We’re still thinking about some of the most impactful trends in AI in 2025 and moving forward in 2026 and beyond. Kenn So writes an annual AI trends report that this year got really in-depth and longer than ever.

I asked him for a summarized version for the thousands of AI enthusiasts, executives, founders, tinkerers, analysts, builders and curious minds who read this Newsletter. When I share a free Newsletter it goes out to everyone and for five days remains outside of the paywall.

It’s been four years since I started AI Supremacy as my full-time job as a blogger and curator. I can’t continue without your active support, and to fuel the traffic I send and my ability to invite incredible guest contributors that I bring to you each week.

The Newsletter is read by people in 211 countries and by nearly 200k AI enthusiasts, including another 50k followers on Notes (where I share my insights and AI news updates and snippets frequently). Over the past year, we’ve gained 72% more readers to the publication.

writes Generational.

Deeply researched analysis of the business and technology of AI.

If this report was valuable to you, consider supporting the contributing author.

Why read the full deep-dive? 100+ pages covering everything from the macro picture down to scaling laws, with proprietary analysis throughout. There’s also a market map of over 1,800 AI startups, highlighting the top 10% that matter most.

-

Multimedia and PDF versions of the report: link

-

AI agent market map: link or head to the bottom of the article

I’m committed to supporting emerging writers and trying to distribute their hard work to a wider audience. If you think that’s a worthy endeavor, share my articles and restack the ones you think are especially good on Notes, it helps not only me but the deep thinkers I want to support.

I’m aware that many of my readers on Email are not active on the Substack app. For voracious readers I recommend the website to browse will you are doing other work. Categories like Technology, Finance and Politics remain a great way to keep tabs on the world of innovation and the U.S. led backdrop of the capital allocation and to explore future opportunities.

Substack’s web reading experience has been improved.

We live in Generational Times in High Tech 🌊

Works by Kenn So

-

How The AI Bubble Will Burst

-

Essay: Agents at Work

-

How to manage a team of AI agents

By mid-2025, 55% of US adults had used a generative AI product. That’s a faster adoption curve than the internet or the smartphone.

Discover Kenn’s fourth edition of his AI Trends report that he’s been writing since 2022 (before ChatGPT launched).

How will AI continues to impact the labor market?

Employment for workers ages 22-25 in highly exposed roles (software development, customer service) has fallen sharply.

How will AI continue to consolidate in the marketplace?

AI exit activity increased 44% from 2023 to 2025, but the biggest value is going to Big Tech acquirers, not new public companies. Acquisitions Are the Exit Path, Not IPOs. – Kenn So

How will the U.S. solve its energy bottleneck as AI Infrastructure continues to ramp up in the immediate years ahead?

These are the kinds of questions (Tech Nerds 🗺️) people like Kenn, , myself and so many others writing here think about and ponder. You don’t have to be Michael Burry to care about these topics, because they impact all of us.

Around the Horn 📯

My own burning question for 2026: How will the future of AI impact the future of work and our lives?

-

On Evaluating Cognitive Capabilities in Machines (and Other “Alien” Intelligences)

-

First impressions of Claude Cowork, Anthropic’s general agent

-

When AI writes almost all code, what happens to software engineering?

-

17 predictions for AI in 2026

AI Trends: 2025 Lookback and 2026 Outlook

AI Trends: 2025 Lookback and 2026 Outlook

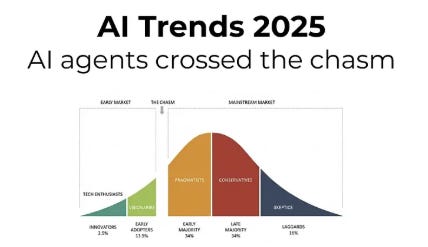

AI crosses the chasm

2025 was the year AI agents crossed the chasm from early adopters to mainstream adoption. Companies moved from experimenting to letting agents autonomously create work. Reasoning models pushed capability to the point where agents match the output of professionals with over 10 years of experience. That capability created measurable economic value. That value drove infrastructure investment. That investment ran into energy constraints. And those constraints created leveraged financial risk.

The same progress in models is also driving new consumer experiences. While much attention focuses on how AI can do work, it has also been helping everyday consumers with daily life. It enables new form factors such as smart glasses and autonomous vehicles.

All of this is driving the rapid growth of leading AI companies, who only a few years after founding have grown to billions in revenue. 2026 is when we’ll see the first IPOs of generative AI-native companies. This piece traces how AI crossed the chasm in 2025 and the path beyond into 2026.

Reasoning Changed What Agents Could Do

The models that defined 2025 were built to reason: OpenAI’s GPT-5, Anthropic’s Claude 4.5, Google’s Gemini 3.0 Pro, and DeepSeek’s R1 all implemented reasoning approaches—thinking before answering—rather than responding immediately.

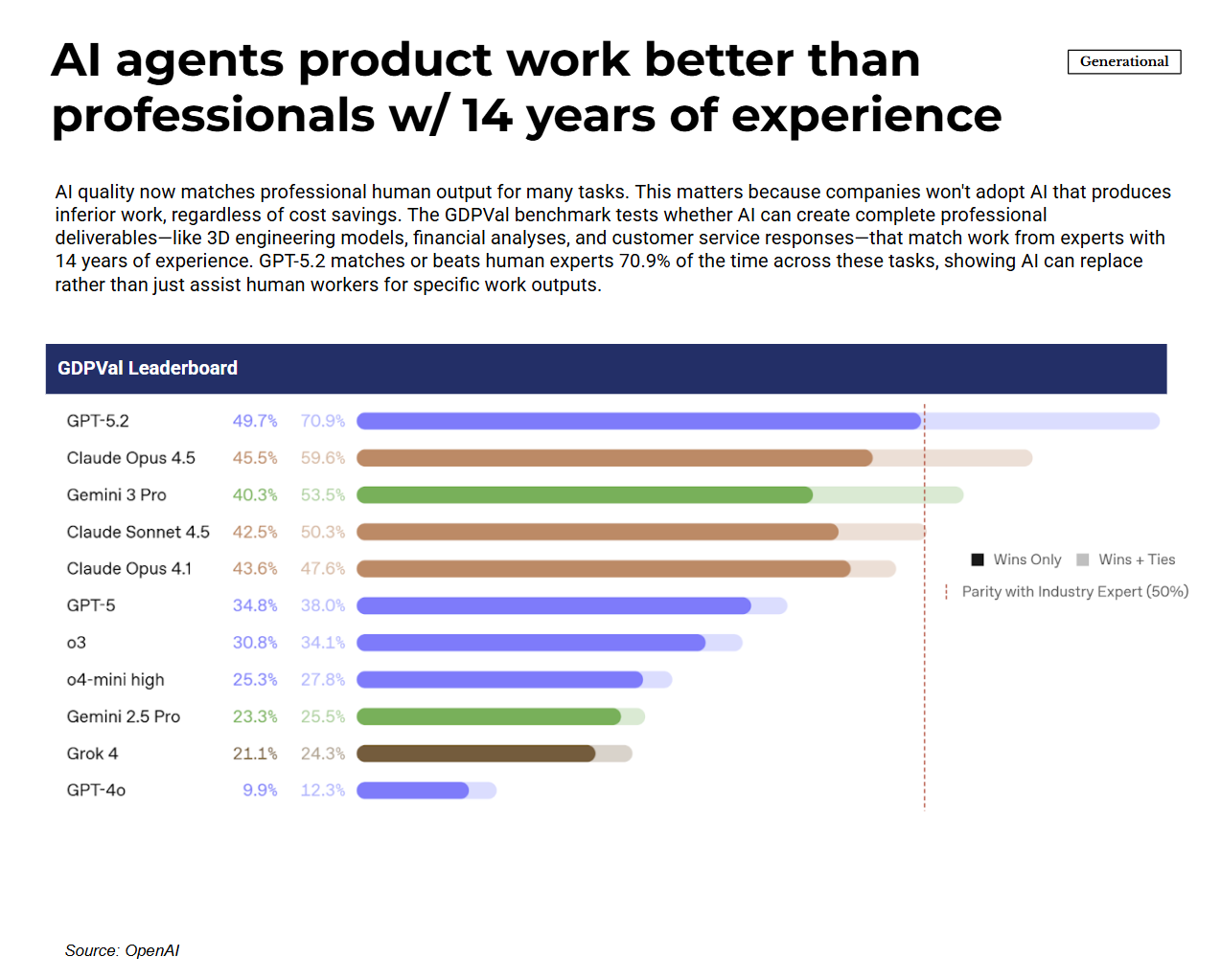

This markedly improved model capability, which showed up in benchmarks designed to measure how well models perform knowledge work. One example is GDPVal, which tests whether AI can produce deliverables that companies would actually pay for: 3D engineering models, financial analyses, customer service responses, and so on. The benchmark encompasses 44 jobs representing $3 trillion in US wages. As of December 2025, the best model matched or beat human experts averaging 14 years of experience over 70% of the time. “Matched or beat” means evaluators preferred or couldn’t distinguish the AI output from work produced by credentialed professionals.

