[[{“value”:”

Semiconductors are the alchemy that turns sand into gold. – Jukanlosreve

Good Morning,

If data is the new oil, what are the builders of the most important AI chips?

Established in 1987, TSMC, which stands for Taiwan Semiconductor Manufacturing Company, manufactures chips for other companies

-

Some breaking news I really wanted to cover as TSMC’s expanding investment in the U.S. looks to be a major event in the semiconductor industry in 2025.

-

TSMC is on track to mass produce the first chips on its A16 (1.6nm-class) process technology in late 2026. TSMC is currently expected to begin mass production of 2 nm chips in Taiwan in the second half of 2025 and willing to do so in the U.S. as well, just maybe not in 2026.

-

Meanwhile the joint-venture with Intel appears to be a go! A scenario where TSMC would get a 20% stake in the joint venture.

I asked the talented of the Newsletter SemiconSam, check out his breaking analysis as always here, for his quick-take analysis. We also had a community chat around this news here.

The TSMC Intel joint venture is taking shape in early April, 2025. It has huge geopolitical and semiconductor supply-chain implications.

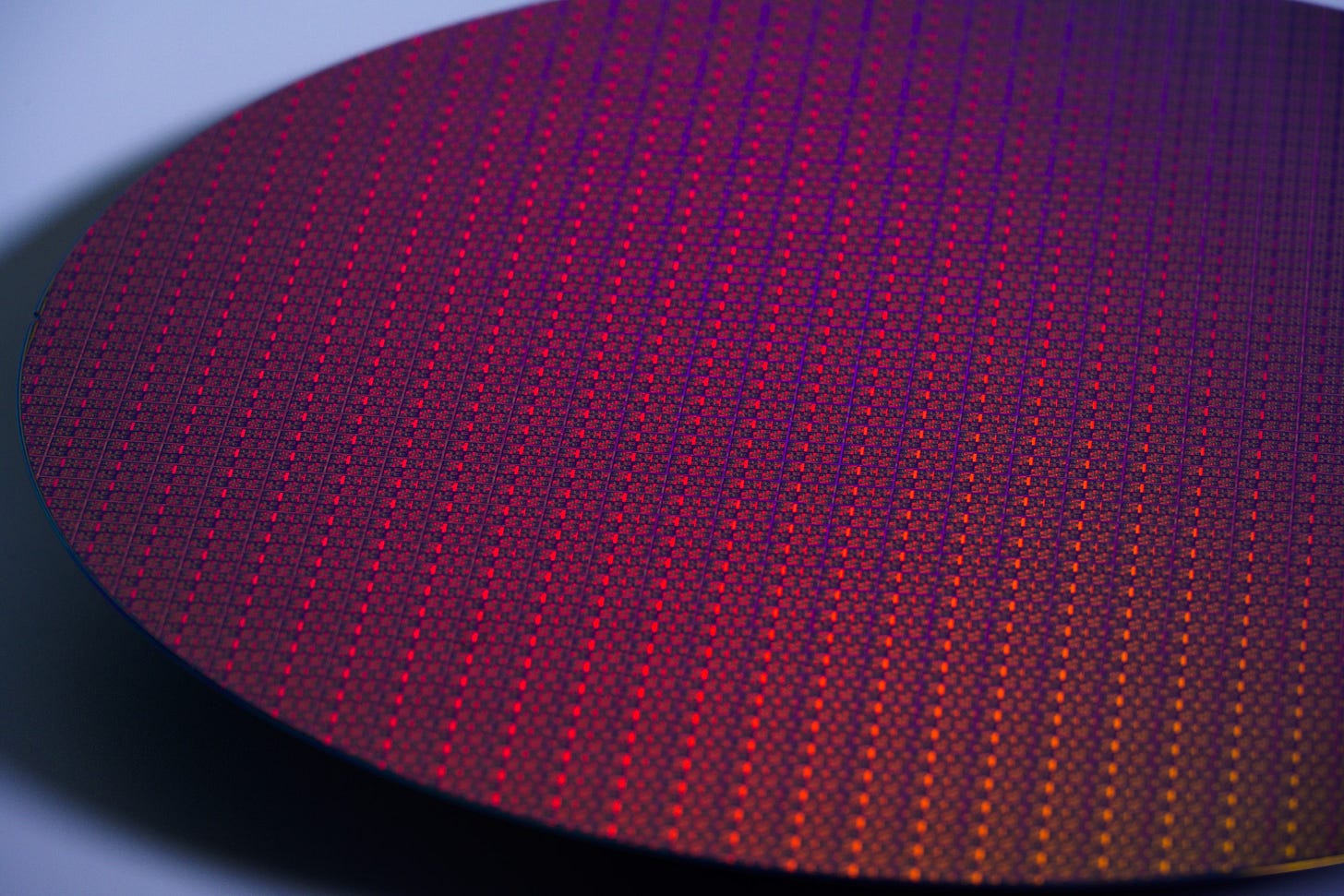

Microchips are the foundation of modern technology, found in nearly all electronic devices, from electric toothbrushes and smartphones to laptops and household appliances.

Building on the company’s ongoing $65 billion investment in its advanced semiconductor manufacturing operations in Phoenix, Arizona, TSMC’s total investment in the U.S. is expected to reach US$165 billion (in the next several years). This is not counting its work with Intel, where Nvidia, Broadcom and AMD are also expected to participate.

The coincides with the Trump Administration’s reciprocal tariff of 32 percent announced for Taiwan on Wednesday reflected Washington’s view that Taipei has high trade barriers.

The A16 process marks an important technology shift for TSMC next year in 2026 and they are clearly in a class of their own. TSMC is the world leader in the best chips.

Recent posts by Jukanlosreve

While there are many Newsletters that cover TSMC and Taiwan’s side of the semiconductor industry, there are way fewer that cover South Korean firms as well. In my opinion is a must-follow for all semiconductor nerds, investors and geopolitical semi watchers, among general AI enthusiasts.

