Good Morning,

I wanted to share some of the things I’m watching with regards to the most funded AI startup in the entire world, OpenAI, with all my readers.

This week I’ve been drilling into the numbers and speculating about OpenAI and its future as it prepares for an early 2027 IPO. Full disclosure, I am not certain they will survive what’s about to come. Let me explain my baseline position and expectations.

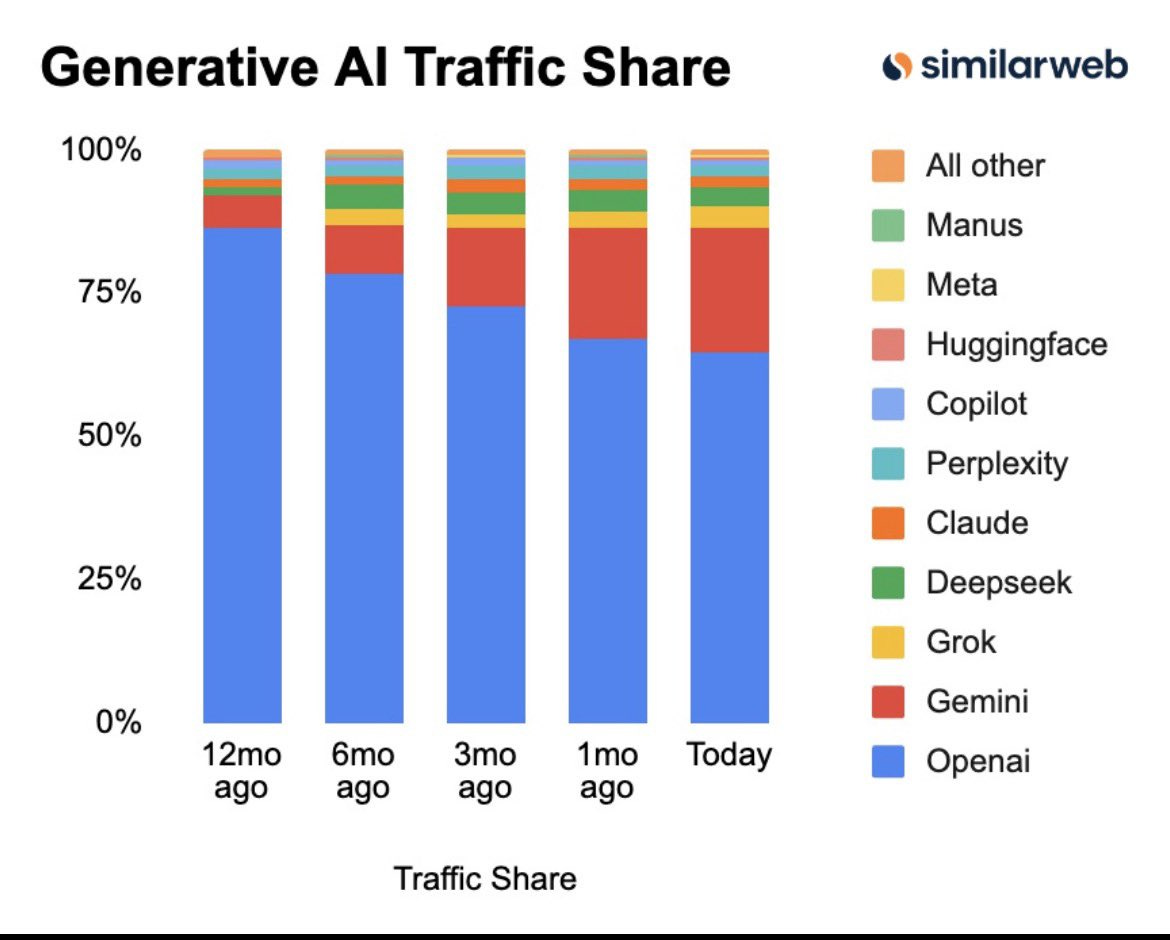

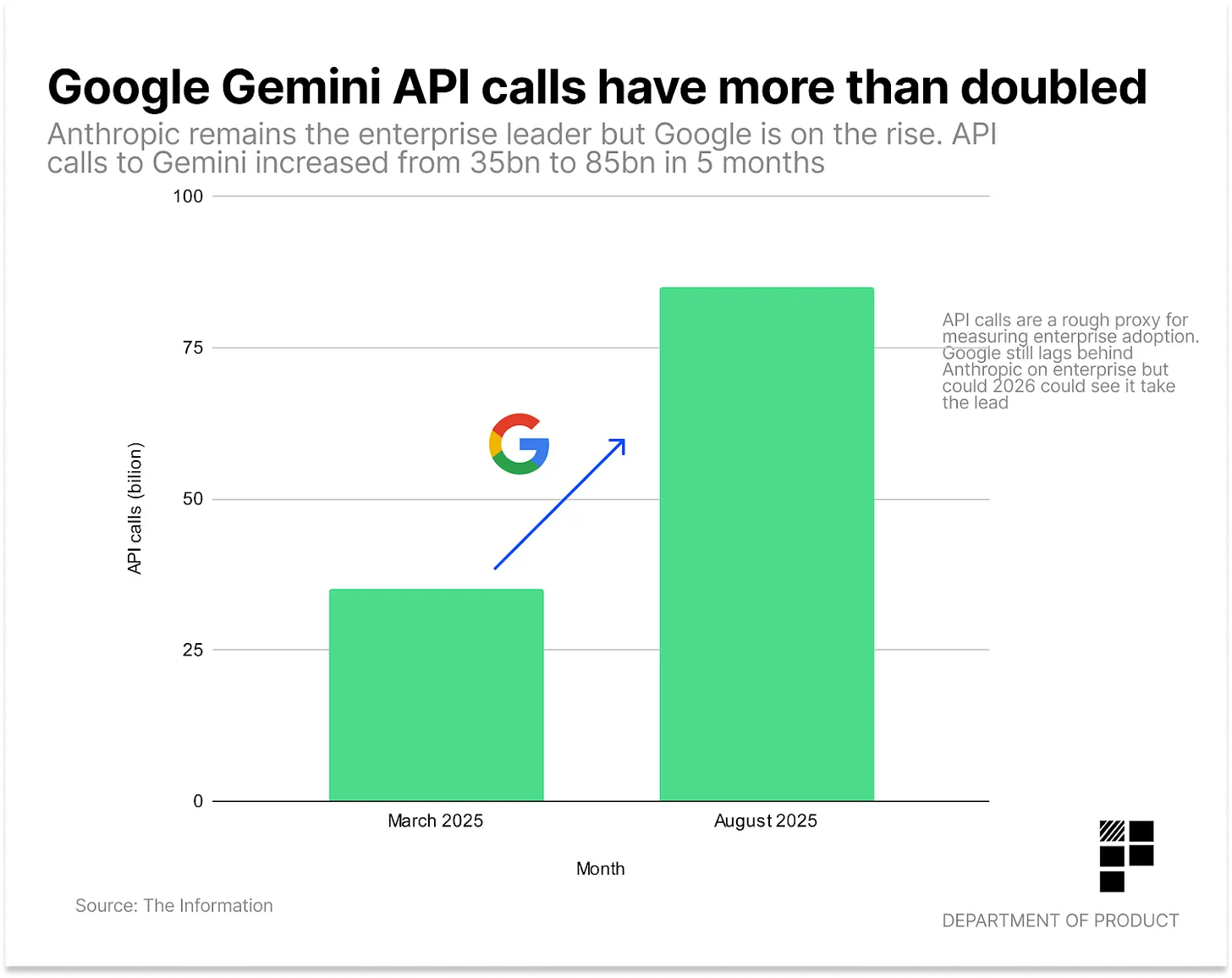

OpenAI as it begins to lose significant B2B API Marketshare and now also B2B chatbot marketshare of ChatGPT compared with Gemini, is starting to come under public scrutiny. Their IPO is likely to be pushed into 2027, less likely a late 2026 date and pivotally after that of arch-rival Anthropic.

Sarah Friar, the OpenAI CFO recently commented in Davos that OpenAI’s enterprise was 30% of the business last year and 40% today (this fact will become important later in my thesis). But they are losing marketshare even as the Enterprise AI market around Generative AI LLMs continues to grow overall. We know that the pie is getting bigger, and that Anthropic and Google are taking a bigger part of it. But where will OpenAI stand when Alibaba Qwen and xAI do their ramp up as well? Meta and ByteDance are prioritizing this now too. ByteDance (the maker of TikTok) and their Vulcano engine (火山引擎, Huoshan Yinqing) is likely to be one of the fastest growing AI clouds.

OpenAI is now in 2026 the Eye of the AI Bubble

If Anthropic goes IPO before OpenAI and with the momentum of Claude Code, they have a tremendous advantage to grow their ARR faster in 2026 along with even better AI coding models focusing on recursive self-improving AI. OpenAI is now a bloated team and are unable to deliver products fast or execute well.