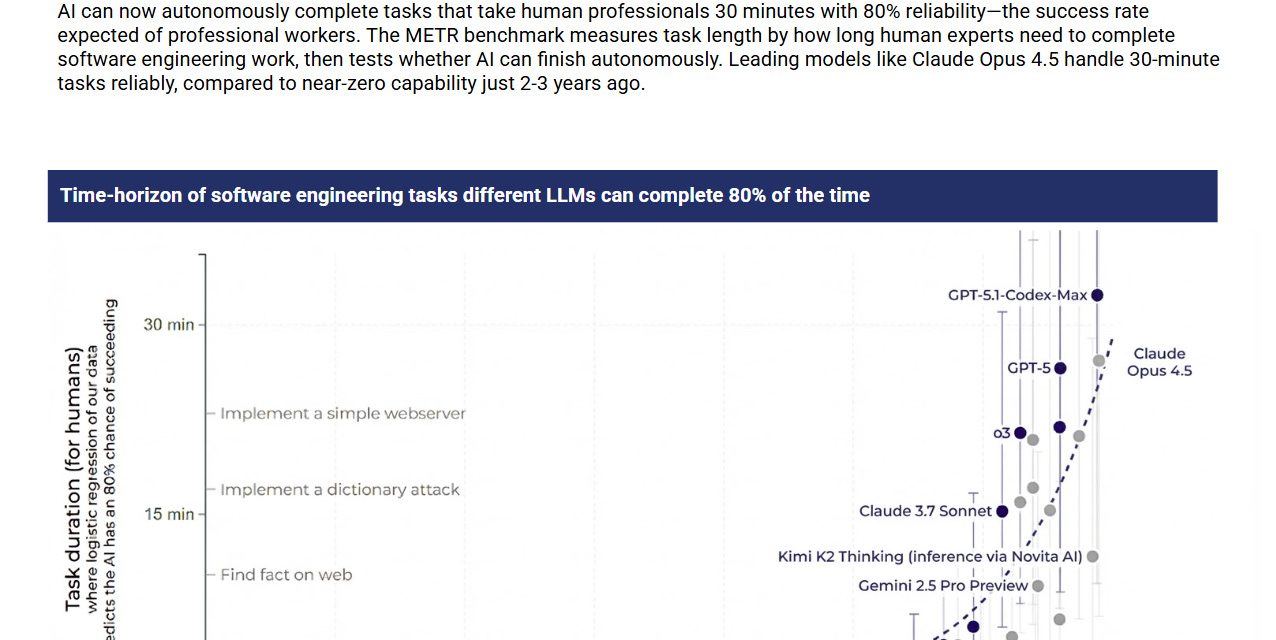

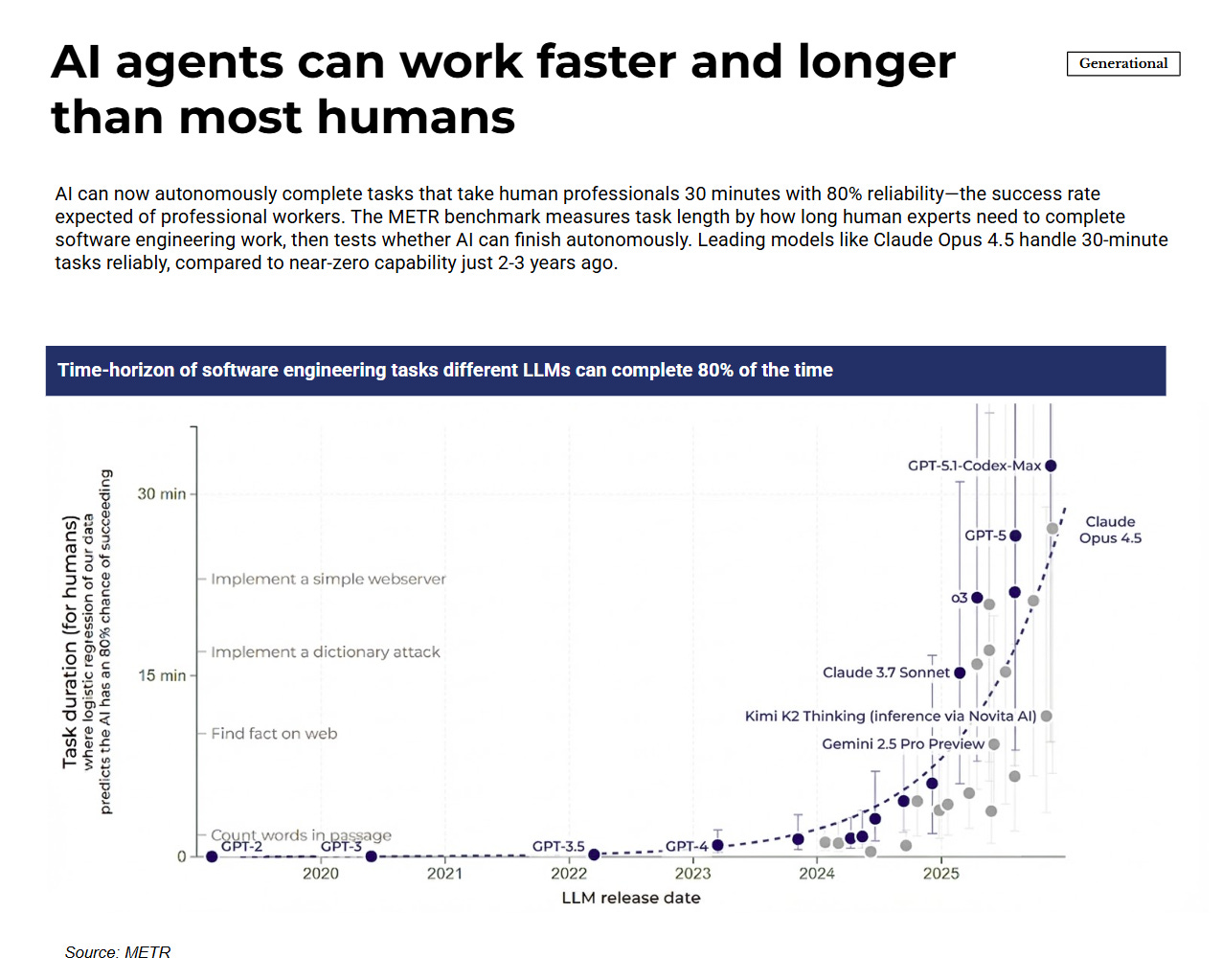

The METR benchmark measures task duration—how long an autonomous agent can work on a software engineering problem before failing. Leading models can now complete tasks that would take human professionals 30 minutes with 80% reliability. Two years ago, the same models could barely handle tasks requiring a few minutes.And thousands of models can be instantiated in seconds to work on projects. Hiring, training and coordinating humans at that scale would take months at best and likely years.

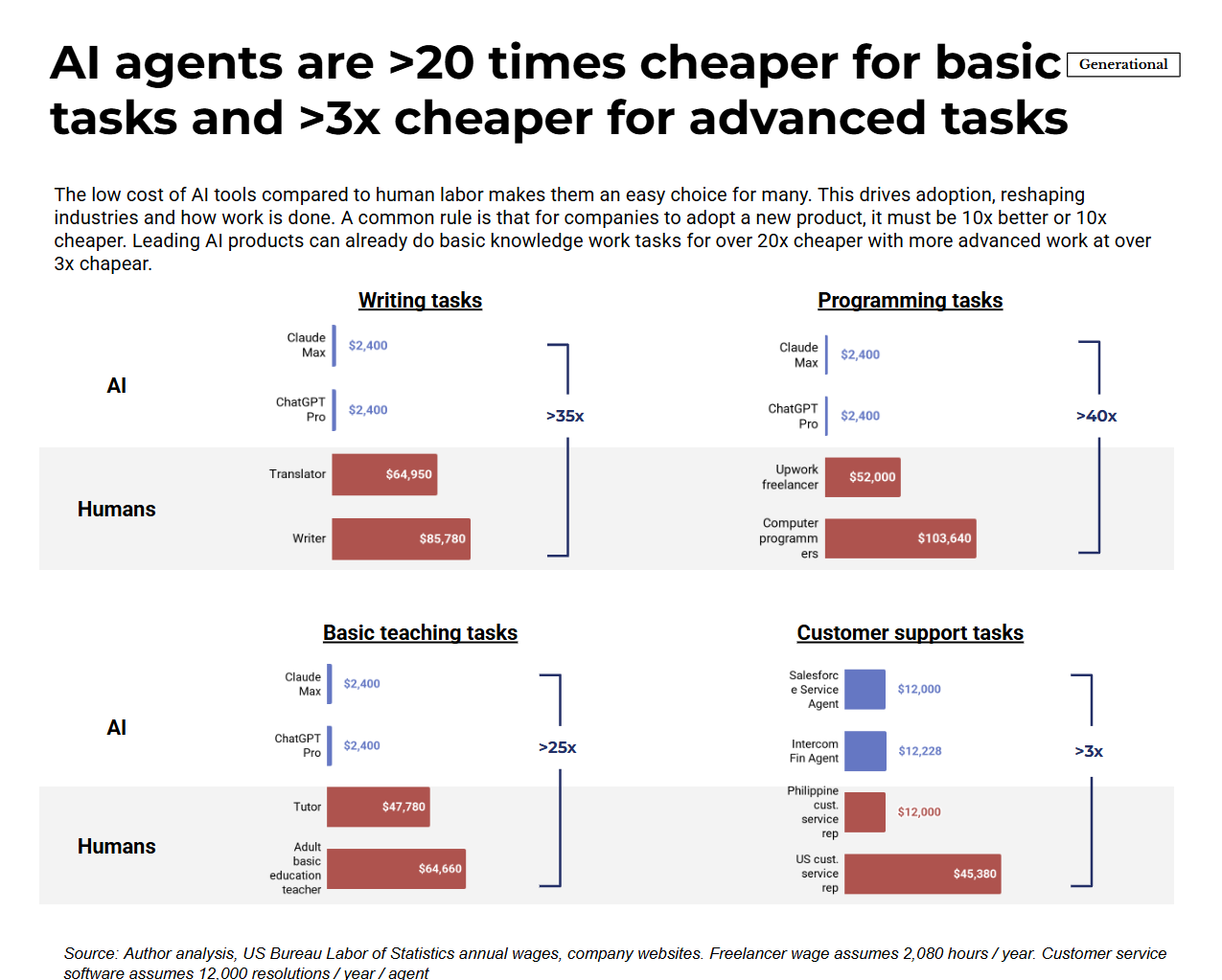

The cost differential compounds the capability gains. For basic knowledge work tasks like writing, teaching, and administrative work, AI agents run more than 20x cheaper than human labor. For advanced work like customer service and financial analysis, the multiple drops but remains above 3x. The 10x threshold—either 10x better or 10x cheaper—that historically triggers enterprise technology adoption has been crossed for substantial categories of work.

The combination matters: agents that match professional quality at a fraction of professional cost and can be deployed at scale. That’s what moved AI from experiments to actual use—in enterprises deploying coding agents, and in consumers relying on AI for travel planning, tutoring, and daily decisions.

