Good Morning,

I can’t stop thinking about the AI hype narrative and the momentum this technological wave has upon us. Thank you to all of my readers, we have appeared in Substack’s Technology rising leaderboard this past week.

There are many who claim that AI looks exactly like the dot.com bubble. The level of enthusiasm and capital expenditures BigTech has put into AI chips, datacenters, AI infrastructure and AI talent is hard to even fathom. If you include OpenAI’s investments in Stargate we are talking about a quarter of a Trillion dollars in 2025 easily. This is not counting investments in Europe, the Middle East or China.

BigTech Capex is telling us this is a Generational Boom

Everyone remembers what a bubble looks like 💭

How do you even explain the AI hype bubble from an ROI perspective for most firms? The stock market looks expensive after one of the fastest rebounds in decades since Trump’s “Liberation day” of April 2nd. The AI market’s soaring valuations and speculative investment raise concerns of a potential bubble, despite its transformative potential. Cash rich corporations and Silicon Valley gate keepers are spending as if AGI is right around the corner. While Warren Buffett, Michael Burry and even Jamie Dimon look like they are getting nervous.

This must be “AI Compute Heaven” 🐇

CoreWeave, one of the first Generative era AI startup to go public, disappointed investors, ending its first day of trading with a market cap of $19 billion. The last time it raised funds as a private company, in May 2024, it was already valued at $19 billion, nearly triple its valuation just five months prior. Now in June, guess how much its worth now after six weeks of stock market frenzy? $69.3 Billion. This is the environment we are living in.

OpenAI and Nvidia power Enthusiasm higher 👑

Demand for compute looks insatiable even 2.5 years after ChatGPT went live. Nvidia’s data center sales jumped another 73%. OpenAI seems to raise cash at will now with a valuation of $300 Billion with just a single product, ChatGPT. Venture Capital have spent a lot of capital just to raise the AI narrative up to god-like status in 2025.

But what do VCs really think? The market is trading at a 23x multiple, expensive in any year. The DeepSeek scare of late January feels like a distant memory, now in June. A new AI pantheon including OpenAI, Anthropic, DeepSeek and Thinking Machines Lab may soon challenge the business models of BigTech incumbents. This is simply how markets work during technological shifts.

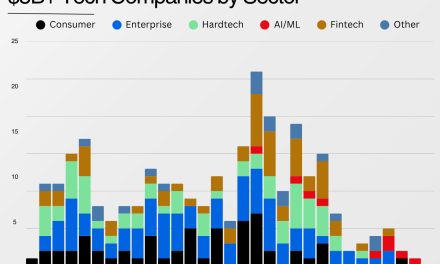

AI startups are eating Venture Capital budgets

is the author of the Newsletter Weight Thoughts, and is a General Partner at Creative Ventures & Co-Founder of Lioness. Even the most bullish VC or angel investor must wonder about the influx of AI startups eating the industry what this will rationally lead to. AI was eating VC for breakfast in 2024 when it accounted for over 50% of global VC dollars. In 2025, this is starting to become a problem.

Lately James has been putting out some really fascinating articles:

-

What LLMs Will Do To Jobs: All You Need is an Oracle

-

AI is Overturning the Military World Order

-

AI’s Endgame (How Foundational Model Companies Can “Win”)

I like how James frames the impact of AI and while techno-optimism predominates in VC circles, how much is just consensus, group-think and wishing thinking I wonder? It’s literally their job to be guardians of a non-critical view of AI’s potential. With the decline of journalism, Venture Capital’s influence on media is only getting stronger. Public relations and lobbying jobs are replacing dying investigate journalism jobs for a reason. “AI mode” is breaking the internet, and this is a weird shift for the internet. The zero click internet is upon us.

The AI Bull Market Could Last Years 🐮

We know this moment feels like an AI bubble, but what does the data say? The U.S. stock market has a Historical Average P/E: ~20.5 (modern era). Today we’re looking at valuations more like U.S. Stock Market P/E: ~24.34 (estimated). We appear to be in an AI bull market. The reality is demand for AI chips and datacenter expansionism and National Defense spending with geopolitical uncertainty could extend this bull market for years to come, giving Generative AI ample time to actually back up its swanky visions of AI Supremacy pitch decks and Venture Capitalist and Tech CEO proclamations. It’s all go if you are an AI podcast bro.