On AI Supremacy, we are increasingly looking into the datacenter and semiconductor industry. The “picks and shovels” that makes AI and advances in LLMs possible.

A semiconductor analyst is born:

“Over the past three (2022-2025) years, I’ve had in-depth conversations with a wide range of professionals in the semiconductor industry. While I wouldn’t call myself an expert, I’ve developed insights and perspectives that are well ahead of the average. As a result, I’ve received research-related offers from several hedge funds and have been cited in major media outlets such as Forbes.” – Jukanlosreve

Why this matters?

-

Intel and Taiwan Semiconductor Manufacturing Company (TSMC) have reportedly reached a preliminary agreement to form a joint venture focused on Intel’s contract chip manufacturing operations.

-

This bolsters America’s DoD reliance and investment in Intel with the White House pushing for the deal with vast geopolitical, semiconductor industry and China relations (tariffs & trade) implications.

-

In exchange for its minority stake of 20%, TSMC would share its advanced chip fabrication processes and provide training to Intel employees. On Friday, China announced 34% tariffs starting April 10th on all U.S. goods additionally it also added 11 entities to the “unreliable entity” list, which allows Beijing to take punitive actions against foreign entities.

-

The White House and the U.S. Department of Commerce have been encouraging this partnership to bolster Intel and enhance U.S. semiconductor manufacturing capabilities at a pivotal cross-roads in Intel’s history.

-

Intel reported 2024 net loss of $18.8 billion, its first since 1986, driven by large impairments. In the past year, Intel’s stock is down over 43%.

-

Intel and other U.S. firms would collectively hold the majority stake, ensuring operational control. Presumably Intel, Broadcom, Nvidia, AMD and TSMC, according to previous reports.

-

So essentially instead of funding its stake with capital, TSMC will share some of its chipmaking practices (expertise, talent, education) with Intel employees and train them.

-

TSMC’s expansion in the U.S. has reportedly raised concerns in Taiwan and the U.S. (who wanted to limited their stake in the joint venture) about the potential (national security) risks associated with such a significant investment abroad. i.e. the Silicon Shield.