Capability Is Driving Value

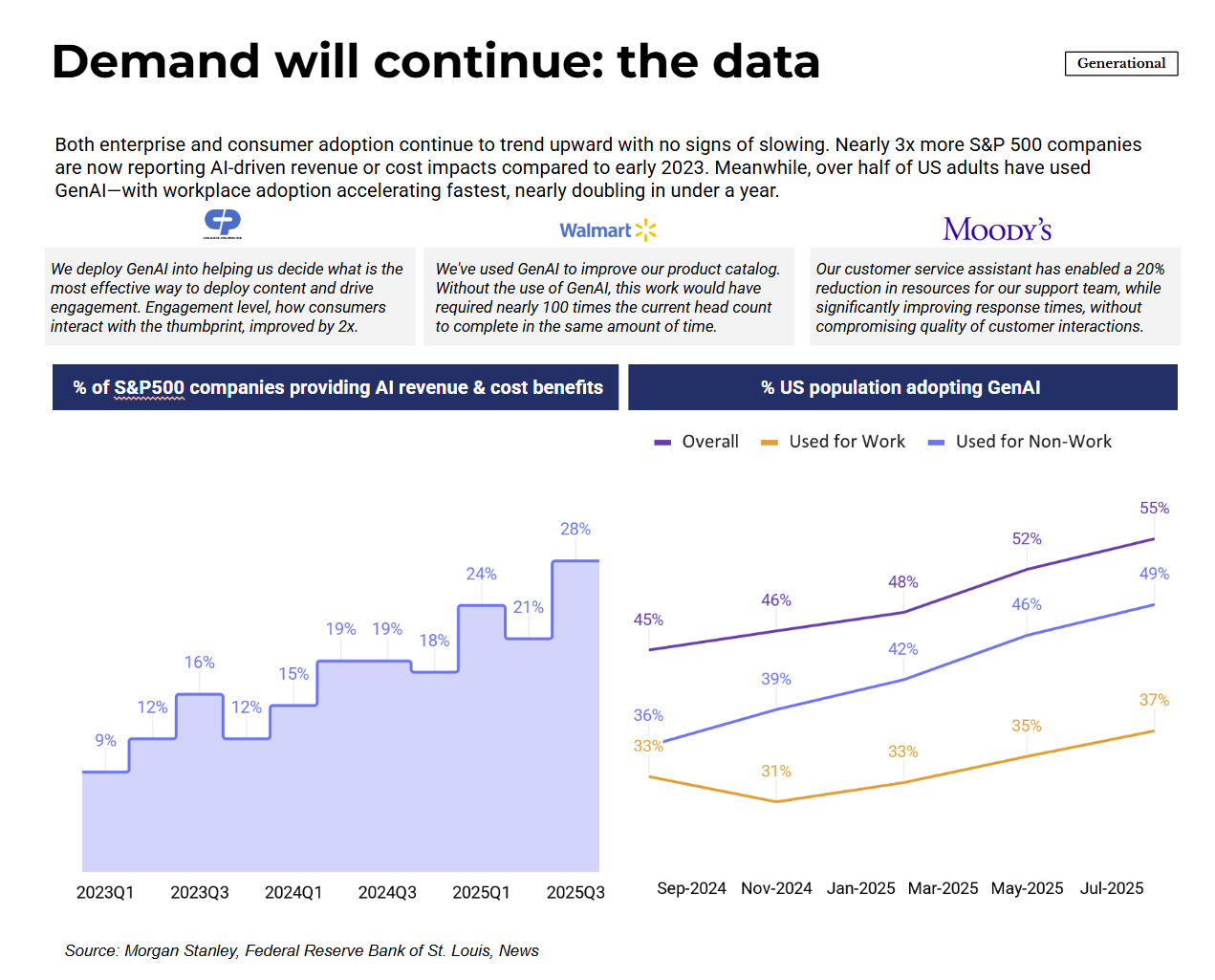

When agents can match professional output at a fraction of the cost, companies deploy them. The evidence showed up in corporate financial disclosures—the share of S&P 500 companies reporting AI-driven financial impact tripled between early 2023 and late 2025, from 9% to 28%. These disclosures carry weight because they’re made under securities law. When Walmart states that GenAI replaced work that would have required 100 times the headcount, or when Moody’s reports a 20% reduction in support resources while improving response times, investor relations teams and legal counsel have vetted those claims.

Source: Morgan Stanley, Generative AI tracker, FRED, company filings

Consumer adoption tells the same story. ChatGPT reached 900 million weekly active users in December 2025. By mid-2025, 55% of US adults had used generative AI—faster adoption than the internet or smartphones achieved in comparable periods. Personal use led the way, growing from 36% to nearly half the population within a year.

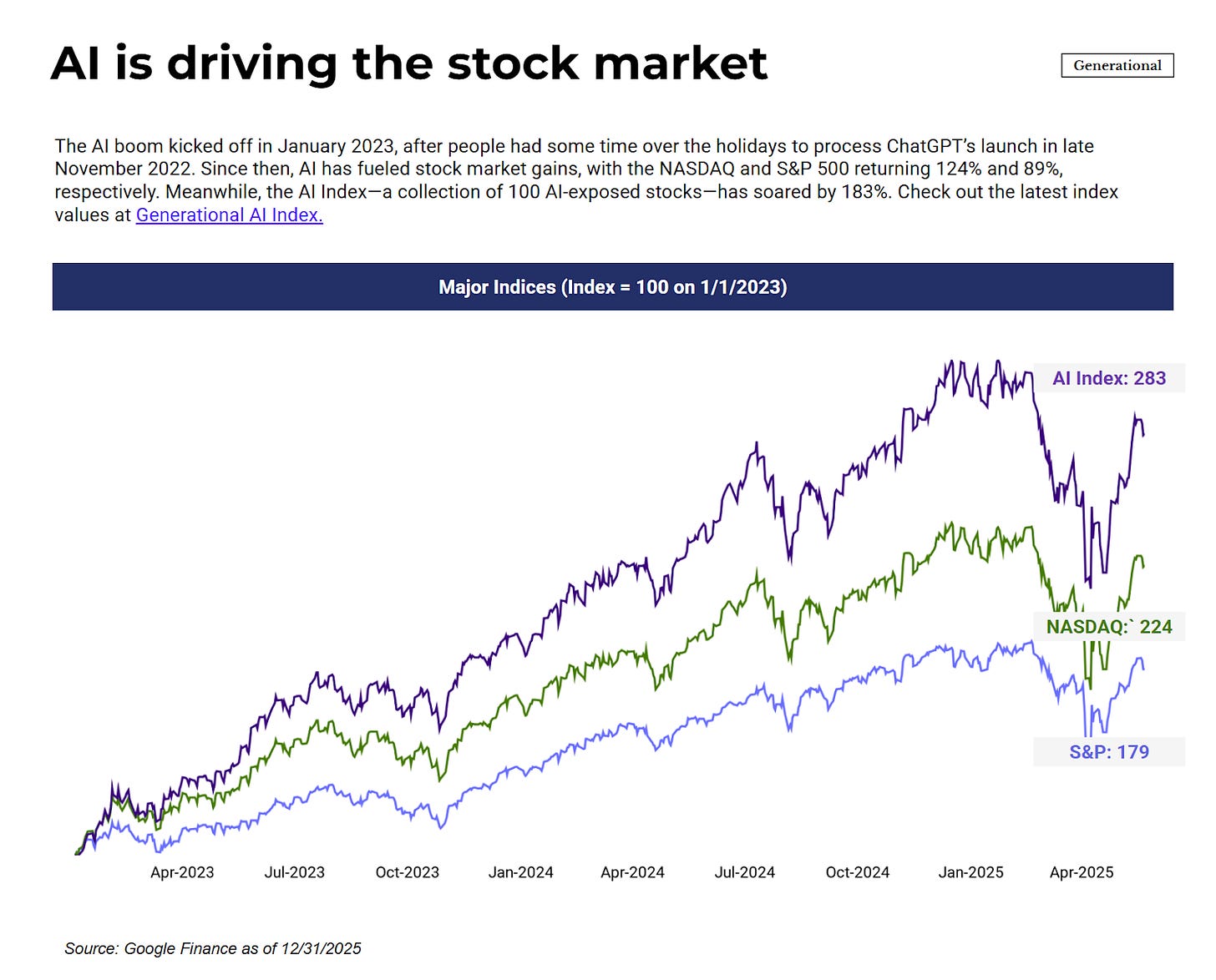

Market returns reflected these adoption patterns. Since January 2023, the Generational AI Index—the top 100 AI-exposed stocks—returned 182%. The NASDAQ returned 124%. The S&P 500 returned 89%.

The market opportunity framing explains why investment continued despite elevated valuations. The global software market totals $915 billion. But AI agents increasingly compete against labor, not just software. AI companies selling autonomous work output are pricing against wage pools, which total $40 trillion globally. This reframes both the addressable market and ROI calculations for investors.