My baseline view of VC’s reality with AI, isn’t biased with financial incentives and insider knowledge of how great AI is going to be:

-

I asked James for his take on Mary Meeker’s incredibly detailed AI report. To my surprise he took the are we in an AI bubble analysis up in a fairly detailed way and to new levels.

I admire James also for asking some of the biggest questions in AI technology. He’s also working on a related book. I wish I knew more VCs who invest in the AI space, feel free to DM me on LinkedIn if you are one. So much of what we are doing today depends on the timing and historical curve of the Generative AI cycle. Recessions and Deep learning winters don’t come as often as they once did, but are there structural issues in the mania?

Where Are We in the AI Cycle—Boom or Bust?

By , June, 2025.

Mary Meeker’s Report and Looking at Market Data

Mary Meeker recently released one of her famous reports. For those unfamiliar, she was known in the 1990s as the “Queen of the Internet.” She called Amazon, eBay, and Priceline at the time—as well as predicted the incredible growth of the internet in the face of skepticism at the time.

On May 30th, Mary Meeker released a report—her first since 2019. This time, on AI.

It’s 340 pages, which means most of you will probably want to read a summary. There are already great ones—including on this publication. Nate Jones also did a good blow-by-blow here.

For the rest of you, she’s always done a good job with outlines, one of which is below. The key is, it’s not just boosterism. There’s a lot of hard data showing that AI isn’t just a fad.

The question is, like when Mary Meeker was releasing her famous reports back in the DotCom days (even if she was right about the potential in the long term)… have we started to get into bubble and crash territory?

Here, we’re going to go through this question using data both inside of Meeker’s report and other sources outside to think about that question.

Is it a Bubble?

“Are we in a bubble?” People ask this every time Nvidia surges in price.

In terms of “animal spirits” in the market, my impression is that sentiments are reasonably balanced. A less anecdotal but also unscientific method to look at this is Google Trends.

One might argue that this is just reflecting AI searches in general, hence the correlation—and you may be right! But we also aren’t seeing a flood of crying that this is a bubble right now.