-

Taiwan unveiled $2.7 billion in help for companies to deal with the 32% US tariffs that won’t include the semiconductor industry.

Neither are these Intel training measures by TSCM certain, or likely, or necessarily going to stop the bleeding at Intel.

The Intel-TSMC Deal Reveals America’s Impatience to Avoid a Semiconductor “Cuban Missile Crisis”

By March 4th, 2025.

Before diving into my analysis, here’s a detailed timeline of the Intel-TSMC deal:

In January 2025, rumors emerged when SemiAccurate, an independent semiconductor-focused publication, first reported that someone was looking to acquire Intel Foundry Services (IFS).

Later, Citi cited information from SemiAccurate behind its paywall, mentioning that Elon Musk was interested in acquiring IFS.

Dylan Patel of SemiAnalysis hinted at hidden negotiations, noting that private jets belonging to Elon Musk, GlobalFoundries, and Qualcomm were spotted simultaneously at Trump’s Mar-a-Lago resort (source). However, subsequent reports did not mention Musk, suggesting he had withdrawn from the deal.

On February 10, 2025, prominent Taiwanese analyst Lu Hsing-chih cited industry sources on Facebook, stating the U.S. was pressuring TSMC to choose one of three options (source):

1. Announce expanded investments in the U.S.

2. Transfer technology to Intel for free or minimal compensation.

3. Invest directly in Intel.

Ultimately, option 1 was implemented, and option 2 is also expected to be partially realized.

Also, on February 10, I tweeted—based on information from a Taiwanese source—that TSMC would likely form a joint venture (JV) with Intel, three days before Baird’s analyst Tristan Gerra reported the same (source).

On February 13, 2025, Gerra, citing Asian supply-chain sources, informed investors that the U.S. government might actively mediate a JV or encourage TSMC engineers to support Intel’s next-generation 3nm/2nm wafer manufacturing efforts.

Subsequently, nearly all Taiwanese media outlets started extensively covering the TSMC-Intel deal. Digitimes reported the U.S. government’s three proposals to TSMC (source):

1. TSMC builds an advanced packaging facility in the U.S., providing integrated services from wafer manufacturing to backend processes.

2. A joint venture (JV) led by the U.S. government, where TSMC and other major firms jointly invest in Intel’s foundry business, including technology transfer from TSMC.

3. Intel handles future packaging contracts from TSMC’s U.S. customers, leveraging Intel’s advanced packaging capabilities.

Historically, TSMC has shown reluctance towards building packaging plants in the U.S., citing labor shortages, low profitability, and potential impacts on backend partners such as Amkor Technology.

The second proposal—a joint investment—is actively pursued by the U.S. government, emphasizing joint investment by TSMC and major corporations, including technology transfer. Industry insiders see this as a strategic U.S. priority.

The third proposal is realistically feasible, considering that major U.S. companies, such as Apple, already contracting wafer production at TSMC’s U.S. plant, have prior collaboration experience with Intel.

Industry sources emphasized that, amidst the U.S. government’s push for a “Made in America” policy and to safeguard Intel’s survival, TSMC was essentially the only viable solution.

Timeline of joint venture media announcements

On February 15, 2025, Bloomberg made a groundbreaking announcement, revealing that Trump’s team recently discussed collaboration options between TSMC and Intel, with TSMC being receptive. Although discussions remain preliminary, the expectation is that TSMC would ultimately operate Intel’s U.S.-based semiconductor plants, potentially involving key U.S. chip-design firms and government-backed investment in Intel equity.

On February 16, 2025, the Wall Street Journal reported that TSMC and Broadcom were exploring potential deals involving partial or full control over Intel’s chip manufacturing facilities.

Bloomberg added on the same day that these discussions originated during the Biden administration. Biden’s team proposed licensing TSMC’s manufacturing technology for Intel’s use, but TSMC declined, citing competitive risks. Moreover, the Biden administration hesitated to actively intervene in the negotiations.