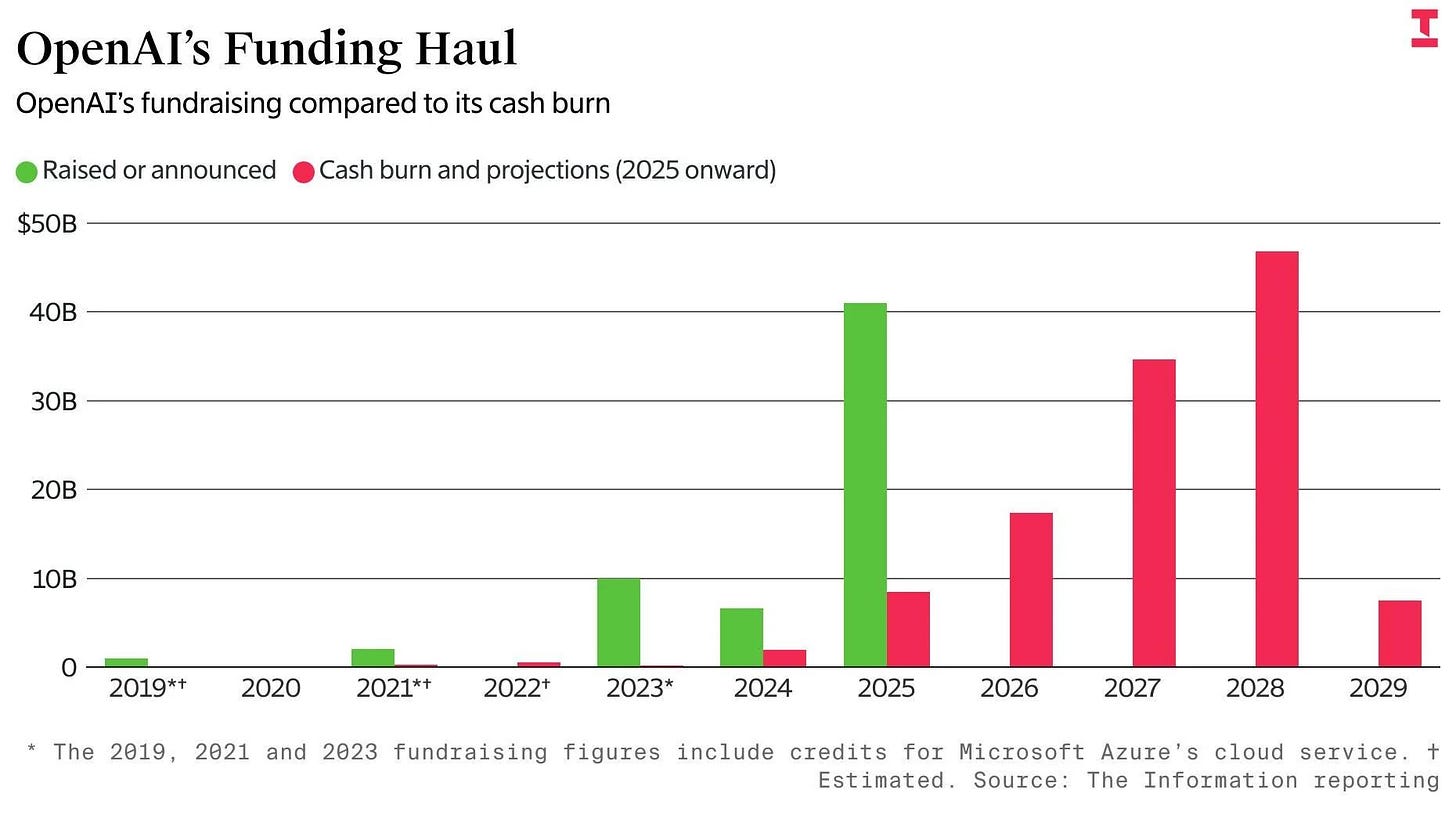

OpenAI is planning Ads, taking a cut of the profits of others, even as they burned a huge amount on Sora, their text to video model and its related app that hasn’t taken off. More apps, Ads and tactics are in the making, but their cash burn will grow faster as their investment in AI Infrastructure outpaces their ARR growth in the years ahead.

Amid reports of circular financing, Oracle debt and, always another funding round mostly from the Middle East, skeptics are starting to chime in a bit louder over OpenAI’s long-term prospects, sustainability and ability to show a real returns to shareholders. Most AI skeptics agree that OpenAI is the eye of the AI bubble. Sam Altman is a legendary Venture Capitalist and broker of deals, but is he CEO material for a company about to go IPO? If OpenAI had a real board, this is the point where I’d hope they were having some real discussions around leadership pedigree.

ChatGPT Users are Migrating to Google Gemini

Gemini continues to take market share now 22% up from 19.5% 1 month ago & 13.3% 3 months ago.

Companies that are likely to continue to put pressure on OpenAI’s first-mover advantage outside of Google and Anthropic vs. ChatGPT and their Enterprise revenue are:

-

Meta (Formerly Facebook, formed Meta Superintelligence Labs in 2025)

-

Qwen by Alibaba –

All of these companies are making significant strides as Research Labs, with commercial scale possibly adding to the competition that OpenAI is going to face way sooner than anticipated. Many of OpenAIs key competitors have AI wearables that will directly compete with OpenAI’s own ChatGPT earbuds expected in late 2026.

Apple Plans AI Wearable Pin

Apple is working on a wearable device that will allow the user to use (Google’s models) AI that will resemble an AirTag. The product is said to be “the same size as an AirTag, only slightly thicker,” and will be worn as a pin, inviting comparisons to the Humane AI pin that never took off. This is not counting the incredible AR/AI glasses Apple and Google are working on that will come out likely in 2027.

DeepSeek that is still working more like a Research lab than a commercial entity is about to launch a few decent models in late February, 2026. Alibaba is releasing multiple consumer apps. Alibaba Cloud launched the Qwen AI app on November 17, 2025, reaching over 100 million monthly active users within two months and over 10 million downloads in its first week.

China’s Open-weight AI startups are producing models that developers and early-stage startups are using for their products. Meanwhile China has given the go-ahead for firms like Alibaba, ByteDance and others to now order Nvidia’s H200 GPUs, a significant upgrade to what they have been using from Huawei. China’s constraints in AI chips and a mature Semiconductor ecosystem have forced them to innovate in LLMs, as well as related software and hardware upgrades.

OpenAI has transitioned more from an AI lab and LLM builder to a product company, but so far its products aren’t really thriving outside of ChatGPT. When you have invested as much as they have in AI Infrastructure, datacenter deals and raise as much as they continue to raise – it’s a major red flag.

OpenAI’s Cashburn and Product Execution look concerning

The period of 2026 to 2030 for OpenAI is often referred to as the “valley of death”. Given that they will IPO will incredible losses and mounting cash burn amid product struggles and tighter and increasing competition. This has been on my mind a lot since the internet has turned against OpenAI in recent weeks. The success of Google’s models relative to GPT-5 models has been stark and Anthropic’s Claude Code momentum seems like it will take the lion’s share of Enterprise AI revenue in 2026 and 2027.

With Meta and xAI likely to become serious well capitalized challengers to OpenAI directly in the consumer space, OpenAI will be facing significant (almost insurmountable) challengers not just named Google or Anthropic. The amount of funding xAI is getting and the amount of capital Meta is allocated to AI is stunning. Even three years after ChatGPT, OpenAI still feels like its starting from scratch. ByteDance and Meta as they ramp up their Enterprise AI efforts, won’t be starting from scratch.