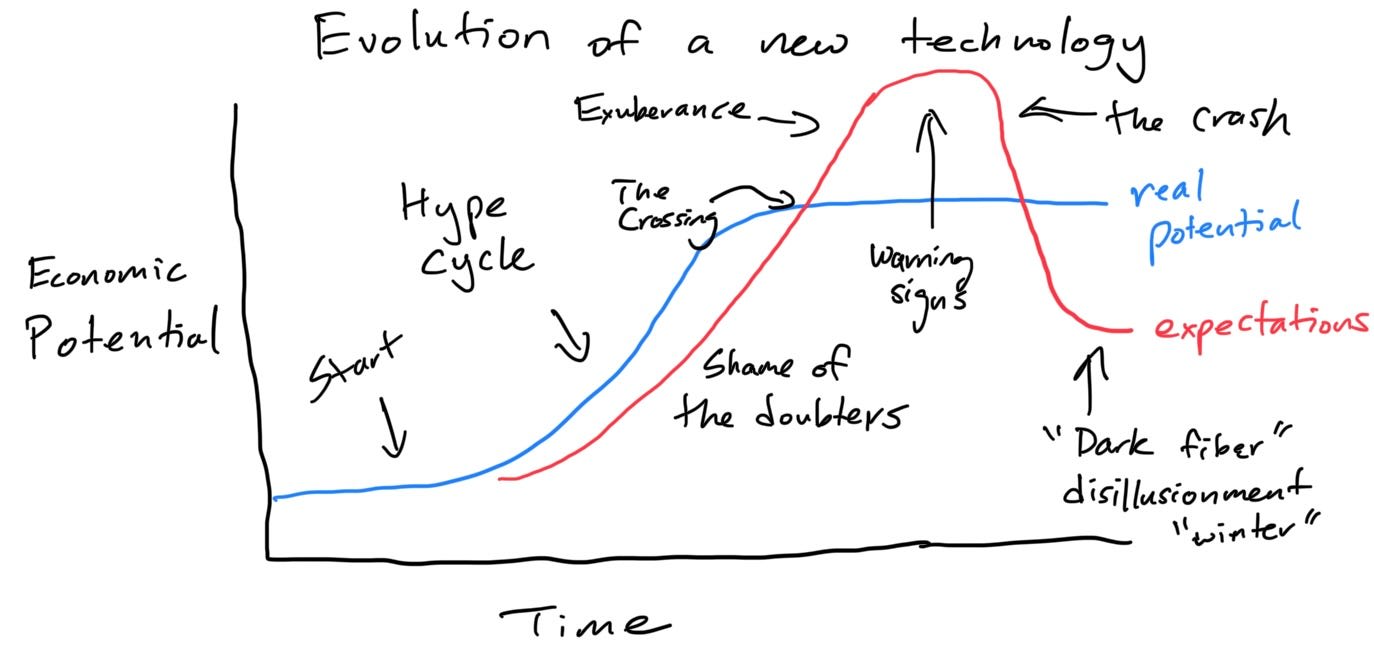

My personal framework, which I covered in “When the AI Bubble Bursts” all the way back in June 2024, is below:

The thing here is—we always have these kinds of boom and bust cycles with technology. It’s even rational in way. With transformative technology, you do not want to underestimate it, dismiss it as a fad, and get left behind. Especially if you keep seeing the technology exceed doubters by leaps and bounds, it makes sense to keep inflating expectations.

We see an innovative technology totally change our lives. We see overinvestment. We see huge financial wreckage from that overinvestment… but then we see multiple companies emerge from it (or new ones pick up the pieces and assume the mantle). Those companies become titans in our economy.

That applies to railroads after the Panic of 1873, with Standard Oil, Carnegie Steel, and JP Morgan.

It also applies to the DotCom bust—with Google, Amazon, and Comcast. The latter, for those who aren’t familiar, went on a buying spree of distressed internet infrastructure, most notably, AT&T Broadband—becoming the company we know and love today.

The key question is, where are we?

-

Are we at the point where the real potential of AI is still continuing to exceed the collective skepticism of the doubters?

-

Have we sailed past actual potential with expectations that are reaching sky-high, impossible heights?

-

Are we way past that point, in the warning signs phase where everyone is talking about how obviously huge this will be… while actual progress has stagnated?

AI is Still Growing Rapidly

Inherently, it’s always really hard to know where you are in a cycle. It looks really clear on my scribbled chart above—but the red line is subjective… and the blue line is impossible to actually know a priori.

We can try, though.

