[[{“value”:”

Hello Everyone,

Just a quick note: I wanted to explore the Newsletter New Economies with you all that do a lot of great reports. Is Generative AI leading to a whole new world? 🌍 I also wanted to share some insights on AI reports I’m reading today:

OpenAI’s new Funding

-

OpenAI has secured $8.3 billion in new capital as part of its $40 billion fundraise.

-

The Times reported that Dragoneer Investment Group, an under-the-radar investor, led the round with a startling $2.8 billion check. Many new investors participated in the round, including private equity giants Blackstone and TPG, and mutual fund manager T. Rowe Price. Other participants include Altimeter Capital, Andreessen Horowitz, Coatue Management, D1 Capital Partners, Fidelity Management, Founders Fund, Sequoia Capital, Tiger Global, and Thrive Capital.

-

Some early investors in OpenAI were reportedly dismayed by the smaller allocations they got in the round as the AI behemoth prioritized bringing on new strategic backers. Given the evolution of Anthropic and Google in API market share, that’s not all they should be dismayed about! OpenAI is dominant in B2C however, with 700 million “weekly” active users for ChatGPT.

-

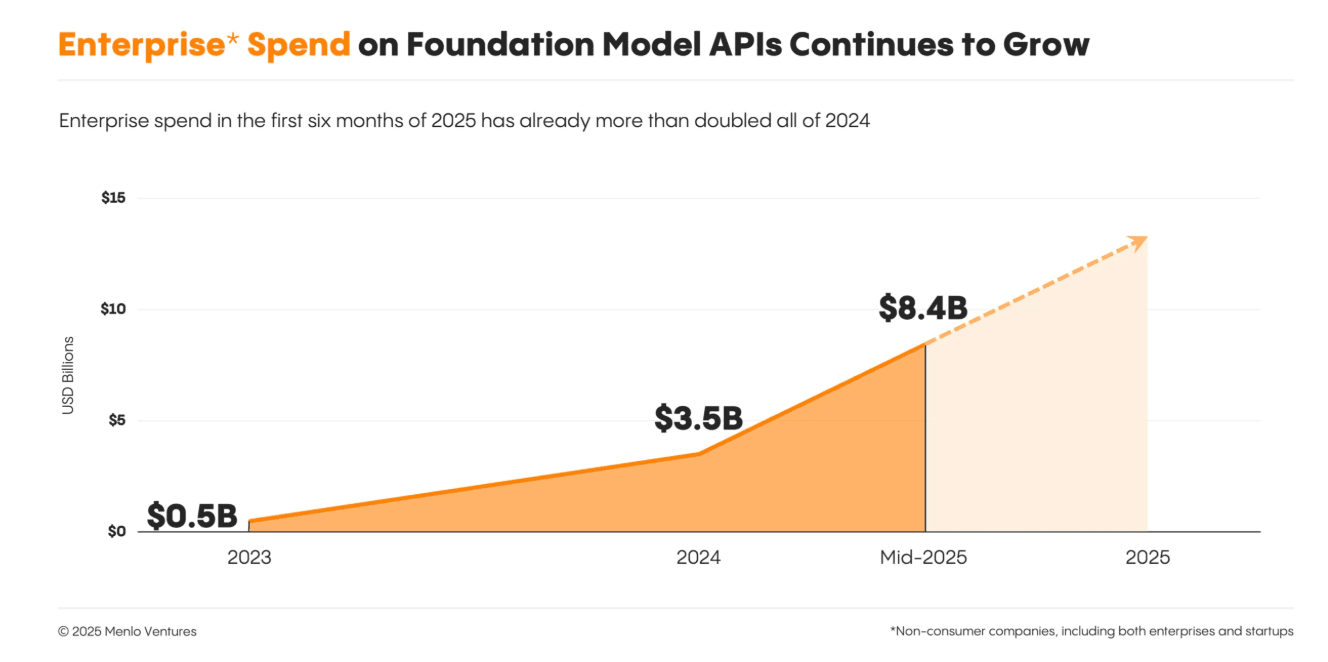

How fast is OpenAI’s ARR growing? OpenAI’s annual recurring revenue has surged to $13 billion and could top $20 billion by year-end. Given Anthropic’s Enterprise AI surge however, OpenAI may will face tough competition. Their latest model GPT-5 is expected however to be great in coding.

AI Coding is the first Killer App and Anthropic is the Early Winner

Menlo released their latest market update on the Foundational Model Landscape and Economics overview.

Anthropic is leaving OpenAI in the dust in LLM API Market Share

-

In my view, this could mean that Anthropic increases ARR faster than OpenAI in 2026.