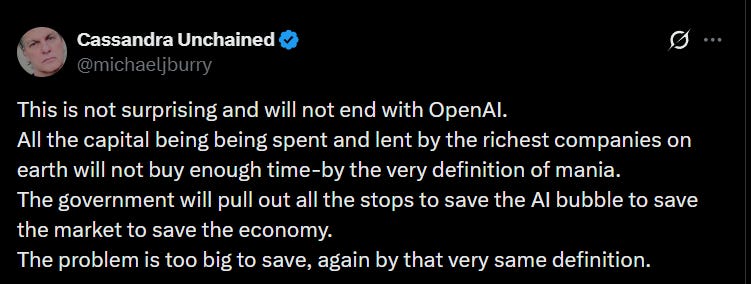

It will be a “make or break” year for such companies, and OpenAI looks particularly “extended,” according to a Deutsche Bank note. Michael Burry in particular, looks especially skeptical of OpenAI’s prospects in terms of fundamentals.

Sam Altman has also been making odd statements in public when questioned about it. For how long will Satya Nadella be laughing about the prospects of Microsoft’s 27% stake in OpenAI? Shareholder dilution is going to burn too. 🔥

‘Enough is Enough’ is not an Answer Investors will like to hear

That video that went viral two months ago, keeps getting air-time (mostly on x) because it portrays leadership that isn’t strong enough to face the challenges ahead.