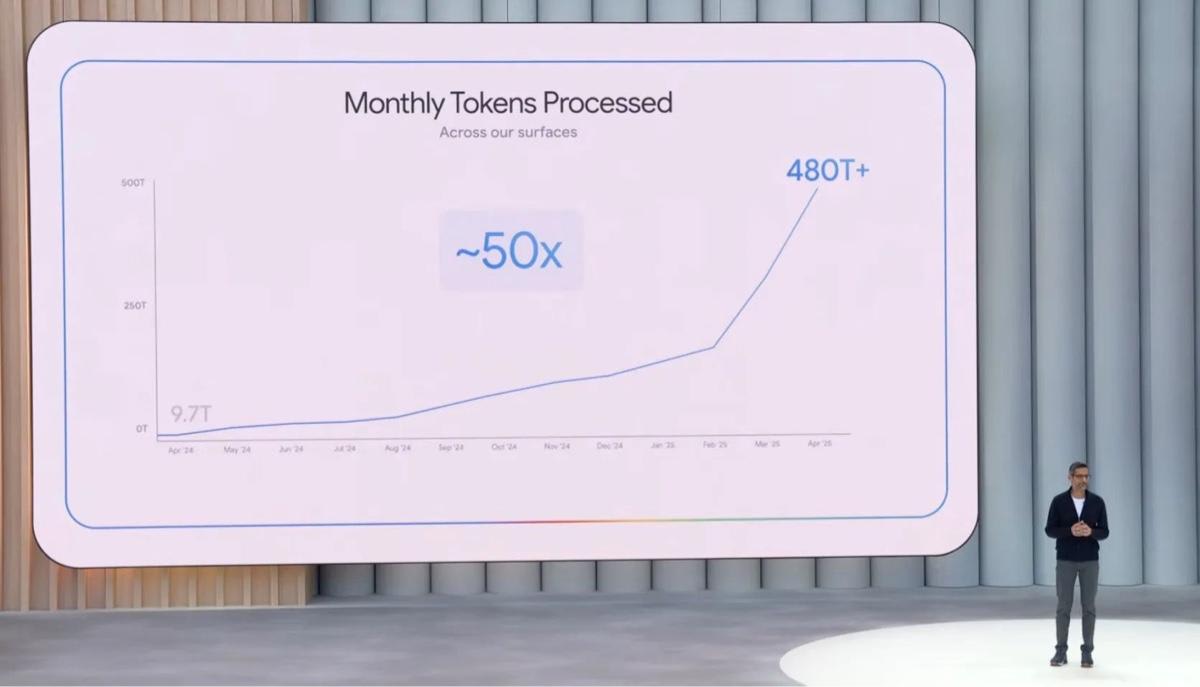

As Nathan Lambert from Interconnects pointed out recently in his coverage of Google I/O 2025, Google’s tokens processed has gotten insane. Monthly tokens are approaching 1 quadrillion.

As he also pointed out:

It puts the daily token processing of Google as a mix of reading or generating all the data in Google Books in four hours or all the instant messages stored in the world in a little over a month.

As a note: Interconnects is one of AI Supremacy’s featured newsletters you should follow; check out the list if you want to find more great newsletters.

Google I/O, timestamp here. Original screenshot credit to Nathan Lambert.

In case one is still asking the question, “But is this just Google setting money on fire?” the answer is yes, but no.

There are plenty of startups growing rapidly and hitting huge revenue numbers. a16z recently covered this on their blog a few days ago.

Lovable hit $50 million in six months. Cursor hit $100 million in its first year. And in a16z’s data on companies, they are seeing faster revenue ramps than ever—and greater divergences between the top and bottom quartiles of their observed companies.

Notably, this is BOTH in consumer and enterprise—with consumer companies actually doing better.

For raising Series A, the magic number used be getting to $1mm ARR (annualized recurring revenue). That’s no longer the case. As per a16z again:

What was once considered “best in” class”—the $0 to $1 million ARR ramp — is now on the lower end of growth we’re seeing.

Expectations are Mixed

We obviously all know AI boosters—especially on Substack. However, mainstream commentators are still somewhat mixed.

Famous economist Daron Acemoglu recently published a paper estimating that AI’s impact on GDP would be, “non-trivial but modest—no more than a 0.66% increase in total factor probability over 10 years…” In other words, 0.06% annually. He’s been deeply skeptical for a while, publishing plenty of opinion pieces arguing against believing the AI hype.

Gary Marcus (another AI Supremacy top featured Substack), consistently and continuously has talked about “deep learning hitting a wall.”

These folks haven’t been run out of town yet

Infrastructure Investment Continues

Of course, even at—or especially at—the end of a boom cycle, infrastructure investment is high. Meeker’s report, of course, has great graphics of this.

Nvidia GPU computing power is a good proxy of overall computing power—especially since AI still largely runs on them.

We’re in the early innings especially when compared to AI adoption—which is still rapidly growing and showing no signs so far as slowing down.

That being said, if we’re going purely by LLMs in particular, we’re going to run out of people rather rapidly. One of Meeker’s core points is that AI’s adoption is also built on the internet’s high penetration—and hence rapid distribution. AI (LLM-wise) is going to reach saturation at a faster rate than any technology in the history of technology.