-

I knew this was occuring, but surprised at the speed and scale of the change of the relative marketshare.

-

The rise of Anthropic and Google (and other emerging competitors) could mean OpenAI will eventually be next to irrelevant for Enterprise AI.

New Economies

is the founder of NEW ECONOMIES, (who also lives in Asia like I do – his Thailand to my Taiwan) a newsletter and podcast show sharing the latest trends in tech. Previously, Ollie worked at venture capital firms, Antler joining as one of their first employees and Molten Ventures. His Newsletter is one of the fastest growing publications of its kind in 2025 on any platform.

I especially like New Economies for their infographics and resources.

My Favorite pieces by Ollie and his Team:

-

AI Agents Landscape

-

The New Operating System

-

The Autonomous Business OS

-

Adopting AI within the Workplace

So the main strength of the publication are their reports. (more on this later)

Let’s dive a bit more into the Menlo report that’s well aligned with Ollie’s work:

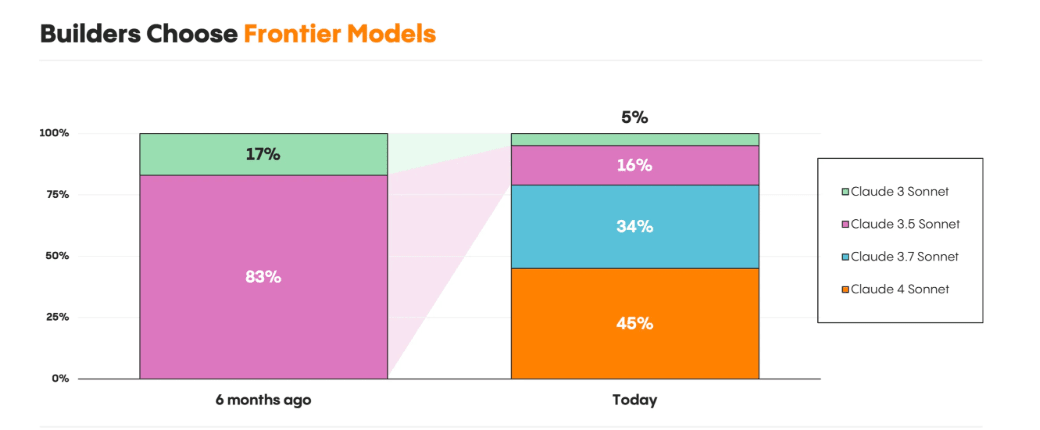

Code generation has become AI’s first breakout use case.

Anthropic Surpasses OpenAI in Enterprise Usage

Anthropic > OpenAI in Enterprise AI. (and it’s not even close, August, 2025).