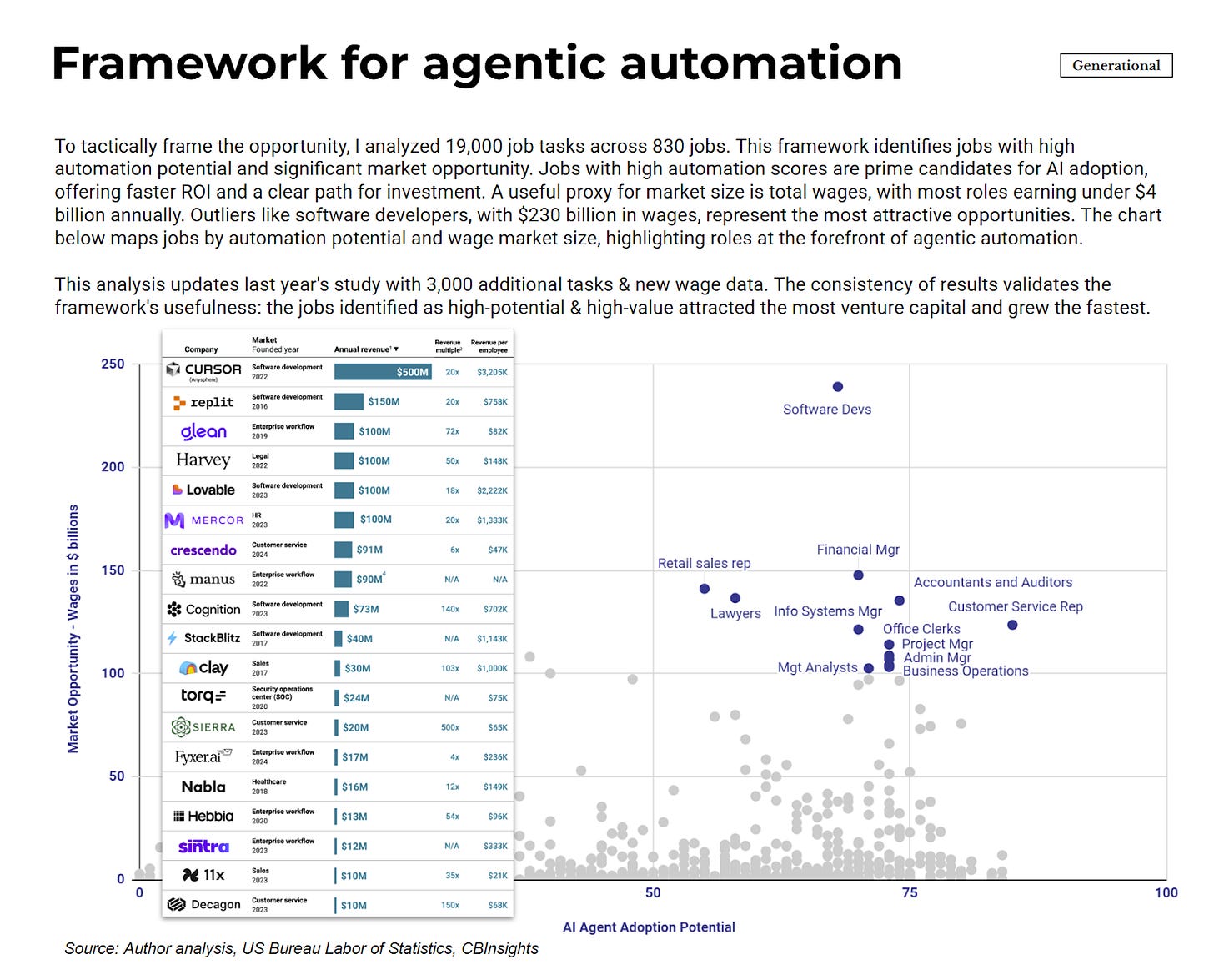

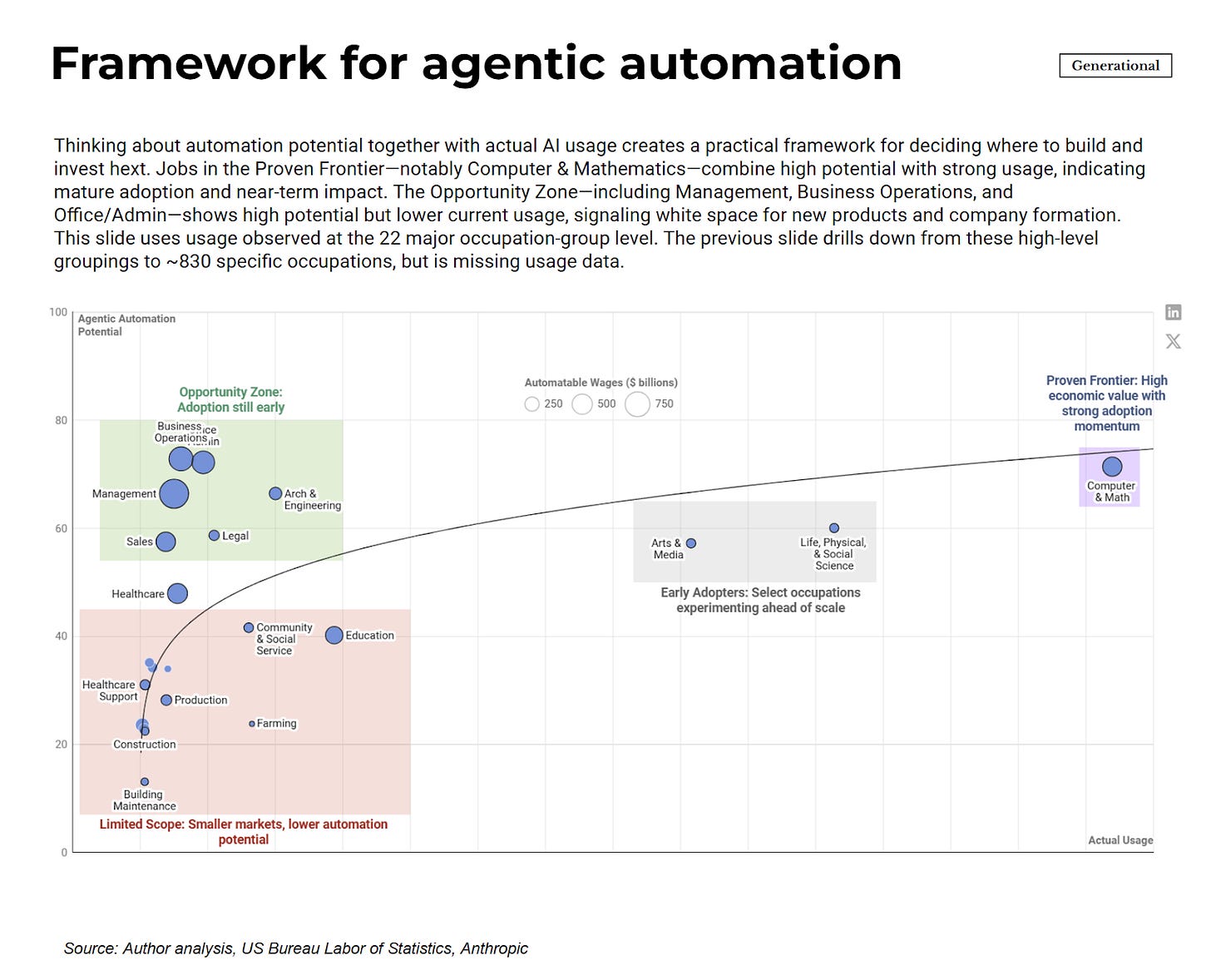

An analysis of 19,000 job tasks across 830 occupations maps automation potential against actual adoption and wage pools.. Software development sits at the frontier: high automation potential, high current usage, large wage pool ($230 billion annually). Both venture capital and revenue concentrated here: Cursor raised $3.2B valuation and crossed $1B ARR in 2 years. Anthropic raised $34B valuation in 2025 and its Claude Code product crossed $1B ARR in 6 months.

The next frontier (highlighted in blue below): customer service, business operations, sales, finance, and legal. These show similar automation potential but lower current adoption. Venture capital is already deploying against this framework: Harvey (legal) raised at $800M valuation in 2025 with $190M+ ARR, Glean (admin manager) raised at $150M valuation in 2025 and reached $200M ARR, and Crescendo (customer service) founded in 2024 reached $100+M ARR.

Value Is Driving Rapid Buildout

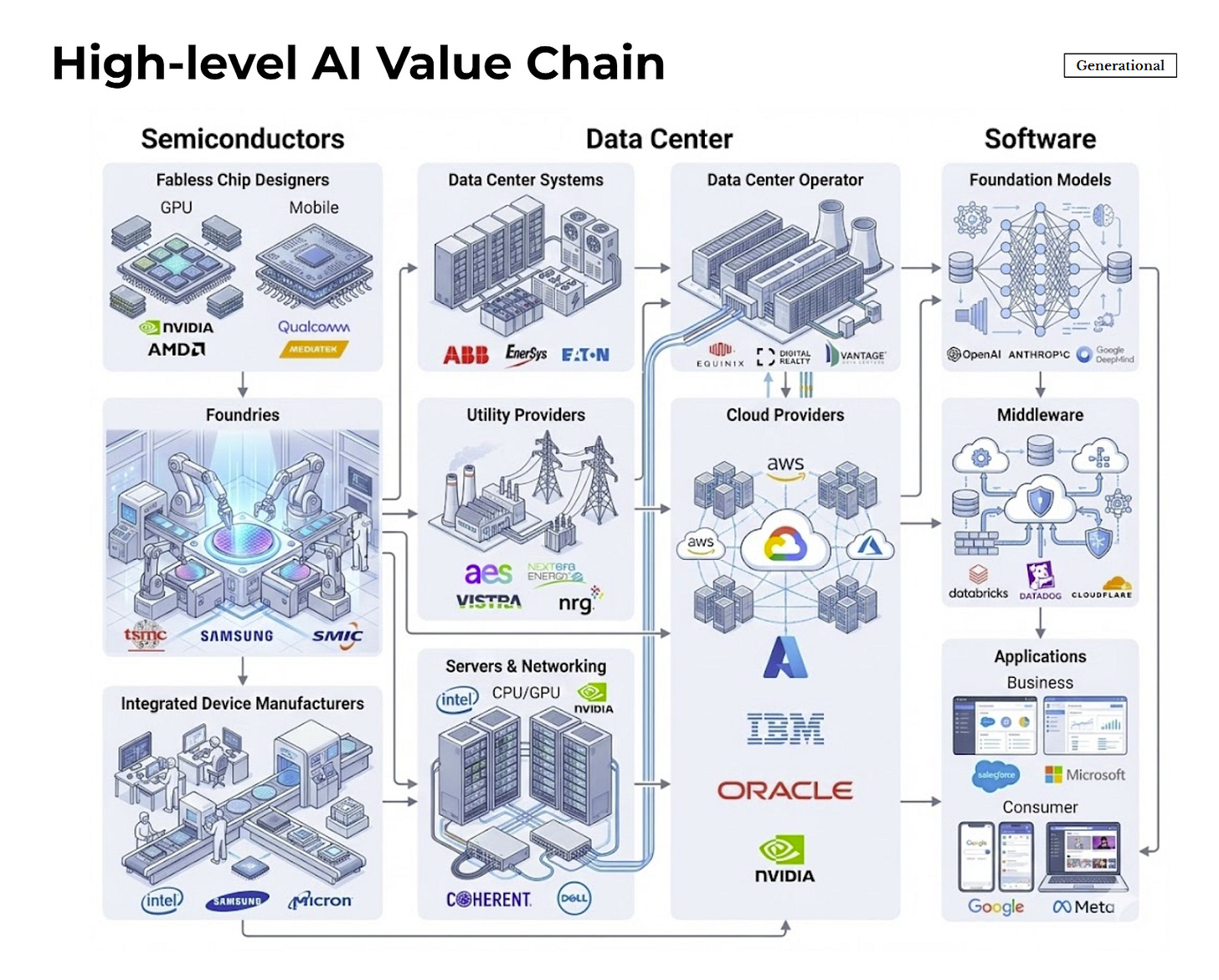

The revenue opportunity pulled capital into infrastructure. Data center capital expenditure commitments reached $2.9 trillion through 2028. The hyperscalers Amazon, Microsoft, Google, Meta committed hundreds of billions. OpenAI committed $1.4 trillion in infrastructure spend over eight years. The opportunity is enormous, but how it unfolds depends on the complex dynamics of supply and demand across the value chain. And critically, on how that supply is being financed.