That might mean that we’re going to see a faster boom—and bust—than any in history too, right?

Real-World AI

One of my venture firm’s key focuses is “real-world AI.” One half of this is enablers of AI—including interconnects, cooling, power solutions, etc.

The other half is literally AI being used in the real world—things that AI enables. Real-world AI in terms of what is being enabled is really just starting—and we’re seeing impacts in a lot of different places.

As Meeker points out in her report, the change is rapid (22% quarter-over-quarter)—but from a relatively low base, especially versus the consumer market. There’s a reason why a16z had pointed out that consumer seem to be doing better.

Consumers have adopted much faster than industry (note the ridiculous penetration of ChatGPT above)—which is non-trivial at 7% of all firms with some adoption (see light and dark blue bars in “All Industries”), but still has plenty to go.

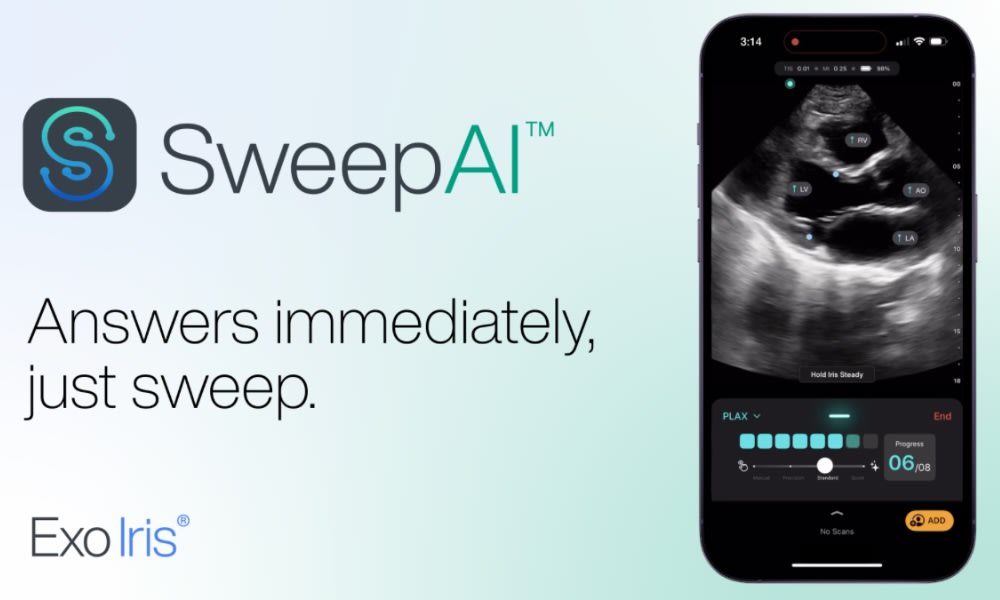

This broader rollout into the real world is happening in medical devices—and helping transform the healthcare system. One company that Creative Ventures invested in during its earliest stages and recently got a lot of attention is Exo Imaging. They use MEMS (microelectromechanical systems—basically, chips) that can replicate traditional piezoelectric crystals.

Anyway, they can do what big cart ultrasounds can do—with a fraction of the cost, voltage level, and overall power. But their real power is from their integrated AI. It’s also how they’re really taking off in healthcare. SweepAI lets you just “sweep” their small, portable ultrasound across an organ—and immediately get diagnostic insights. That’s not their only FDA clearance for AI either.

In 2024 alone, Exo has achieved FDA clearance for a total of 4 AI indications, bringing the total clearances to 9. With the launch of SweepAI, Exo Iris now includes automated AI-based indicators for congestive heart failure, detection of acute decompensated heart failure, stroke volume and heart rate, and determination of left ventricular wall hypertrophy.

Why am I talking about this? Am I just “talking up my own book”? Well, I am proud of Exo and especially all the lives they will improve and save.

However, I’m pointing this out because Exo is a good example of a broader trend. Hardware—because you need it in the real world—and AI make incredible things happen.