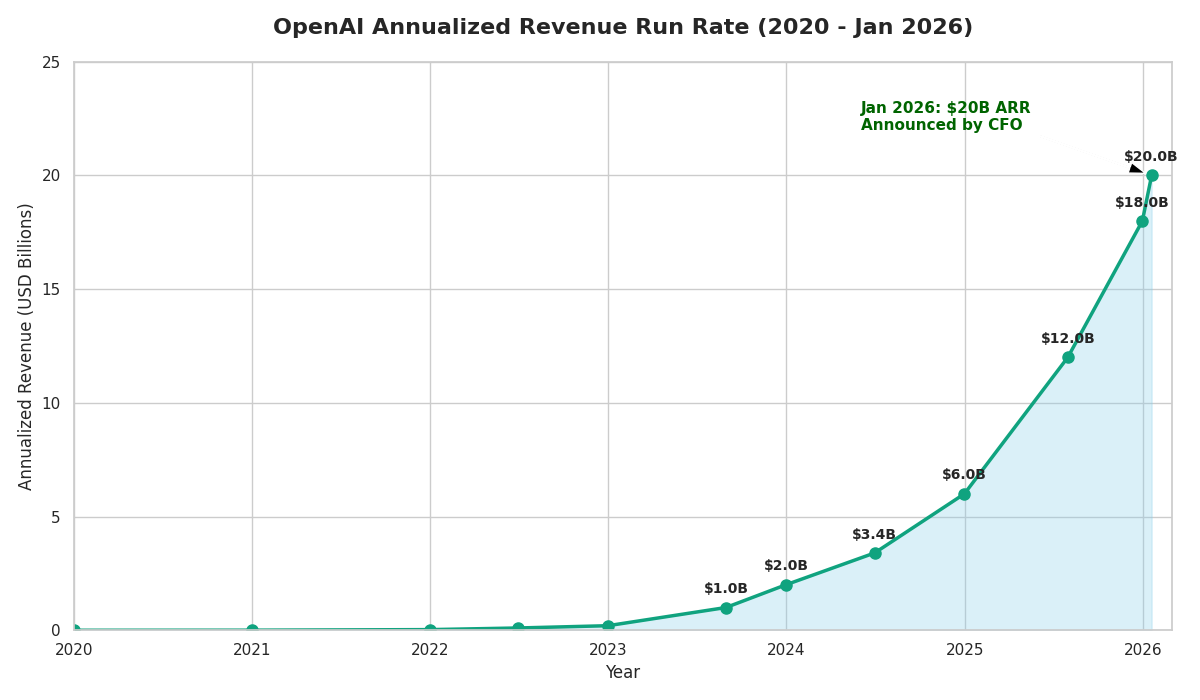

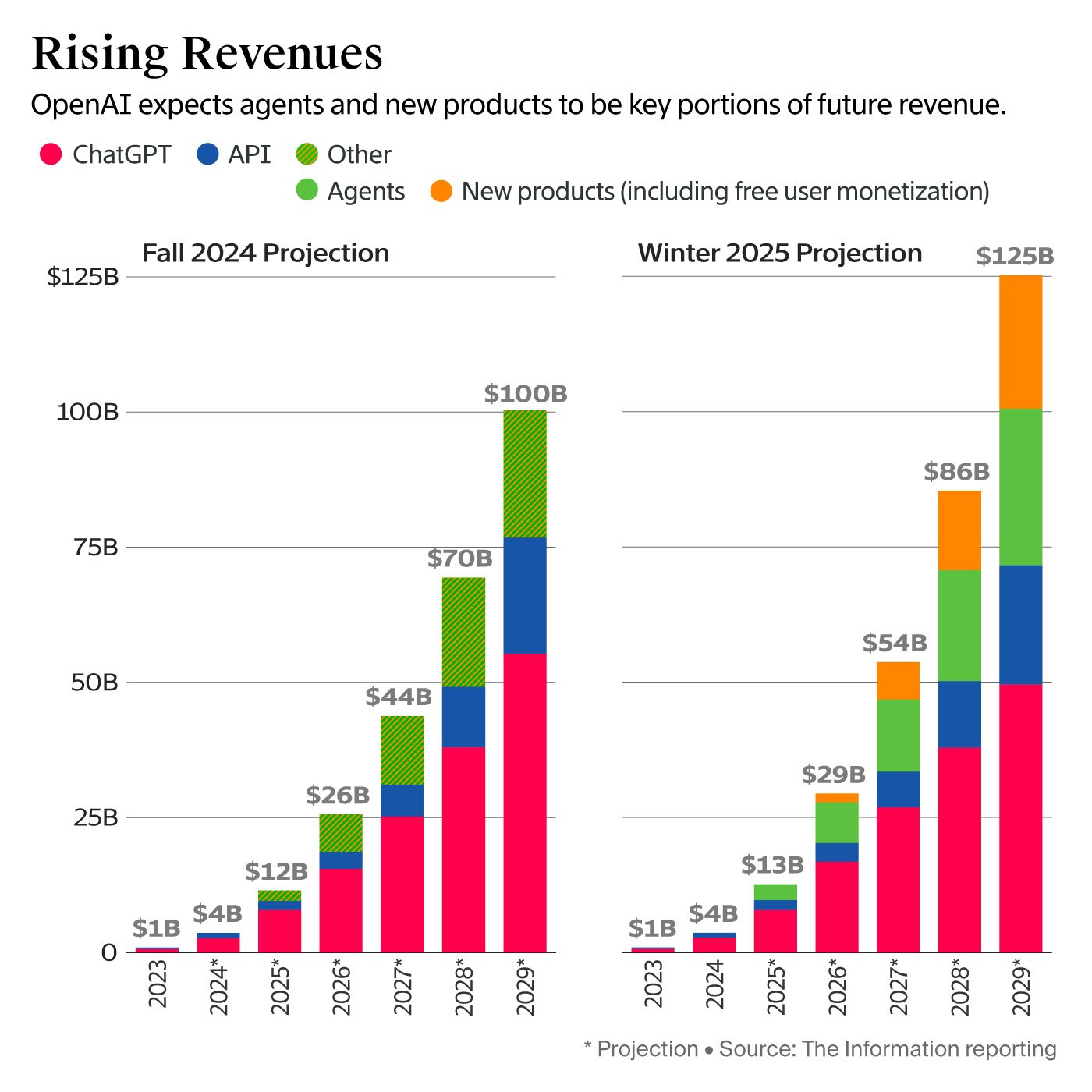

OpenAI’s ARR is increasing though still at an impressive rate. But will it be enough?

I expect OpenAI’s ARR to slow down considerably in its valley of death period, while new winners keep emerging.

OpenAI have already back tracked on Ads

In October 2024, Sam Altman said ads were a “last resort.”

In January 2026, OpenAI turned them on. That’s a fast escalation of going from a Code Red to using a last joker card.

You might recall:

The desperate signs we are seeing from OpenAI means their projections that are continually updated are likely not following their best-case expectations. Moreover, they are underestimating the level of competition they will face and how much marketshare they will even have and by the time they finally go IPO! As they continue to dilute shareholders with outrageous rounds of funding.

OpenAI’s Compute Advantage may be Under Threat in the 2030s

OpenAI could acquire Stoke Space to go to orbital datacenter route, but can they afford it? My wager? They could end up acquiring instead Relativity Space. But competing with SpaceX and Blue Origin here is not only not rational, it’s not possible. Sam Altman doesn’t understand what competing at this level requires.

OpenAI is following a pattern of over-promising and under-delivering on product that I find very concerning with regards to a potential AI bubble. They will go IPO just as xAI, Meta and Qwen are ramping up globally, after an inflated SpaceX IPO that will give Elon Musk even more weight among investors.

Why Space Infrastructure isn’t Sci-Fi