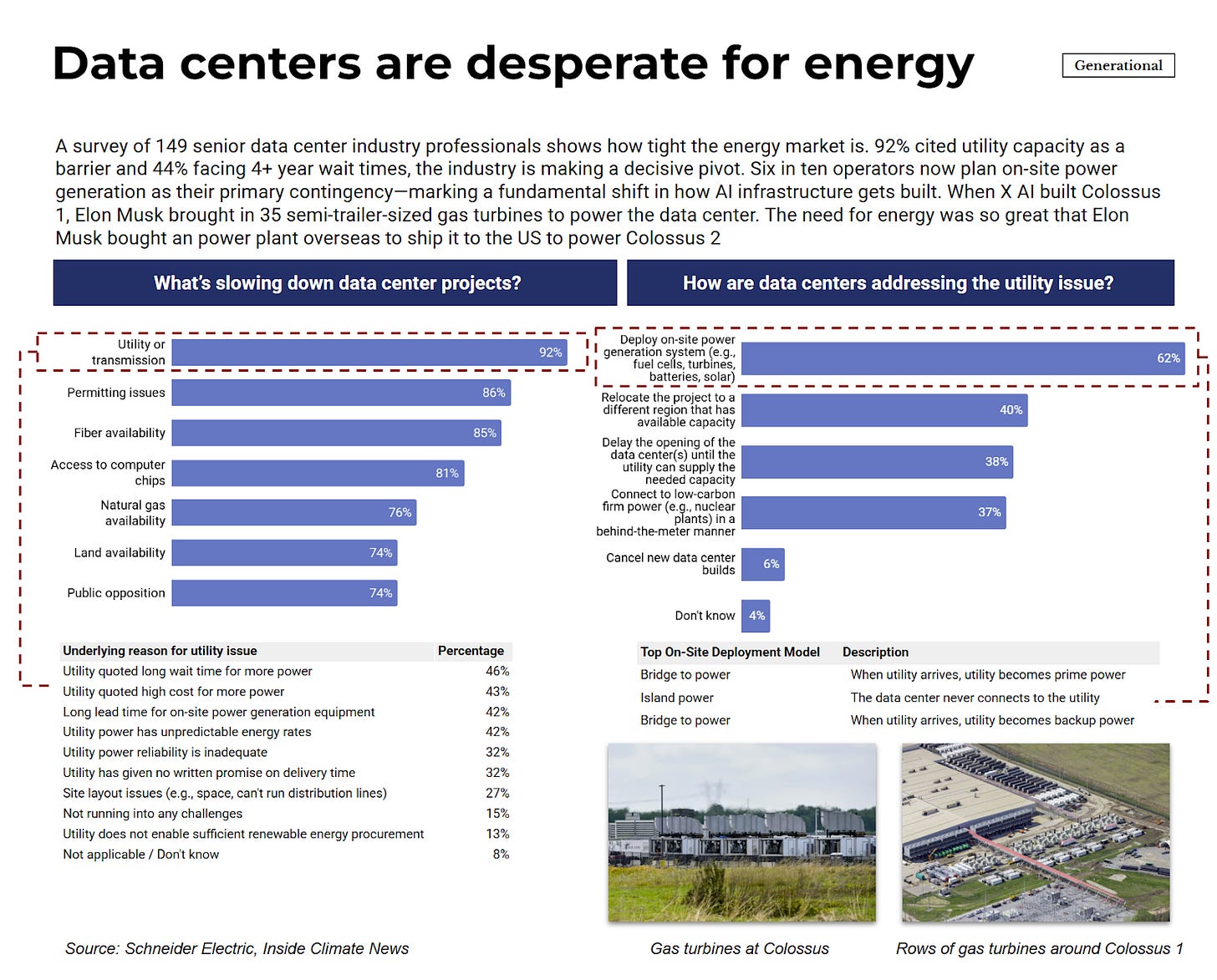

The buildout required coordination across the entire value chain: semiconductor fabrication (concentrated in TSMC, Samsung), data center construction (power systems, servers, networking, physical facilities), cloud operators purchasing compute capacity, and software companies consuming it. Each layer depends on the others. Constraints anywhere ripple through the system. Over the past year, the binding constraint shifted from chips to energy in the US. Over 90% of data center professionals cite utility capacity as a barrier to expansion. 44% of them faced wait times of four or more years for grid connections. The industry response has been to route around constraints rather than wait. 62% of operators now plan on-site power generation as primary contingency, treating utilities as backup rather than default. Elon Musk built the Colossus I data center with 35 semi-trailer-sized gas turbines. For Colossus II, he purchased a power plant overseas, disassembled it, and shipped it to the US for reassembly. Google acquired Intersect, a clean energy data center specialist, in December 2025 for $4.8B to bypass grid constraints.

Nuclear energy had been taboo in the US for decades until AI made it fashionable again. Particularly promising are small modular reactors (SMRs) that can be factory-built and deployed on-site, bypassing both grid congestion and transmission losses. In the past 18 months, hyperscalers signed agreements for over 10GW of new nuclear capacity: Microsoft’s $16 billion deal to restart Three Mile Island by 2028, Google’s 500MW Kairos Power SMR fleet targeting 2030, and Amazon’s $20+ billion Susquehanna campus conversion plus 5GW X-energy SMR pipeline. Regulatory timelines compressed after May 2025 executive orders mandated 18-month maximum NRC reviews for new reactors, down from historical 7-year processes.

These workarounds and new capacity commitments may eventually ease the energy constraint. But they take years to materialize. The scale of this buildout raises a question: where does the money come from, and what assumptions does it rest on?

Financial Risks of Rapid Buildout

The energy constraint matters beyond infrastructure planning because it creates the shortage pricing that makes current data center financing structures work. As long as demand exceeds available compute, even less efficient hardware can command premium prices. The question for data center investors is how long this shortage persists.

Meeting the $2.9 trillion buildout requires approximately $1.5 trillion in capital beyond what hyperscaler operating cash flows can fund. The external capital stack breaks down as follows: $200 billion from corporate debt issuance (companies borrowing against their own balance sheets), $150 billion from securitized assets (loans packaged and sold to investors), $800 billion from private bilateral credit (direct loans from non-bank lenders), and $350 billion from other sources including private equity.

The $150 billion in securitized assets and $800 billion in private credit deserve particular attention because of their scale and characteristics. Private credit consists of loans extended by asset managers, pension funds, and specialty lenders rather than traditional banks. The loans are typically held to maturity rather than traded, which means problems don’t surface until borrowers actually struggle to pay. Securitized assets carry a different risk: loans packaged and sold to dispersed investors who may not fully understand the underlying collateral dynamics—a structure that should sound familiar from 2008.