How Quickly Things Change – API Marketshare

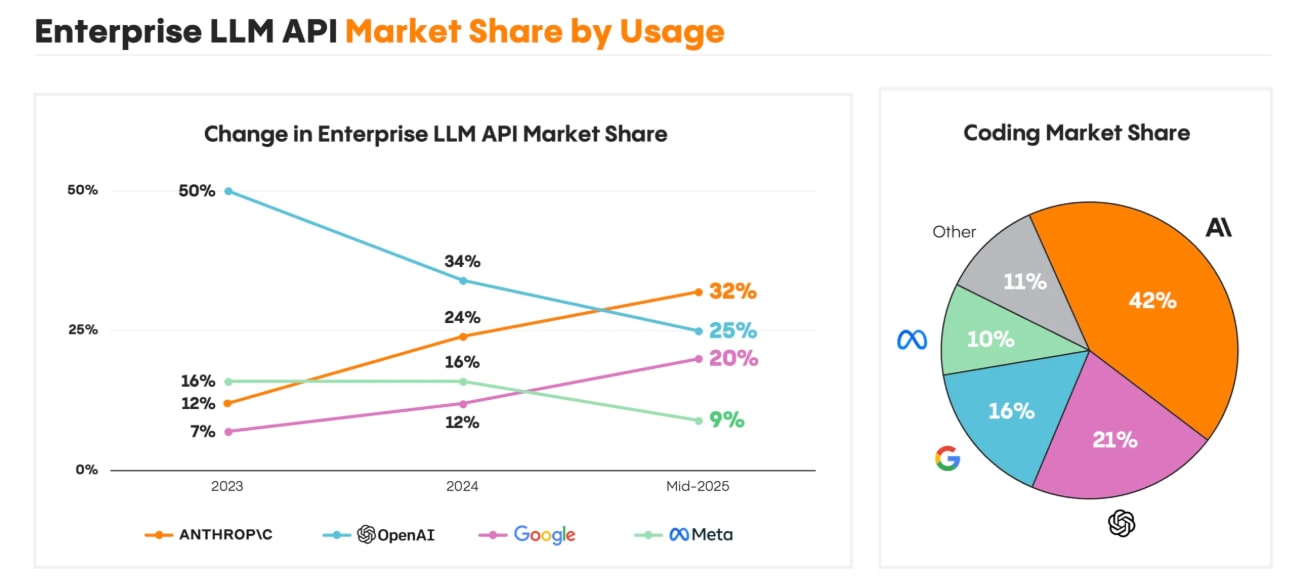

By the end of 2023, OpenAI commanded 50% of the enterprise LLM market, but its early lead has eroded. Today, it captures just 25%3 of enterprise usage—half of what it held two years ago.

-

Claude quickly became the developer’s top choice for code generation, capturing 42% market share, more than double OpenAI’s (21%).

-

This trend shows no signs of slowing down either.

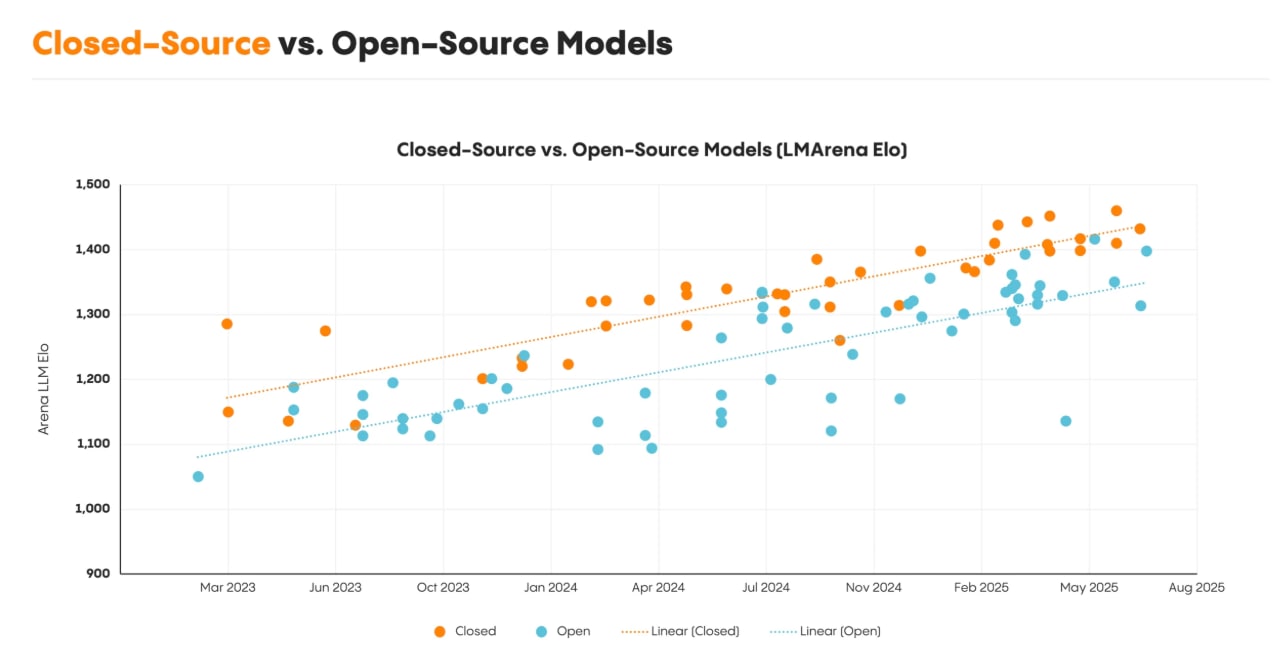

When Meta pivoted from Llama to Closed-Source Meta Superintelligence Lab type dynamics and hiring, Open-source Adoption had already slowed down.

Open-Source Adoption in the Enterprise Flattens

Thirteen percent of AI workloads today use open-source models, down slightly from 19% six months ago. Chinese firms rising to become the leader may be part of this trend.

Menlo notes that the landscape has stayed active, with notable launches from DeepSeek (V3, R1), Bytedance Seed (Doubao), Minimax (Text 1), Alibaba (Qwen 3), Moonshot AI (Kimi K2), and Z AI (GLM 4.5) in the last six months. You can try all of these in one API on OpenRouter*.