OpenAI’s compute advantage? Elon Musk is expected to push orbital datacenters with the SpaceX IPO and its main rival Blue Origin is a likely winner in major ways. Orbital solar arrays could make OpenAI’s costly energy inefficient terrestrial datacenter projects less impactful. Elon Musk literally said at Davos he’s going to do this. Blue Origin has been working on orbital datacenter for years. With the number of Space-tech IPOs in 2026 and 2027, space infrastructure is going to be far less sci-fi and way more AI supremacy related rather suddenly. More capital will go into solar arrays in space than most people can even conceive.

Meanwhile bottlenecks in U.S AI Infra, energy/electricity, and the latest HB memory chip bottleneck are going to mean delays. The intensity of AI Infra race is also going to ramp up as the stakes get even higher. OpenAI’s staggering fundraising still won’t be enough to give it a definitive advantage in compute, even as in product, models and adoption will begin to lag the growth of significant rivals and new arrivals.

According to Microsoft’s latest financial filings (specifically its FY26 Q1 report for the period ending September 30, 2025), OpenAI has incurred massive losses. Capital burn that’s accelerating faster than revenue growth. We now know that Anthropic is experiencing massive, rapidly increasing compute costs driven by high demand for its Claude models, with expenses sometimes approaching 100% or more of its revenue. This means OpenAI’s margins and their over-intesment in compute and AI infra are going to catch up with them. But the longer they delay the IPO, the worse the (fundamentals) story is going to look. This is essentially because Qwen, Google, Anthropic and others are executing better, and faster, both on LLMs, product and even on compute like xAI. In short, OpenAI is losing most of its key competitive advantages. Early distribution and compute don’t matter, if others execute better.