On February 17, 2025, Taiwanese media reported that TSMC would acquire a 20% stake in IFS, with Qualcomm and Broadcom potentially joining a consortium investment (source).

On March 3, Reuters reported that AMD, Broadcom, and Nvidia were considering using IFS. Then, on March 12, Reuters reported that TSMC proposed the joint venture idea to Nvidia, AMD, Broadcom, and Qualcomm to prevent TSMC from acquiring over 50% of IFS equity. (Later, Nvidia’s CEO Jensen Huang denied receiving such a proposal.)

Finally, on April 3, The Information reported that TSMC and Intel had tentatively agreed to establish a joint venture to operate Intel’s U.S. semiconductor facilities. TSMC would hold a 20% stake, with Intel and other U.S. semiconductor firms holding the rest.

What does all this imply?

I assert that the U.S. is increasingly impatient.

Given the rising tensions across the Taiwan Strait and the risk of war, Washington may view Taiwan’s semiconductor facilities similarly to how President Kennedy perceived Soviet missile bases in Cuba during the Cold War.

Indeed, with the AI revolution heavily reliant on Taiwan’s cutting-edge semiconductors, the stakes today are arguably even higher than in the 1960s. While China’s threat to Taiwan effectively holds America’s critical supply chains hostage, paradoxically, U.S. efforts to prevent China’s access to Taiwan’s chips may have loosened Beijing’s dependency and encouraged more aggressive behavior towards Taiwan.

Consequently, Washington urgently recognized the need to revive Intel. Historically, the fastest method for a lagging firm to catch up has been through technology transfers—essentially, through technology “theft.” Japan appropriated American technology; South Korea followed by appropriating Japanese technology; and China similarly absorbed South Korean technology.

Now, Washington seems intent on acquiring Taiwan’s technology.

Trump openly accused Taiwan of “stealing” America’s semiconductor industry and repeatedly threatened massive tariffs. If you’ve read Trump’s “The Art of the Deal,” you know he’s exceptionally skilled at bluffing—initially taking an aggressive stance to draw opponents into negotiations, seemingly conceding slightly, yet ultimately achieving exactly what he wants.

Trump wielded tariffs and even threatened the U.S. commitment to Taiwan’s defense, compelling TSMC into massive investments in America. Notably, the recent establishment of TSMC’s R&D center in the U.S. is particularly significant, as it implies the relocation of TSMC’s entire semiconductor pipeline—from research to production—to U.S. soil, albeit on a smaller scale. Placing TSMC’s R&D personnel in the U.S. paves the way for potential joint research with Intel.

Furthermore, Reuters’ March 12 report indicated that Washington strongly opposed TSMC holding majority stakes in Intel’s foundry business. Clearly, the U.S. desires TSMC to revive Intel—not absorb it. Such protectionism is bipartisan tradition in the U.S., exemplified when intense opposition arose during ASML’s acquisition of Cymer, an American light-source firm, forcing Intel and others to lobby Congress heavily.

Interestingly, Taiwanese media’s February 12 reports—claiming TSMC would be “handed over” to America—caused a national uproar. TSMC is considered a “sacred guardian mountain,” a symbolic protector of Taiwan’s sovereignty. Many Taiwanese believed that TSMC’s critical role in global chip supply chains guaranteed U.S. protection—the “Silicon Shield.” Thus, news of massive American investments and possible technology transfers to the U.S. deeply unsettled them.

However, in my view, the fate of TSMC has now slipped from Taiwanese hands. Its future increasingly hinges on American strategic interests rather than Taiwanese autonomy.

Korea, despite its critical role in the memory semiconductor sector, faces significantly less U.S. pressure compared to Taiwan—not only due to its robust defense capabilities, but mainly because of Micron, a competitive U.S. memory firm. Conversely, TSMC dominates 65% of the global foundry market and nearly 95% at cutting-edge nodes, with no American equivalent like Micron to compete against.

In short, the lack of a domestic U.S. competitor to TSMC in the foundry space is precisely why Washington responds so anxiously, if not hysterically, toward Taiwan.