Open-source models offer clear enterprise advantages: greater customization, potential cost savings, and the ability to deploy within private cloud or on-premises environments. However the slow down since the DeepSeek moment is most curious:

Other AI Reports I’m reading this Weekend

-

AI Talent Report – Zeki

-

State of AI Apps Report – SenseTower

-

The Business Imperative of Agentic AI – Deloitte

Founders and Startups Choose Frontier Models

-

This is beginning to skew more Anthropic and Google, less OpenAI.

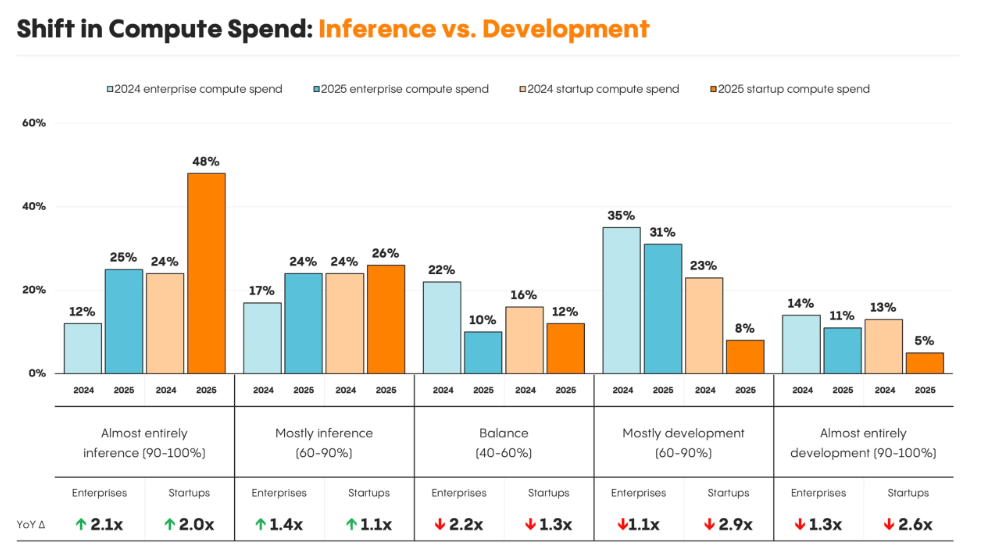

AI Spend Is Moving from Training to Inference

Spending on compute is steadily shifting from building and training models to inference, with models actually running in production.

-

This has in part to do with the dominance of reasoning models which are significantly boosting demand for compute, leading to more Capex spend and more shareholders rewarding BigTech and Cloud hyperscalers doing this.

-

Do note that Menlo is a backer of Anthropic, check out their full portfolio here.

New Economy has written several deep reports, especially and notably around the Creator Economy.

-

Check out the Data Room.

-

Get Full Access to their charts, resources and reports.

-

See the Founder resources.

So this article is a summary of snippets from his various reports and startup landscape overviews.

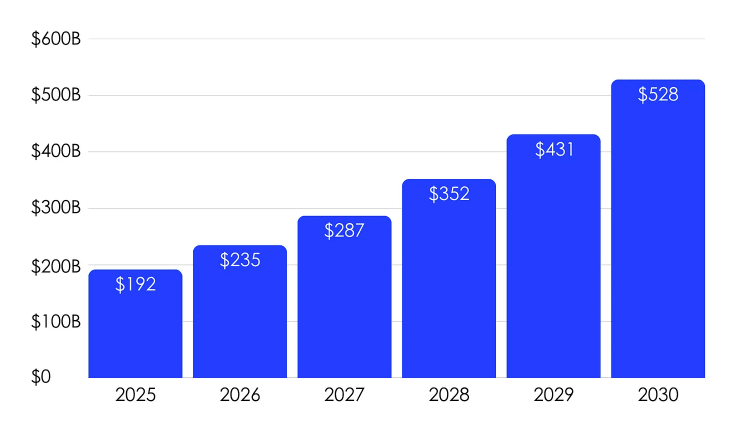

How big is the Creator Economy?

-

Ollie’s reports explore emerging Economies of scale in deep dives especially from the perspective of market landscapes, for founders and listing startups.

-

To gain full access to them, you will need a paid subscription to his Newsletter.

-

His work helps me figure out the macro overviews of startup landscapes that most interest me about the future.