OpenAI Funding

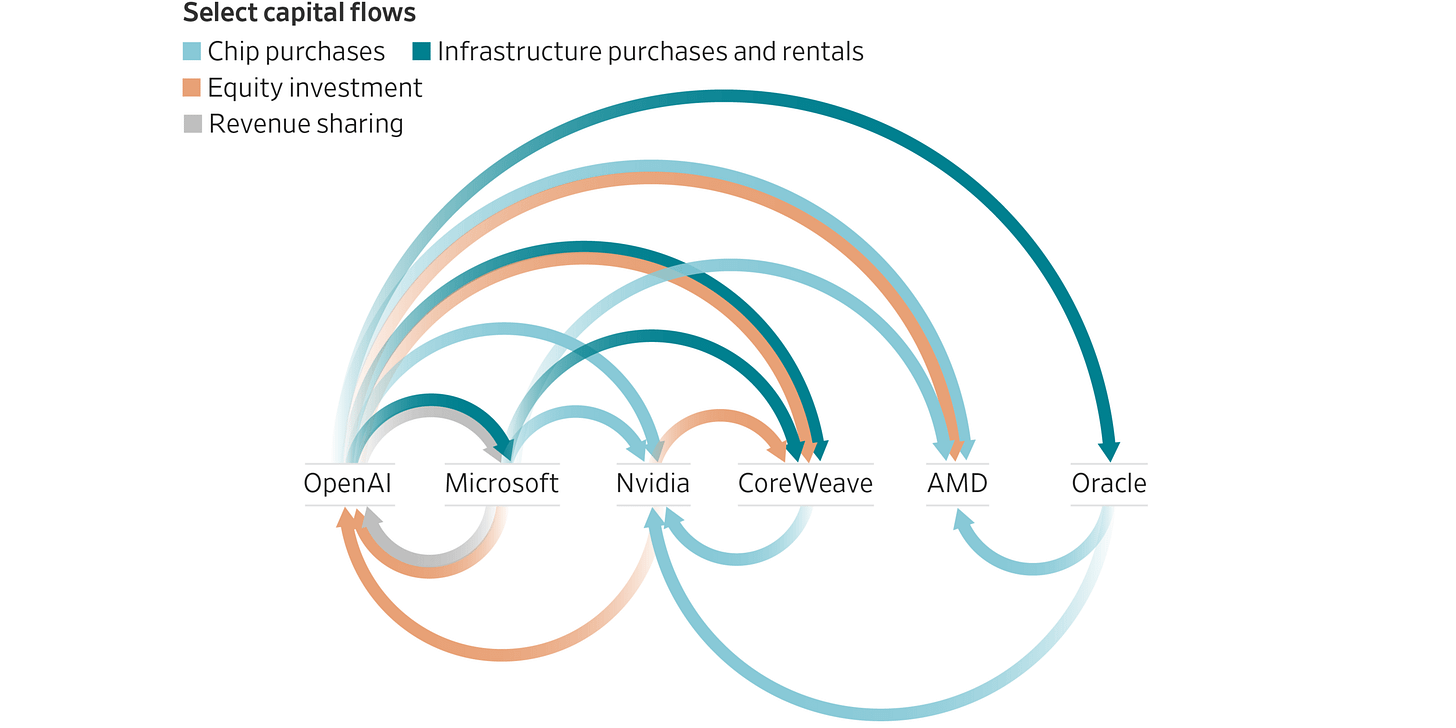

Perhaps most alarming for the AI bubble watchers is the debt Oracle has taken on for OpenAI and OpenAI own funding gambles.

-

As of late January 2026, OpenAI has raised approximately $64 billion in total primary funding.

-

OpenAI is reportedly seeking to raise a massive new funding round of at least $50 billion, with some reports suggesting the target could be as high as $100 billion. This is primarily from Oil money of the Middle East, namely their Sovereign Wealth Funds.

-

Historically first-mover advantages like OpenAI has in Generative AI in previous technological new paradigms is negative, not positive (or good), for eventual outcomes.

-

China’s come from behind story in AI is likely just beginning.

-

Google and Meta have tremendous amounts of capital in order to compete.

-

Anthropic has more BigTech investors: Amazon, Google, Nvidia, Microsoft.

-

xAI can do as much funding as OpenAI has done, in due time.

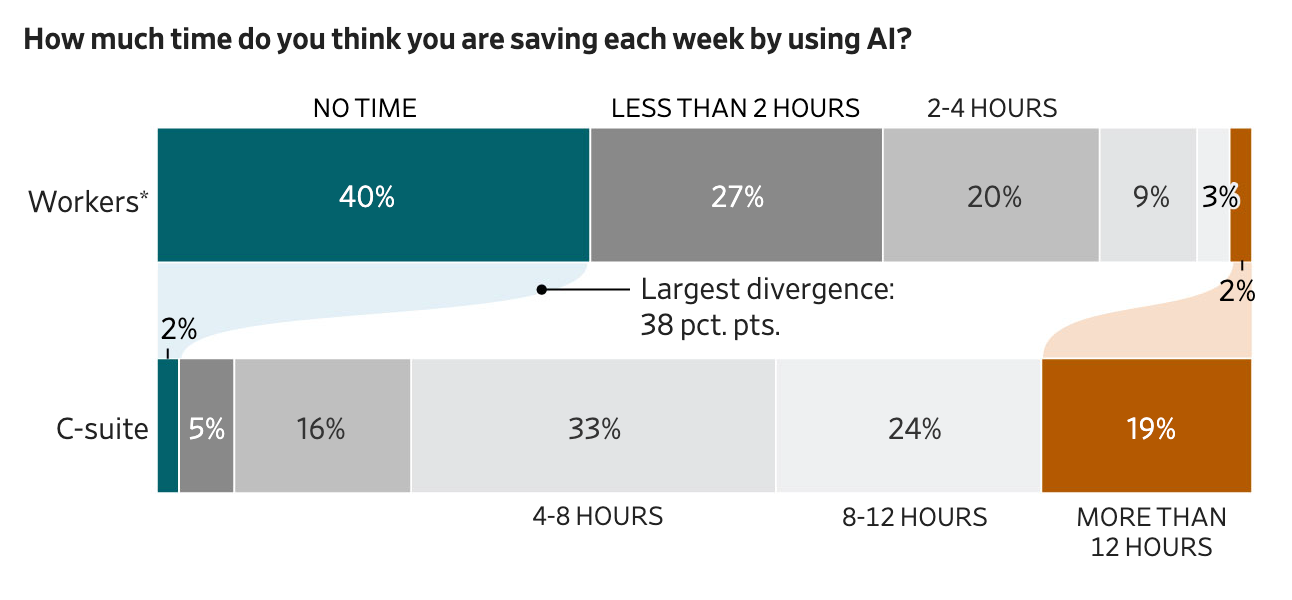

Executives, the financial elite, Venture Capitalists and analysts are way overboard on how “transformative” artificial intelligence and its economic boom will be in terms of dramatically changing how people live and work. The data is saying its in fact much slower and less pronounced in reality. This means OpenAI isn’t just working against more and rising competition, but with more inertia in society in terms of both consumer, work and enterprise adoption.

