillion

-

Amazon is in discussions to invest up to $50B in OpenAI with additional significant sums coming from Nvidia and Microsoft.

The Magnificent seven of BigTech will have major equity stakes in BigAI startups going IPO: OpenAI, Anthropic and xAI.

Elon Musk’s Tesla is supposedly pivoting from being a car manufacturer to a Tech company with a focusing on robotics and even building their own Chip Fab. Tesla depends on TSMC and Samsung, but still faces shortages despite expanding supplier output.

How long before Tesla, a $1.3 Trillion entity merges with SpaceX in a Musk great merge do you suppose?

Michael Burry on Elon Musk recently:

“I wrote of incentivized futurists, and there is none more than Elon. I am glad he is here in America. He will go down in history like PT Barnum and Thomas Edison.” – Michael Burry. – Source context.

Tesla has rapidly lost marketshare to Chinese EV rivals like BYD. Tesla, Inc. released its fourth-quarter and full-year 2025 earnings on January 28, 2026 with its first ever annual revenue drop. Tesla expects spending to more than double this year to more than $20 Bn. while investing $2 Billion in xAI. Tesla is also gearing up production of humanoid robots, part of a series of factory investments. As of early 2026, xAI is burning approximately $1 billion per month.

OpenAI’s human-first social network to compete directly with X will have biometric gating to reduce bots.

Are SpaceX and Tesla AI companies?

Recent reports from early 2026 indicate that SpaceX is indeed laying the groundwork for a massive Initial Public Offering (IPO), with the development of orbital data centers serving as a central pillar of the company’s pitch to investors. This as rival Blue Origin is far ahead in manifesting space-infrastructure projects and datacenters at scale.

OpenAI will go to Space and do Robotics as well

I speculate that OpenAI could acquire Stoke Space or Relativity Space to maintain their compute lead. When Eric Schmidt took over Relativity Space he understood the how key the orbital datacenter race would be with cheap solar power. Relativity Space is a promising 9 year old rocket company and Schmidt took over about 9 months ago.

OpenAI could also acquire a general purpose humanoid startup. The one it’s most likely to acquire as of early 2026 is 1X Technologies. The Norwegian-US company give OpenAI a vertically integrated “physical body” for their models, allowing them to compete directly with Tesla’s Optimus in the home market. They already run a customized OpenAI-model now. Sam Altman, CEO of OpenAI, is a major investor1 in 1X Technologies.

The extra funding from BigTech not only allows OpenAI to survive its valley of death period between 2026 and 2030 when it burns a lot of cash but to make big strategic acquisitions to rival the frontiers of the AI industry.

Meta becomes a new rival to OpenAI by 2027

Since Meta is doubling capex in 2026 from 2025 levels, I expect Meta to emerge as a significant player in Generative AI, both on the consumer and Enterprise AI fronts. They will be able to afford to do this by launching Subscriptions for WhatsApp, Instagram and Facebook with Manus AI benefits upselling their AI services into bundles. Meta plans to test new subscriptions that give people access to exclusive features on its apps where these new subscriptions will unlock more productivity and creativity, along with expanded AI capabilities.

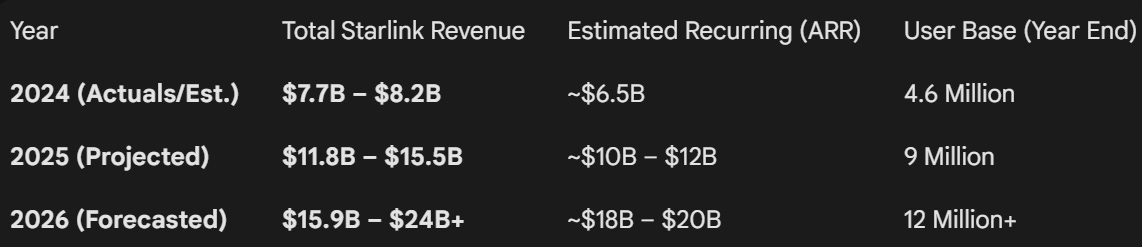

Starlink Revenue powers the Great Merge

Starlink generates about as much revenue as OpenAI does as of early 2026. As of early 2026, Starlink has become the primary revenue engine for SpaceX. While the company does not publicly disclose official financial statements, analyst reports and leaked internal data provide a clear picture of its rapid growth.

Blue Origin that I believe will also go IPO, likely in 2027 or 2028, has its own Starlink competitor that’s more B2B. Blue Origin’s competitor to Starlink is TeraWave, a planned high-speed satellite network (official) designed for enterprise, government, and data center clients rather than average consumers. I also believe a future where Blue Origin merges with Amazon is not outside the realm of possibility. This makes Amazon’s valuation today rather attractive. Amazon is poised to automate its warehouses in the next 5-10 years with a sophisticated system of in-house robotics.

The iPhone is Still King – Blew Me Away 🍎

Apple just announced a stunning biggest iPhone sales quarter in its history.

Overall iPhone revenue surged 23% on an annual basis to $85.27 billion.

This staggering (Earnings) beat allows Apple to do the required R&D and Capex to become a major consumer robotics player in the years ahead. Apple is currently undergoing a significant shift, pivoting away from “stationary” tech toward a future of ambient and mobile AI. This includes an AI pin, smart glasses, and home robotics. It’s coming Tabletop Robotic Hub is its most immediate “robot” release.