The Creator Economy 2025

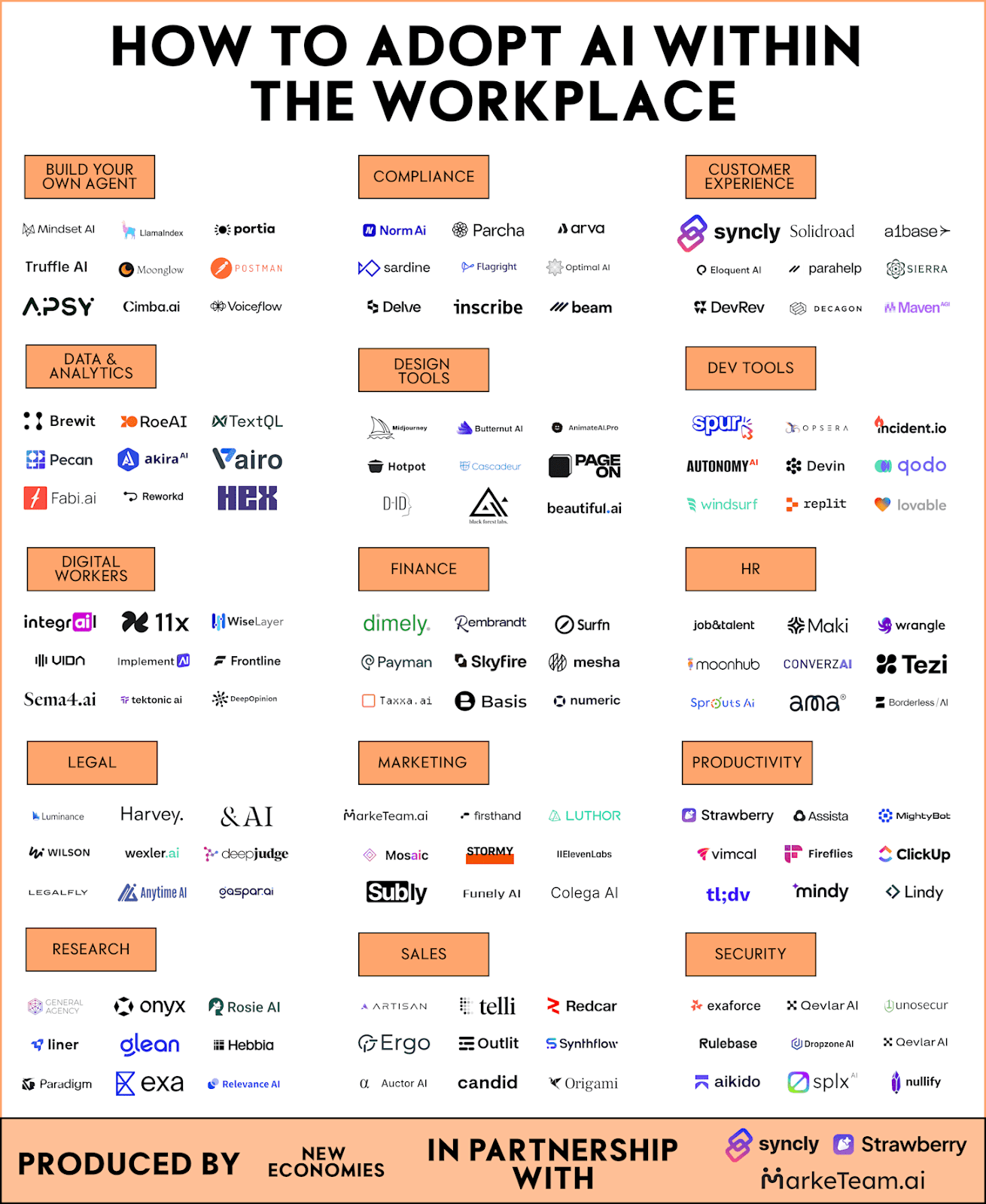

The state of AI now and in the future is still unknown with so much changing on a daily basis. We have gone from Generative AI to AI Agents to now vibe coding yet, adopting AI within the workplace is still a priority for companies. In this report, we discover:

-

The current state of AI: Now and in the future.

-

How to adopt AI within the workplace across functions.

-

The latest platforms you should be using.

-

The startup fundraising landscape: The most active investors, the mega funding rounds and the latest fundraising activity.

-

The biggest challenges that lie ahead: What to expect.

-

The impact of AI: Where do we go from here?

-

Who will win: China or the U.S.?

-

AI Trends: Which trends operators and investors are most excited about.

-

Resources: Learn how to build the next big AI company. Read the pitch decks from companies who have raised billions.

Ollie also works with a number of great sponsors (I’m not affiliated with any of his sponsors and Ollie is just a peer): His disclosure reads: this report would not have been possible without the support of our three incredible partners: MarkeTeam, Strawberry and Syncly.

-

In this document expect many more infographics like this one:

READ HOW TO ADOPT AI IN THE WORKPLACE

The Creator Economy 2025

“}]] Read More in AI Supremacy