This likely means that OpenAI capital allocation and funding is mostly wasted capital.

AI Adoption and Diffusion is Slow: Executives Over Promise too

One of the main ways CEOs and executives use Generative AI to save time, is less time on their Email. Personal Intelligence is a newly launched (January 2026) personalization layer for Google’s Gemini AI (most people still use gmail). It acts as a connective bridge between your Google apps—specifically Gmail, Photos, and Search. Thus Google has reached their HER moment before OpenAI that some of us were hoping were working on a real AI operating system, that never seemed to materialize.

Gmail has over 1.8 billion to 2.5 billion active users worldwide, making it the world’s largest email provider. That’s roughly 27% of internet users globally.

AI’s Productivity boost, work adoption and public perception all in question

CEOs and executives have financial incentives to exaggerate the capabilities of AI. 40% of workers say Generative AI has not saved them time at all.

Time, efficiency and by the way – where is the ROI?

The problem of hype vs. reality is that reality always catches up with perception and public knowledge eventually. If Generative AI even leads to an eventual return on investment (ROI) is still open for debate. OpenAI didn’t just over-invest in compute, they over invested in PR and communications. But pretending isn’t the same as doing. as many of these child-like Billionaires are finding out. You can have a baby-face like Altman or Wang, but we can see when they are over their head. Alexandr Wang somehow is a big-shot now at Facebook (Meta) with way too much responsibility and salary for his 20-something experience and abilities. Nor is his approach at all even compatible with Zuck. We’ll talk about Meta’s AI issues another day.

Workers Disagree with Executive and CEO Exaggerations on AI

Generative AI adoption hasn’t taken off like OpenAI expected and they over invested in ChatGPT, versus building a real ecosystem of revenue generating products. By the time they course correct, it will be too late. OpenAI is not built to compete with research labs and product teams with more talent and more money. With more access to capital than even Sam Altman. Momentum does not trump existing ecosystems and incumbents will only get stronger. All at a time when OpenAI’s momentum has dried up.

AI Supremacy isn’t just a story of the United States vs. China, but of the pace of innovation altering the landscape in sometimes unexpected ways. OpenAI is going to be a casualty of dreaming too much, and doing too little. The AGI gimmick was fun, but ultimately was not a sustainable strategy to rally a team to build incredible products. OpenAI invested in huge public relations and communications teams, but what happens when you are in the limelight for all the wrong reasons? Sam Altman is a perfect example of how not to lead a technological revolution.

OpenAI’s Circular Deals

Circular financing deals are great when you are Nvidia who have a global monopoly on the one thing everybody needs, the best AI GPUs with crazy high margins. Not so great when you are just another chatbot maker like OpenAI with rising compute bills without the revenue to pay for it. Read negative margins.

OpenAI in early 2026 face nearly insurmountable odds as an early AI startup in the years and decades ahead. Meta poached a considerable amount of their talent in 2025. Anthropic has better talent and retention. Google has a full-stack and ecosystem advantage. As the Enterprise AI pie gets larger, OpenAI’s share of it will only continue to decrease. By 2028, it’s unlikely OpenAI will be a major player in B2B and AI for businesses, or a favorite for developers. OpenAI doesn’t have real scale or experience in building or marketing apps. Nor in hardware. Nor in building anything outside of ChatGPT.

API calls to Gemini models more than doubled from around ~35 billion in March 2025 to ~85 billion in August 2025:

The Diminishing Returns of being a Spectacle ✨

As OpenAI loses relevant marketshare in Enterprise AI, they will fight over for consumer scraps literally against the top AI consumer makers in the world like ByteDance, Meta, Apple and Google. That’s not a winnable story.

We can debate if OpenAI is the Netscape, WeWork or Altavista of Generative AI. Whatever it is – it has considerable favor in the Trump Administration via Peter Thiel connections. The U.S. Government investing into OpenAI (to “save it) wouldn’t surprise me given how Trump operates and who his real masters are. But like Intel, that also won’t save OpenAI. There’s no remedy for poor execution at this level. OpenAI should be thriving with the absurd traffic advantages it has had with ChatGPT for the last three years, but somehow, it isn’t.

These my friends are the signs of an AI Bubble. But there’s also more peculiar intrigue in the story.

Betraying former Colleagues and OpenAI’s Drama

Watching how Sam Altman is treating Mira Murati of Thinking Machines is also very sad. Barret Zoph shared property info with outside parties presumably OpenAI and has now been poached along with some of his team. The co-founder, Barret Zoph, was hired Wednesday by OpenAI, along with two other Thinking Machines employees, Luke Metz and Sam Schoenholz.

But this shows yet another ugly side of Sam Altman’s behavior as a dirty player. The historical drama at OpenAI aren’t exactly not on the public record. It’s these personal details of questionable morality and manipulative behavior that ultimately will contribute and lead to the downfall of OpenAI. On November 17, 2023, OpenAI’s board of directors ousted co-founder and chief executive Sam Altman, and if the OpenAI team and Altman would have accepted the decision, OpenAI might have become a sustainable winner. It could have been saved. But with the bizarre reversal, OpenAI would go on to lose too much key talent. The writing was already on the wall.

