[[{“value”:”

Hello Everyone,

We are now halfway through the decade now getting closer to the twilight of 2025, and it’s become clear that AI and in particular AI Infrastructure called datacenters (I prefer the term “compute warehouses”) is big bet of the United States and others are starting to make on the future of LLMs. But what if large language models don’t demonstrate an adequate return on investment? Three years after ChatGPT went viral, there are some mixed signals.

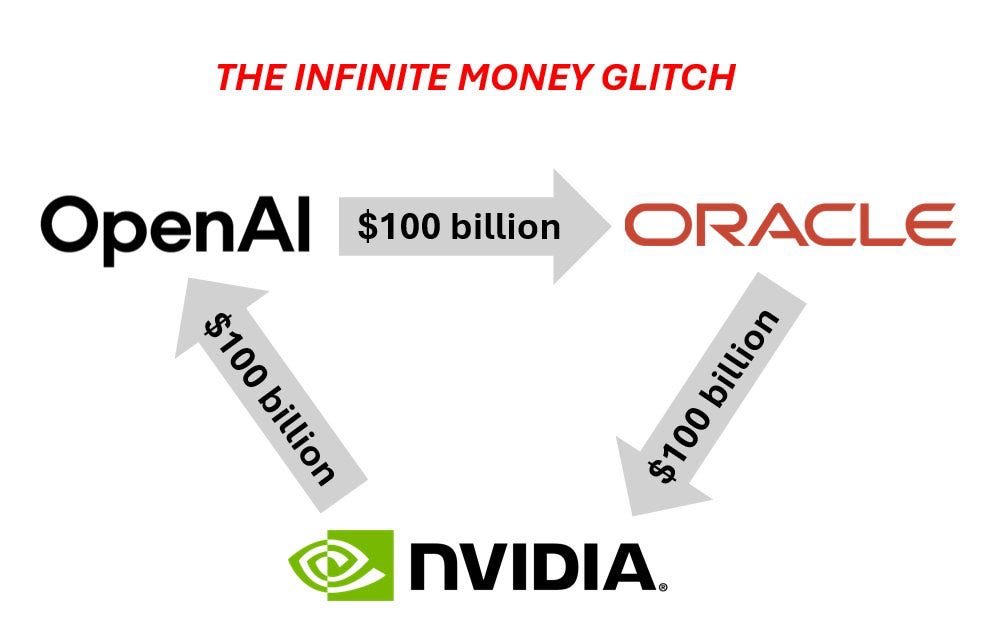

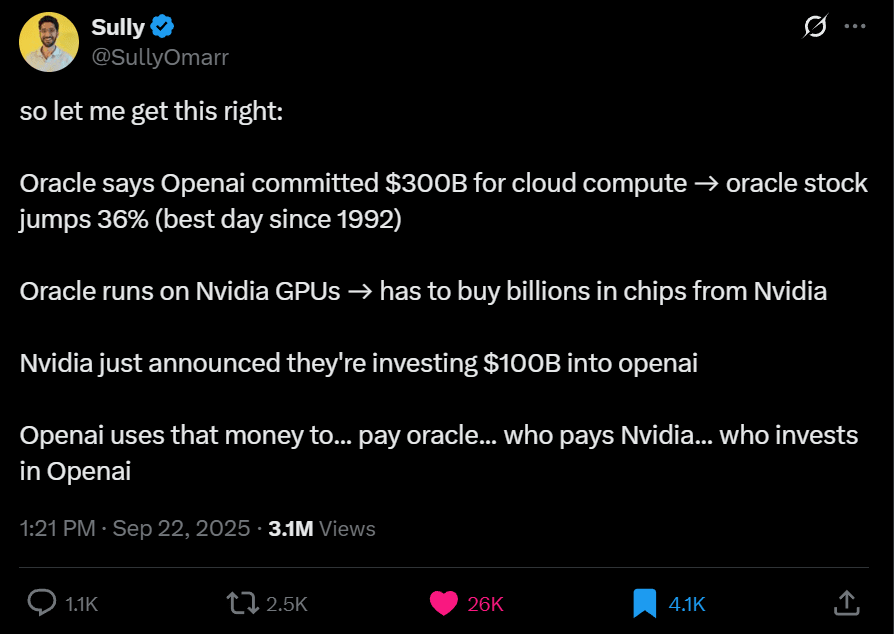

This week Nvidia’s $100 billion investment in OpenAI has investors questioning whether we’re seeing too much circular investing and really brought to light the extent which Nvidia has implemented tactics of vendor financing that has artificially stimulated sales to meet capacity as hyperscalers struggle to keep up with the demand for compute.