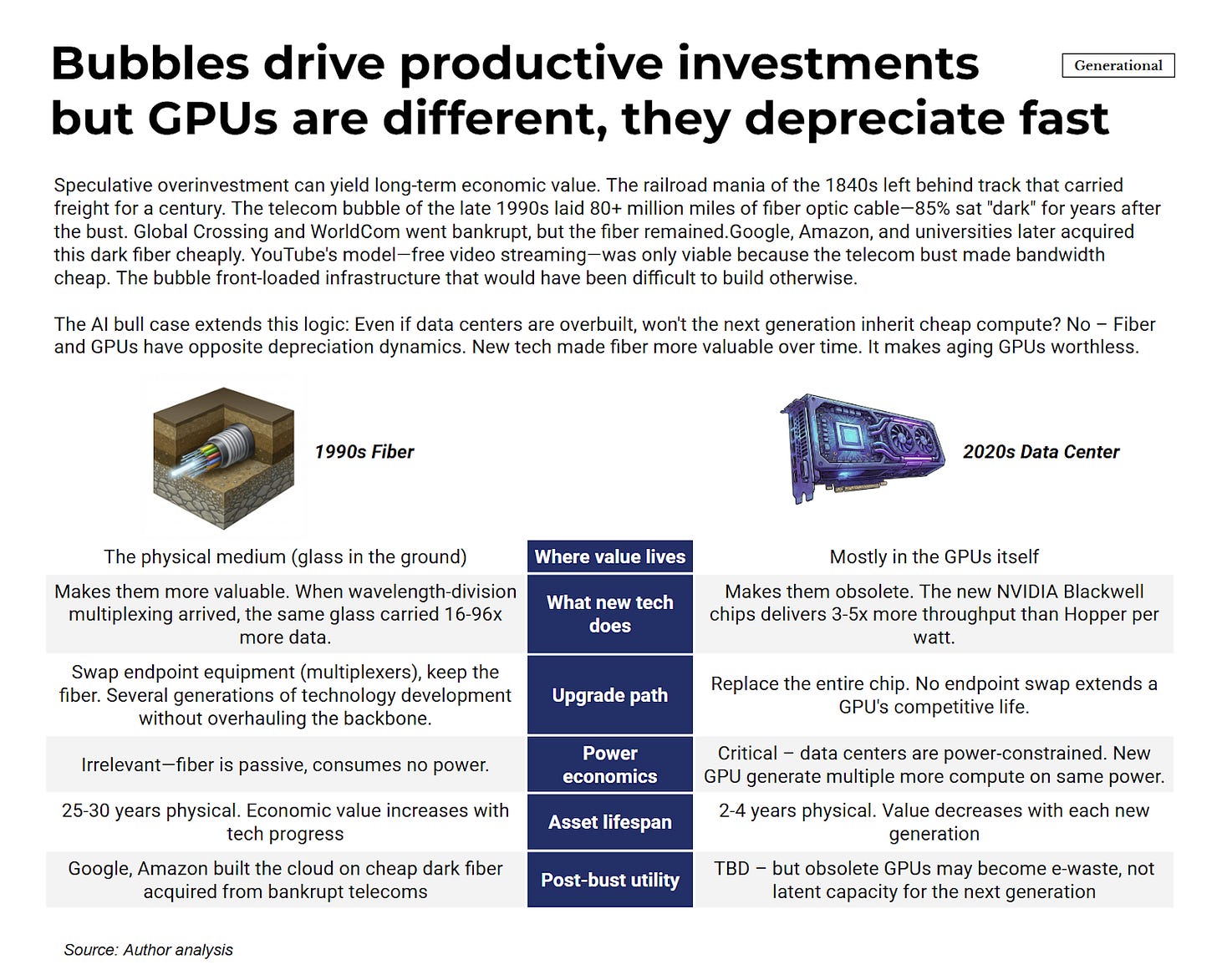

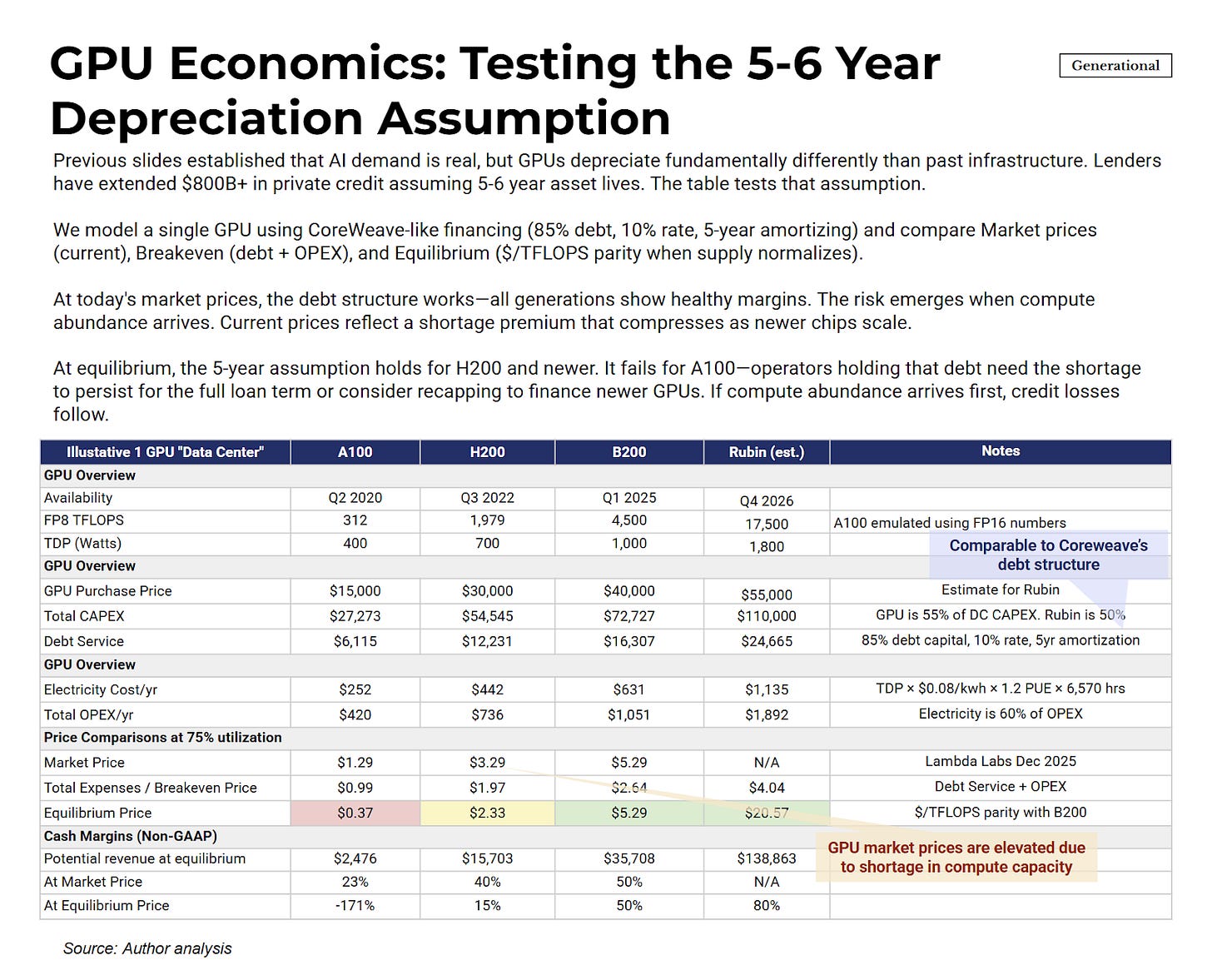

Lenders financing GPU-based data centers assume underlying assets will retain economic value over 5-year loan terms. Standard infrastructure lending makes similar assumptions: buildings depreciate over 30-40 years, fiber optic cable over 25-30 years, aircraft over 20-25 years. GPUs behave differently. NVIDIA releases new architectures roughly every 12-18 months, with each generation delivering 2-4x better performance per watt. Competitive lives run 2-4 years before efficiency gaps make older GPUs economically uncompetitive.

The financing math works if shortage pricing persists throughout loan terms. If equilibrium pricing arrives earlier—if supply catches up with demand and older GPUs must price at parity with newer chips on performance-per-dollar—operators holding older equipment face default or unfavorable refinancing. Consider an operator who financed A100 GPUs in 2023 with a 5-year loan. At today’s shortage prices, they earn healthy margins. If equilibrium arrives by 2027, those same A100s compete against Rubin chips delivering 9x the compute per dollar. The operator either prices at a loss or watches customers leave. Either way, they can’t service the debt.

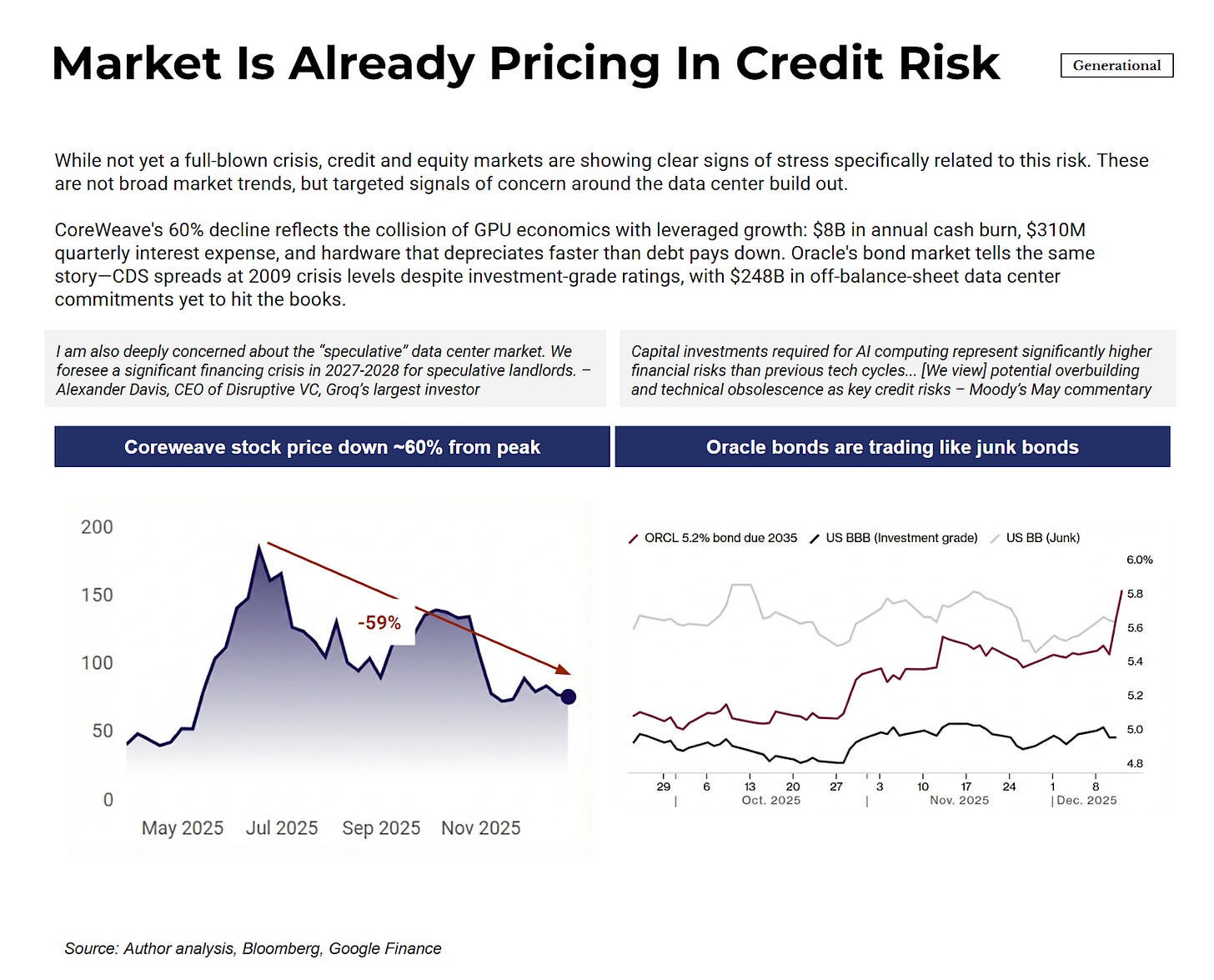

Stress signals have appeared. CoreWeave stock declined approximately 60% from peak levels. Oracle bonds due 2035 trade at yields closer to junk-rated than investment-grade paper, with CDS spreads at levels last seen during 2009.