Editor’s Notes

The White House’s department of commerce wants to make Trump look good, but the deal might not end up making much sense for Intel’s viability of its foundry business. The deal hasn’t been finalized, and there’s no telling if it will actually come to fruition, but there’s something awkward in how the Trump Administration is dealing with Taiwan and TSMC in particular.

Taiwan tethering itself too much to the U.S. may also pose a serious national security risk for its own Silicon shield, taking away a major deterrent with regards to a potential invasion of the island by China.

Intel’s foundry business may never break even. It’s bleeding cash, posting an operating loss of $13.4 billion in 2024. Intel formerly said it doesn’t expect its foundry business to break even until 2027. By 2027 rolls around, Intel might be unrecognizable after more rounds of layoffs and assets being sold off.

Some Intel executives apparently fear that the partnership could result in yet more layoffs at the company, which cut more than 10,000 jobs late last year and they are probably right. The Trump Administration cannot bring back the past, the history of technology moves too quickly forward. Intel is no longer a peer to TSMC or even Samsung, those days are long over.

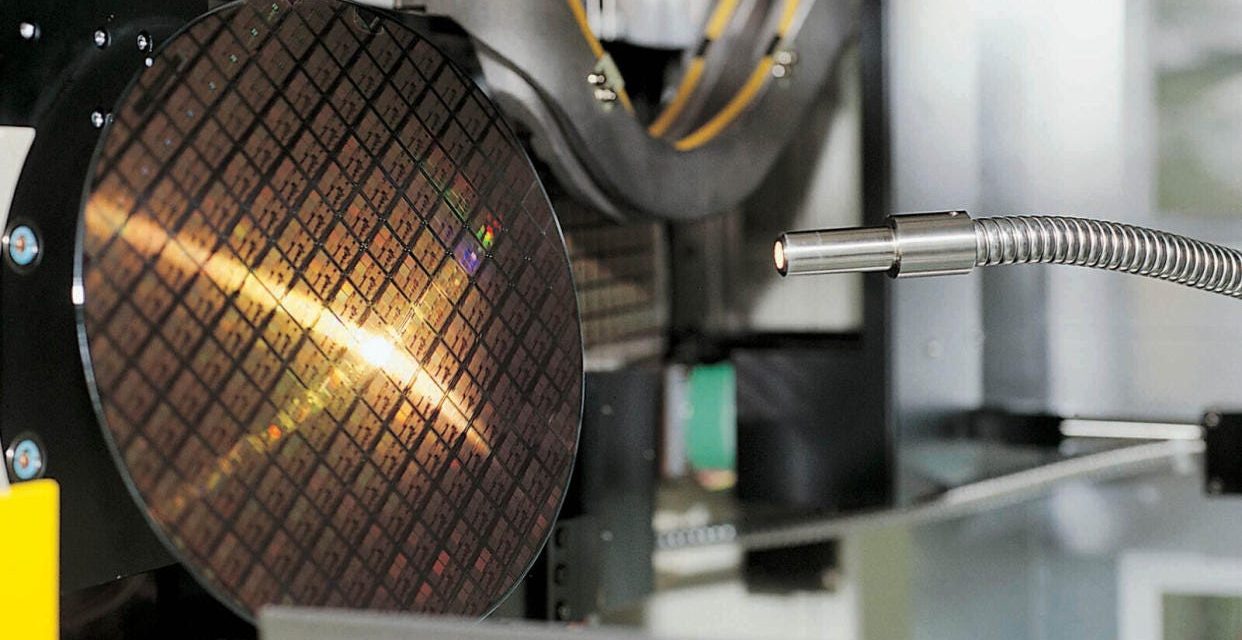

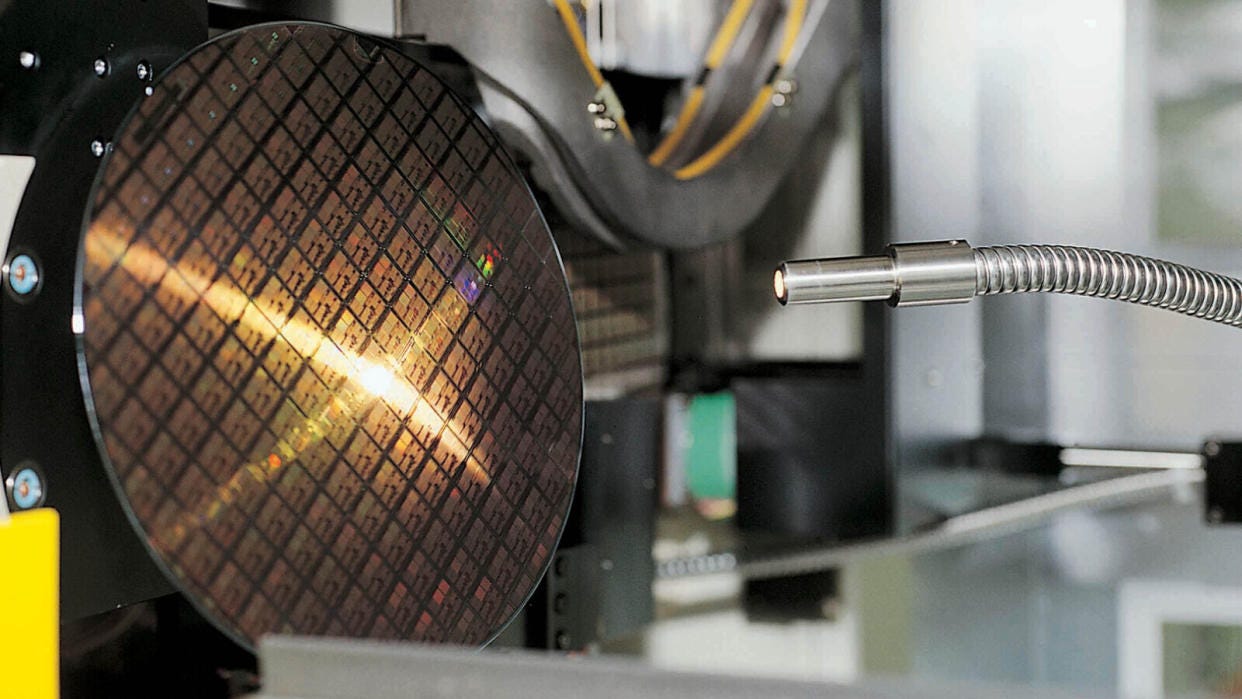

The microchip industry consistently endeavours to pack more transistors into a smaller area, leading to faster, more powerful, and energy efficient technological devices.