Sully Omar of Cohere Lab said on X:

“Oracle says Openai committed $300B for cloud compute → oracle stock jumps 36% (best day since 1992) Oracle runs on Nvidia GPUs → has to buy billions in chips from Nvidia Nvidia just announced they’re investing $100B into openai Openai uses that money to… pay oracle… who pays Nvidia… who invests in Openai.” – Circular vendor financing of Nvidia to boost sales and meet hyperscaler capacity, 2025.

Nvidia has done similar things with its investment and vendor partner financing around CoreWeave and others. How much has this inflated sales in recent quarters or is this just them doing the extraordinary to meet capacity?

Wall Street is already concerned about an AI bubble, and so am I! Neither am I assuming like many others that Generative AI is automatically a general purpose technology like the steam engine, computer, electricity – just because there’s a huge infrastructure roll-out due to the hype. Given how tech hype cycles go, we can’t assume anything just yet.

-

Sam Altman argues in his blog post that as artificial intelligence rapidly advances and becomes more accessible, it will drive the global economy. So far AI outside of the investment in compute warehouses, isn’t doing very much for the economy.

-

Tech executives like Mark Zuckerberg recognize there’s a significant bubble with this AI Infrastructure capex frenzy that historically is likely to hit headwinds of one kind or another.

Bain and Company’s sixth Technology Report delivers some relevant insights:

-

Full report download: https://www.bain.com/globalassets/noindex/2025/bain_report_technology_report_2025.pdf

A new Bain report says AI buildout will need $2 trillion in annual revenue just to sustain its growth, and the shortfall could keep GPUs scarce and energy grids strained through 2030.

If you include Oracle via OpenAI, xAI, Anthropic and other private AI startups with the Hyperscalers in 2026 we will soon hit that $500 Billion Bain proposes we need but this is capex and not actual revenue we are talking about. Where will the added revenue come from that is needed? We’ll need in the area of another 100 gigawatts of new demand in the US by 2030. Yet the Energy bottleneck of the U.S. grid itself could lead to a crash of the AI bull market and the AI Infrastructure bubble. The Trump Administration’s purge against sustainable energy isn’t helping!

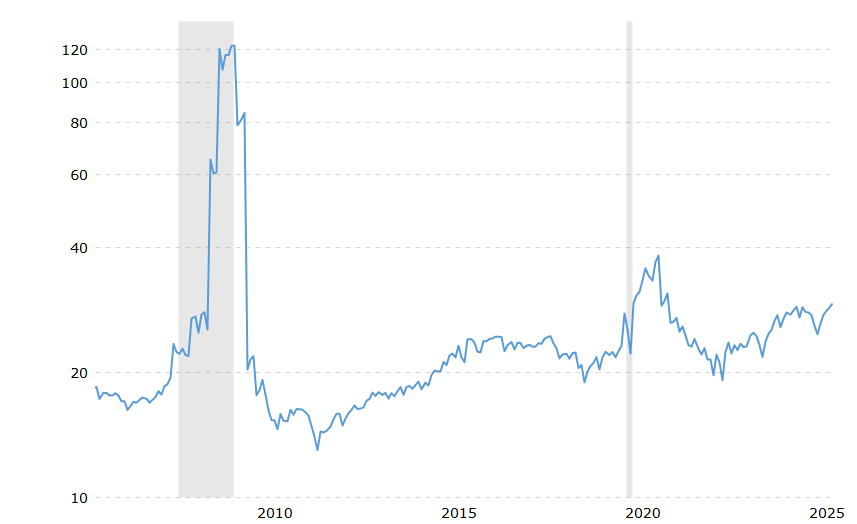

The stock market is also showing significant signs of an AI boom stock market bubble with predictable features: passive investing (think more ETFs) combined with more centralization in BigTech and semiconductor stocks means valuations could expand more based on capex and anticipation, than earnings and ROI.

-

The S&P on price-to-earnings ratio based on trailing 10-year earnings is now 40x. Comparable with dot com type peaks via analysis by DataTrek co-founder Nicholas Colas.

Free cash flow yield of S&P 500 is near also Dotcom Bubble levels. If the AI spending doesn’t substantially accelerate the earnings growth, a correction is inevitable.

S&P 500 PE Ratio Climbing into Bubble Territory – 20 Year Chart

-

The S&P 500’s price-to-sales (P/S) ratio is also currently at historically elevated levels, around 3.33 to 3.35 as of late September 2025.

-

For context, the historical average price-to-sales (P/S) ratio for the S&P 500, based on monthly data from 1946 to the present, is 1.39. For context, the historical median is 1.08, the minimum is 0.35, and the maximum is 3.41.

This implies that the weight of surging companies like Nvidia are skewing everything from passive index investing to the future of how we see AI. These are classic bubble type phenomena. It’s not as if Generative AI is creating jobs or leading to any kind of real abundance, investors are just rewarding hyperscalers for crazy investments in AI Infrastructure due to their strong Earnings relative to the rest of the markets.

I go into some detail here:

“}]] Read More in AI Supremacy