Source: Media, Google Finance, Bondblox

CoreWeave exemplifies leveraged GPU economics. The company is highly reliant on debt as their Q3 2025 financials show:

(US$ in millions)

Three Months Ended

September 30, 2025

Nine Months Ended

September 30, 2025

Revenue

$1,365

$3,559

Total operating expenses

$1,313

$3,516

Operating income

$52

$44

Other income, net

$22

$50

Interest expense, net

($311)

($841)

Loss before income taxes, excludes debt repayment, which isn’t considered an expense per accounting rules

($237)

($748)

Debt Repayment

($1,404)

($2,979)

Debt Issuance

$4,020

$7,563

The hyperscalers will survive this. Alphabet, Microsoft, Meta, and Amazon have fortress balance sheets—Alphabet alone holds $96 billion in cash. When writedowns eventually come, they can absorb accounting hits. Risk concentrates in operators who financed GPU acquisitions with debt rather than cash flow.

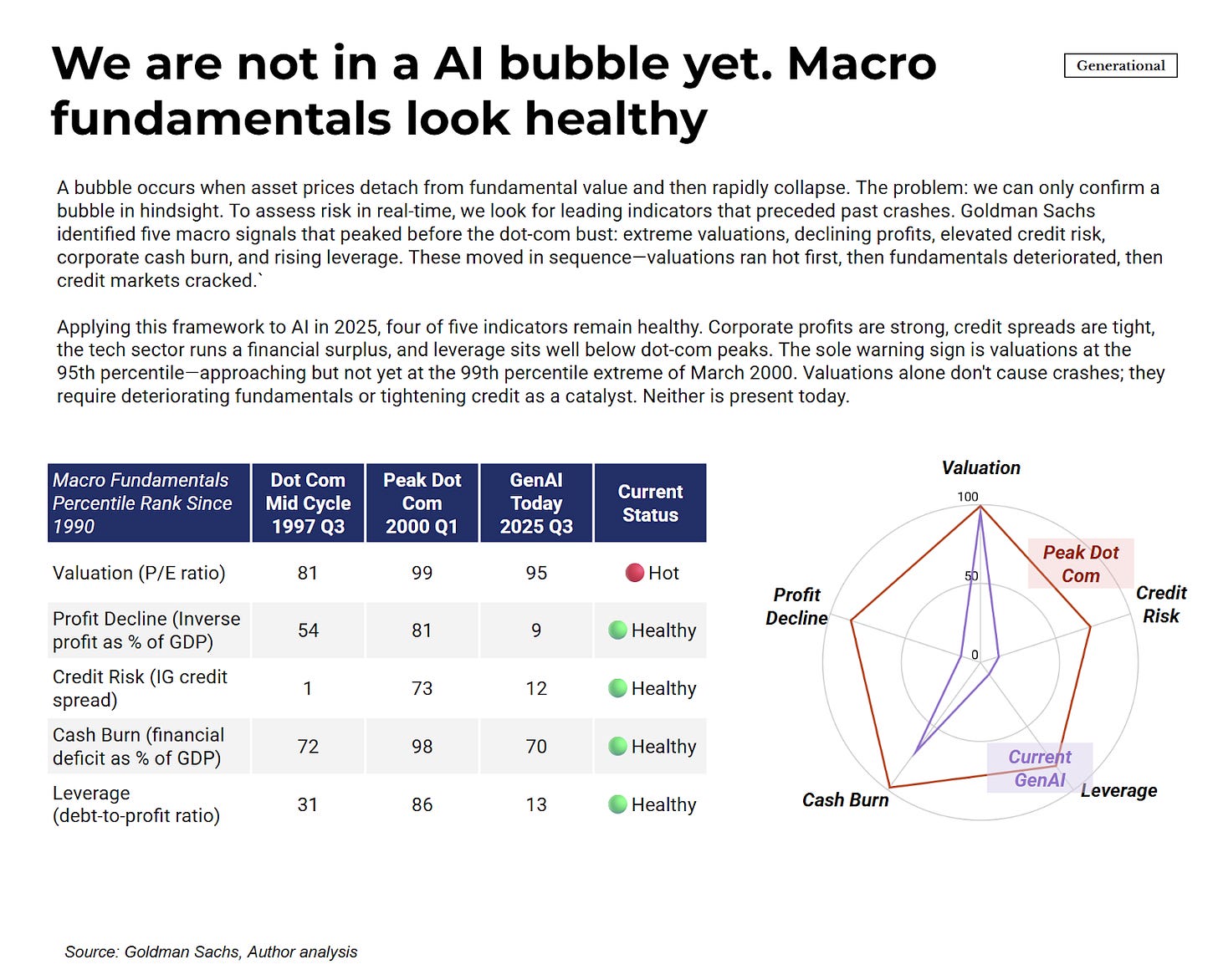

To be clear, this is not a bubble. Traditional macro indicators that preceded the dot-com crash—extreme valuations, declining corporate profits, elevated credit risk, high cash burn, rising leverage—show just one warning sign against four healthy readings. Companies support elevated valuations because underlying profits are strong. The risk is narrower: financing structures built on assumptions about GPU economic lives that may not hold. I examine this financing risk in detail elsewhere.

“

2026: Beyond the Chasm

In 2025, AI crossed the chasm. The question shifts from “does this work” to “where else does this work.” 2026 is what happens on the other side. Three frontiers define the year ahead: new job categories absorbing AI tooling, physical systems gaining intelligence, and public markets opening to AI-native companies.

The enterprise beachhead was software development—high automation potential, large wage pool, and a workforce already comfortable with AI tools. The adjacent opportunity lies in categories with similar potential but lower penetration. Management, business operations, sales, and legal all show automation potential above 60% but lag software in actual usage. These become the deployment frontier for 2026.

The product evolution is already underway. Anthropic’s Claude Code became one of the fastest-growing AI products of 2025 by letting developers delegate coding tasks to an agent. But users started repurposing it for non-coding work: building slide decks, organizing files, analyzing data. On January 12, Anthropic launched Cowork—the same agentic architecture, repackaged for everyone else. Give Claude access to a folder on your computer, and it can read files, create spreadsheets, assemble expense reports from receipt photos, or draft presentations from scattered notes. That’s the pattern for 2026. The tools that proved themselves in software are spreading into the rest of the office.

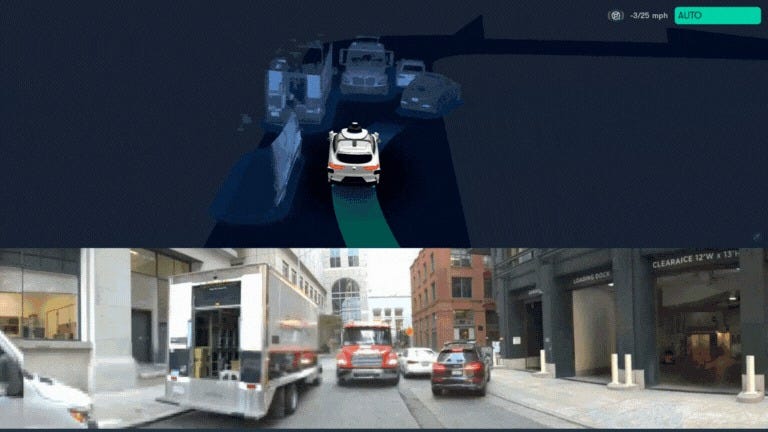

What’s less obvious is that the same reasoning architecture is also making physical AI much better. Waymo’s autonomous driving system uses explicit chain-of-thought reasoning, articulating its decision rationale step-by-step before determining where to drive—the same deliberative process that makes Claude useful for debugging code. This approach improved Waymo’s planning accuracy by 7%, which translates to better handling of edge cases: a vehicle on fire blocking the road, a police officer directing traffic contrary to signals, construction zones with ambiguous lane markings. Its architecture mirrors how the brain works: a System 1 layer handles rapid perception while a System 2 reasoning engine deliberates over scenarios that don’t fit learned patterns.

The deployment numbers reflect this. Waymo now serves 450,000 weekly paid rides across five US cities with approximately 2,500 robotaxis. The company is targeting 20+ new cities in 2026, including Tokyo and London, aiming for 1 million rides per week by year end. Tesla operates supervised autonomous services in Austin and San Francisco, with unsupervised testing now underway. Industry projections put US robotaxis at 50 million trips in 2026. Autonomous vehicles are becoming common urban infrastructure.

The reasoning model connection extends to smart glasses, though the mechanism differs. The form factor has existed for years; what changed is AI that can usefully interpret a live camera feed and respond in context. The model inference still happens in the cloud or a paired phone—the glasses themselves are sensors and display—but the models processing that data are now multimodal and capable of reasoning about what they see rather than just labeling objects. Meta’s Ray-Ban glasses have sold over 3 million pairs, driving the smart glasses market to 110% year-over-year growth. The use cases driving adoption: real-time translation while traveling, hands-free recipe guidance while cooking, and live captioning for the hearing impaired. Meta delayed the international rollout of its Ray-Ban Display glasses due to strong demand in the US. The company plans 10 million pairs annual production capacity by 2026. Google and Samsung are releasing Android XR glasses in 2026 through partnerships with consumer eyewear brands Warby Parker and Gentle Monster. Smart glasses are becoming socially acceptable and useful accessories rather than tech curiosities.