Apple is reportedly negotiating with SpaceX to leverage its Starlink network of satellites to provide direct-to-cell connectivity for the upcoming iPhone 18 Pro models.

Elon Musk’s Great Merge 🤖

SpaceX is also considering a merger with Musk’s electric vehicle maker Tesla, as per Bloomberg reporting. Tesla’s energy part of the business is highly compatible with the solar arrays needed in space to power the orbital datacenters. You might recall merging assets is standard practice for Elon Musk. Back in November 2016, Tesla acquired SolarCity in an all-stock deal valued at $2.6 billion, integrating the solar installer into Tesla Energy. While Tesla’s car business has faltered, its energy business is doing great as of 2026.

If SpaceX is becoming an AI company you need the energy to power it. xAI’s cash burn could be on a similar trajectory to OpenAI’s cash burn and thus requires more time and funding to grow. Elon Musk and Sam Altman will essentially compete for AI compute and datacenter supremacy.

Like I have been saying over at Last Futurist Capital, the Generative AI era is a catalyst to new space-technologies and under the guise of national defense spending. This is all about AI supremacy with national characteristics but for planetary long-term goals.

This will mean companies like Google and Microsoft will need to spend even more Capex to compete and consider doing the same. While many of my readers and peers have dismissed my optimism around orbital datacenters as sci-fi speculation and exaggerations, this time it’s actually real. The engineering barriers are minor compared to the energy-efficient benefits. The cost of rocket launches and AI inference will go down tremendously in the 2030s.

The June SpaceX IPO is a major catalyst.

Favorite Quote

“What the Railroad Panic of 1873 and the 1979 Toyota Corolla Can Tell Us About OpenAI vs DeepSeek

Bloomberg reports that Amazon is in talks to invest up to $50B in OpenAI, as part of a funding round could reach $100B, alongside Nvidia and SoftBank. The stated goal is more compute, more scale, and tighter strategic alignment.

The open question is what phase we are actually in. Is this pre railroad panic of 1873 moment, where scale results in overbuild, or a 1979 Corolla moment, where Japan efficiency quietly prevails over Detroit?…”

– Note by of the Newsletter The Metabolist. – Source.

-

Essays on Cognition, AI, attention, and systems under constraint, by Lawson Bernstein.

SpaceX as an AI centric Company

In short, this is why I believe we will see an odd convergence between space rocket firms and AI companies. Starlink revenue will be directly tied to funding xAI’s developments and the capabilities of Grok 5 will tell us a lot. Grok 5 is currently in training on the “Colossus 2” supercluster, which reportedly utilizes over 200,000 NVIDIA GPUs.

Since Colossus 2 reaches peak capacity in March, 2026 that’s when I expect Grok 5, the flagship model of xAI to finally be ready for launch.

What do you think of all of this?

If you found this article interesting, consider sharing it. 🙏 I’m trying my best to spread awareness about the future. AI Supremacy is a Newsletter about AI at the intersection of technology, business, innovation, society, geopolitics and the future.

Highlights

-

The circular financing of BigTech investments (Nvidia, Microsoft, Amazon, Google) picks OpenAI and Anthropic as winners of the LLM makers.

-

xAI and likely Tesla will very likely merge with SpaceX in 2026 and 2027 (Tesla).

-

OpenAI will follow Elon Musk into space (orbital compute) and humanoid robotics. I have predicted which companies they are most likely to acquire in order to do so.

-

Meta will emerge as a new significant rival in consumer and B2B AI services in the second half of the 2020s.

-

Blue Origin will be the first-mover in space infrastructure and orbital datacenters (already in their plans) and rival Starlink with their own similar product.

-

Apple’s rejuvenation of 2026 leads to more physical AI and hardware AI supremacy leading to a better consumer robotics division empowering ambient computing.

-

SpaceX’s IPO in June, 2026 is the pivotal catalyst for more National defense funding and capital allocation to space-technologies greatly lowering the cost of inference and compute due to higher energy efficient orbital datacenters in the 2030s.

-

The weird and wacky convergence of rocket companies, AI firms and Orbital compute with solar arrays is already in the works. Blue Origin the company founded by Amazon founder Jeff Bezos is likely the front runner. BigTech in 2026 is starting to realize they have to follow.

Addendum

I believe there’s a 70% chance xAI merges with SpaceX before the June, 2026 IPO. I’d give it a 65% chance of Tesla merging with SpaceX before 2028. Overall a high chance the combined entity is diversified in AI, energy, robotics and other revenue sources by 2030. SpaceX has a decent chance of being at the frontier in energy efficient compute, Satellite Edge Nodes, Extraterrestrial Computing Infrastructure and orbital compute that forms the backbone of Celestial services (like Starlink)

Starlink is SpaceX’s satellite internet constellation that provides high-speed, low-latency broadband internet access to almost any location on Earth using thousands of small satellites in low Earth orbit.

The OpenAI Startup Fund led a $100 million Series A2 funding round for 1X in early 2024, signaling a strong strategic push into embodied AI by Altman. Sam Altman owns OpenAI Startup Fund, if I had to guess it has nothing to even do with OpenAI directly.

Read More in AI Supremacy