On April 1, 2025, the Taiwanese manufacturer TSMC introduced the world’s most advanced microchip: the 2 nanometre (2nm) chip. This signals TSMC is years ahead of the world.

The rumor mill around an Intel-TSMC deal has been revolving for quite some time now, and they are fueled by the fact that TSMC needs to escape Trump tariffs which they have now achieved as of April, 2025. If Intel can continue being competitive as a company is however an open-question.

-

In 2020, TSMC unveiled 5nm FinFET technology.

-

In 2022, TSMC launched a 3nm miniaturisation process based on even smaller microchips.

-

Now in 2025, TSMC will have 2nm.

-

While in 2026, A16 is yet another game changer.

TSMC is likely the world’s most important company due its pace of innovation.

TSMC and Intel are two-way different companies with unique management, workforce, and technology roadmap planning, meaning that fundamentals cannot be merged. Simply having a 20% stake and trying to train them with better working practices isn’t going to save Intel.

If you are interested in the semiconductor News cycle (and its impact on AI) join my Newsletter Semiconductor Things.

🔴 Over to you 🇹🇼

At what point does business and semiconductor frontier technology impact national security given Taiwan’s position between two great superpowers? Read recent Hacker News comments on this story. The idea that Trump’s department of commerce is weakening Taiwan’s Silicon Shield with this deal is top of mind:

Many thanks to the talented Semiconductor observer for his analysis.

“}]] Read More in AI Supremacy