Zoph reportedly admitted to Murati that he had a romantic relationship with a junior colleague that began while they were both working for their previous employer, OpenAI. OpenAI not only poached Zoph but promoted him placing him in a key position to lead their failing Enterprise push. Zoph was previously the vice president of post-training inference at OpenAI from September 2022 to October 2024. It’s all these acts of desperation in the life and choices of Sam Altman that shows just how doomed OpenAI truly is. OpenAI ending up poaching so far, at least nine people from TML (Thinking Machines Lab).

Zoph is becoming an executive in a mission critical side of OpenAI’s future in which he literally has no previous experience. OpenAI launched its enterprise-focused ChatGPT Enterprise product in 2023 more than a year before Anthropic and multiple years before Google but are losing marketshare faster and faster in the B2B segment. This sabotages the entire thesis of OpenAI’s real path to profitability. Zuck did a number on Altman and Altman has now done a number on Mira Murati, who was one of the key leaders responsible for OpenAI’s early success with ChatGPT. It’s just business? OpenAI is subsequently going to get crushed. OpenAI themselves have an especially ruthless and legendary harsh NDAs, but it turns out Sam Altman doesn’t respect the IP of other companies in the first place.

OpenAI isn’t just a bad business, it represents a style of business that is morally bankrupt. They have failed to prioritize trust and saftey, and made multiple blunders that has lowered trust in them and their products not isolated to poor conduct by Sam Altman.

There’s a Fair case to be made that Sam Altman is the SBF of AI

Sam Altman may turn out to be the SBF of AI. Sam Bankman-Fried (SBF) is the founder of the now-bankrupt cryptocurrency exchange FTX and its sister trading firm, Alameda Research. Once a prominent figure in the crypto industry, he is now serving a 25-year federal prison sentence following a high-profile fraud trial. Even the favor of elites can’t protect you if you fail to have good judgement and conduct yourself with questionable behavior of low credibility and shady tactics at key moments. That’s on you.

I’m sorry to the OpenAI fans among you, but I’m not feeling the AGI. But I would love to hear how you think or the bull case for OpenAI inspite of all the odds? The entrepreneur and AI writer favors OpenAI over Anthropic and I know he is not alone.

In a future article I’ll try to make the bull case for this startup as a real investigator. But for now my initial skepticism has turned to mockery and cynicism as more of the reality is now visible to all with regards to the future prospects of OpenAI.

I write AI Supremacy Newsletter, that covers AI at the intersection of business, technology, innovation, startups and society. I hope you learned something new today. If you agree with some of my curation and opinions, and think others need to hear this side of the story be my guest to share it.

Addendum

How might Apple’s AI Pin look?

Apple’s device is described as a “thin, flat, circular disc with an aluminum-and-glass shell,” which engineers hope to make the same size as an AirTag, “only slightly thicker.”

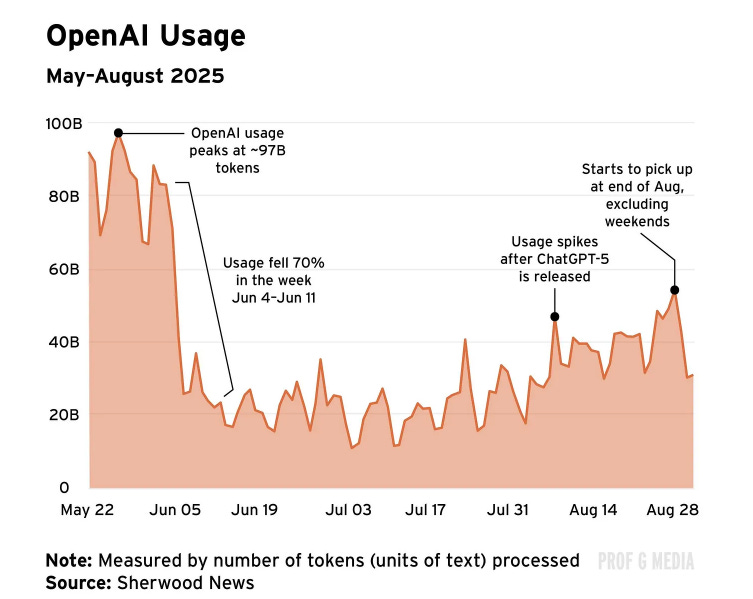

OpenAI’s Usage is likely in a Major Decline Since Mid 2025

-

You could make the argument the vibe coding fad actually hurt OpenAI. As Claude Code emerged as a real winner.

Future winners of Enterprise AI?

Companies like ByteDance and Meta will be making a big push on Enterprise AI in the 2026 to 2030 period. Anthropic, Google and Alibaba won’t be the only winners. Obviously not good for OpenAI’s ARR growth – if as they say this is now 40% of their business.

The sooner Anthropic and OpenAI start their own Cloud computing efforts, the better for their Enterprise AI future. To be viable and build an adequate and real partner network, it’s a must have. Not many signs OpenAI is capable of building a full-stack or ecosystem foundation yet. Without it they would have to overachieve, but currently they are underachieving.

Future of Search

A Perplexity acquisition by Apple is still a possibility. While Perplexity remains private and its CEO has stated there are no plans for an IPO before 2028, the company has become a central target in “Big Tech” acquisition rumors. If Apple had its own search product (not just relying on Google), it would hurt OpenAI further.

OpenAI’s potential in search did not materialize, while Google’s own AI overviews, AI mode and Gemini responsiveness overtook ChatGPT sometime in 2025. You can’t make much Advertising revenue without a legit Search product.

Read More in AI Supremacy