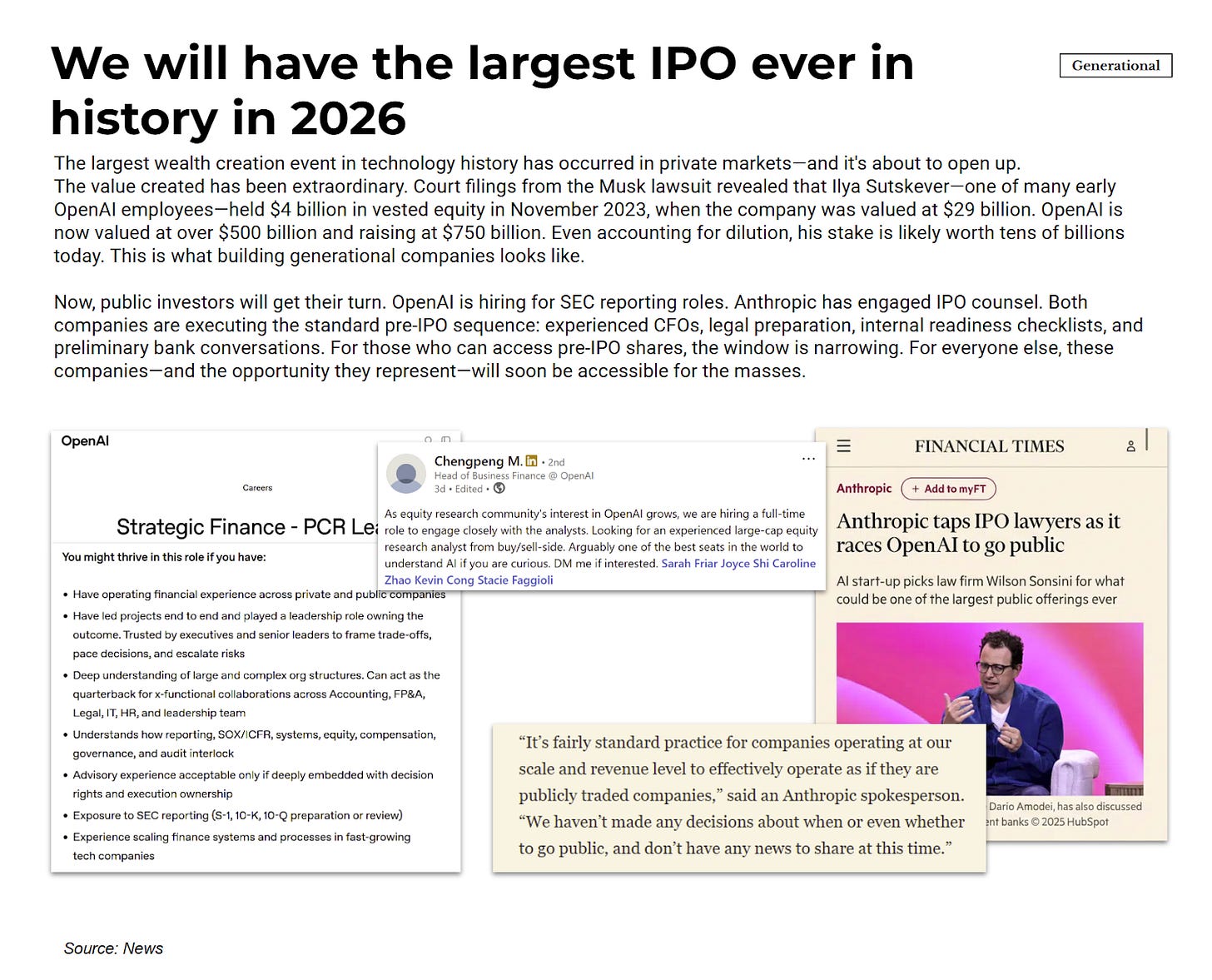

Public stock markets are where AI will permeate through society most broadly. Not everyone will proactively adopt AI but pension and sovereign wealth funds will invest in AI on behalf of their constituents. The largest wealth creation event in a three-year span has played out in private markets and 2026 is when it opens up. OpenAI now trades on secondary markets at valuations approaching $750 billion. The returns for early employees and investors are staggering. But until now, only private investors have had access. For individual investors looking to gain exposure before these IPOs, secondary markets offer one path—a practical guide to accessing them here.

Two Chinese AI companies already crossed into public markets this month. Zhipu AI and MiniMax debuted on the Hong Kong Stock Exchange on January 8 and 9, with market capitalizations of $11.8 billion and $27.6 billion respectively. MiniMax more than doubled on its first trading day.

The US pipeline is filling up. OpenAI is hiring for SEC reporting roles—10-K and 10-Q preparation, S-1 filings. Anthropic has retained Wilson Sonsini, the firm that took Google, Salesforce, and countless other iconic companies public, to begin IPO groundwork. Per CEO Dario Amodei, Anthropic is already operating as if it were publicly traded. A host of other private AI companies are also gearing up for IPOs: Databricks, Cerebras, Lambda, and others.

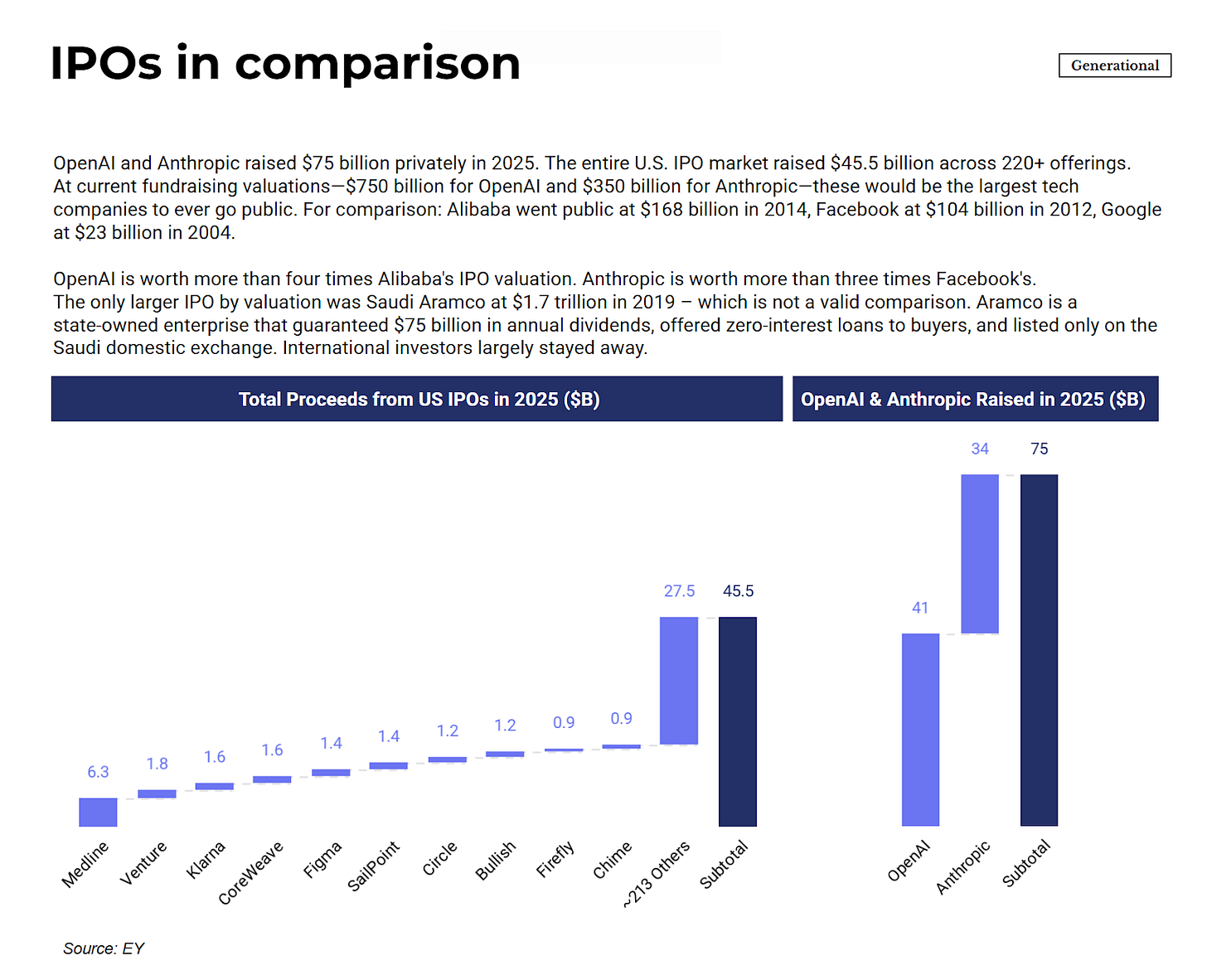

The scale would be unprecedented. OpenAI and Anthropic raised $75 billion in private capital in 2025 alone — 70% more than the entire US IPO market raised across 220+ offerings that year. At current valuations, both would rank among the largest technology companies to ever go public by market capitalization. Alibaba’s 2014 IPO set the record at $168 billion. Facebook went out at $104 billion in 2012. Uber at $82 billion in 2019. OpenAI is currently valued at more than four times Alibaba’s IPO. Anthropic at more than three times Facebook’s. The only larger IPO by valuation was Saudi Aramco at $1.7 trillion in 2019—but that comparison doesn’t hold. Aramco is a state-owned enterprise that guaranteed $75 billion in annual dividends, offered zero-interest loans to buyers, and listed only on the Saudi domestic exchange. International investors largely stayed away. OpenAI and Anthropic would be the largest technology IPOs in history by a wide margin.

Closing Thoughts

The pattern across all of this is AI becoming infrastructure. Robotaxis ferrying passengers in five cities. Smart glasses selling in the millions. Job functions beyond software development absorbing AI as default workflow. When OpenAI and Anthropic go public, retail investors will buy into companies that existed only in venture rounds three years prior.

This is moving fast. Faster than previous technology transitions. The internet and mobile each took a decade to reach comparable penetration. AI is compressing that into years. The adjustment period that usually absorbs shocks is shrinking.

That speed creates real friction. Entry-level hiring has already contracted as companies reassess which roles need headcount. Workers who would have spent years building expertise before AI could match them now face that competition immediately. Hyperscalers are commissioning nuclear reactors and building on-site power plants because grid infrastructure can’t keep pace. Private companies becoming energy providers out of necessity. Debt structures financing data center buildouts assume five-year asset lives on hardware that may be economically obsolete in two.

Any one of these might resolve smoothly given time. The question is whether they resolve smoothly together, at this pace. I don’t know the answer. I’m not sure anyone does.

What I do know: the expansion is real. AI is crossing from early adoption into mainstream use, from Silicon Valley enthusiasm into everyday workflow, from private capital into public markets. The capabilities keep improving. What 2025 proved and 2026 will confirm is that AI works. The rest is figuring out how fast everything else can follow.

Other Generational articles:

-

AI Trends 2025: The full 100+ page report this article summarizes, with deeper dives on scaling laws, sector breakdowns, and a market map of 1,800+ AI startups.

-

How the AI Bubble Will Burst: A detailed examination of why this isn’t a demand-side bubble, but why the supply-side financing structure around GPU depreciation carries real risk.

-

Agents at Work: The underlying framework mapping 19,000 tasks to wage pools, showing where agents create value and early evidence of employment effects.

-

How to Invest in AI: A practical guide for individual investors covering public and private market access, including how to participate in secondary markets before IPOs like OpenAI and Anthropic.

Read the full AI Trends 2025 Report, to go even deeper.

Read More in AI Supremacy