And Exo is not alone at all in healthcare, as per another slide from Meeker’s report.

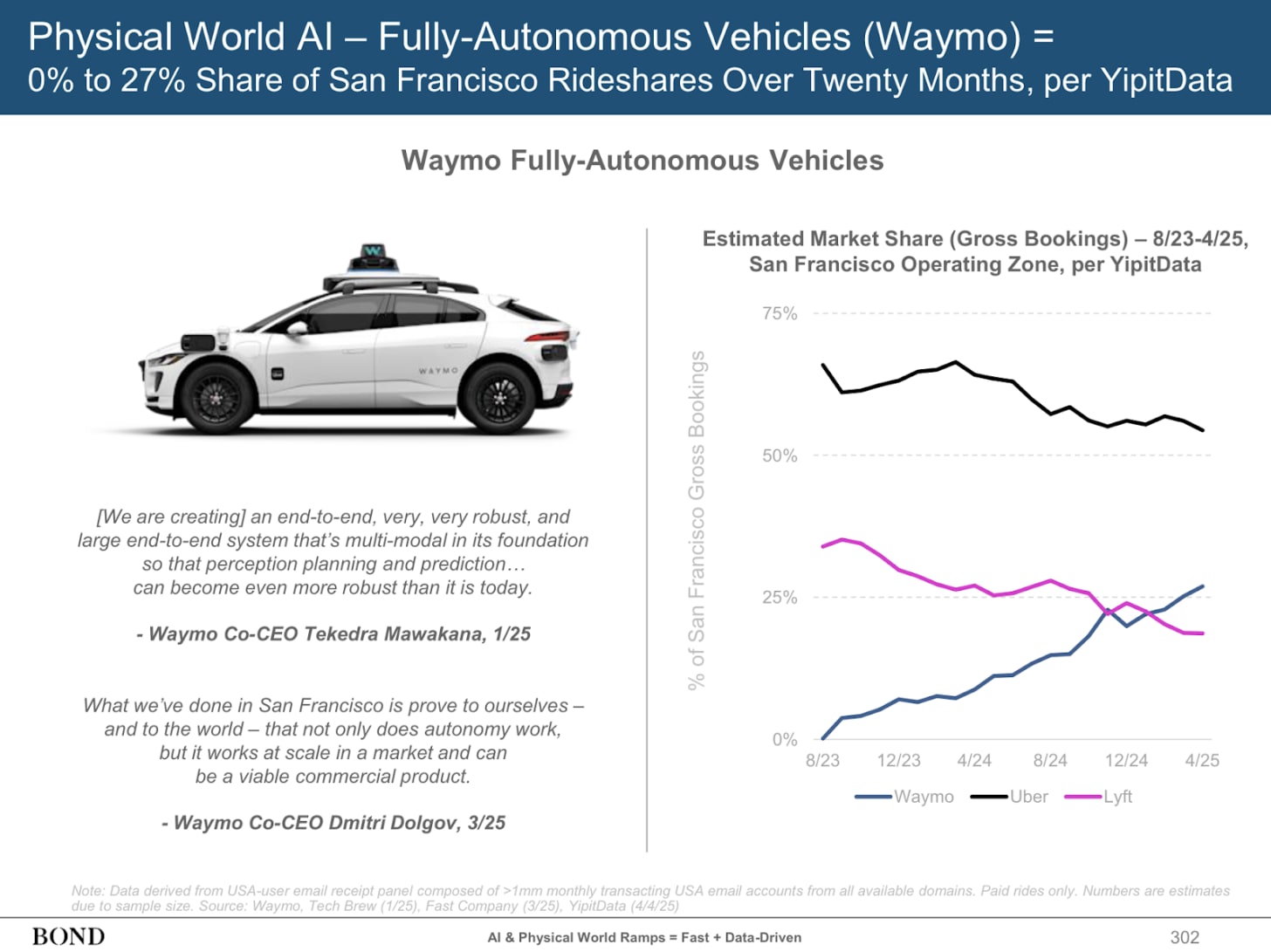

Real-world AI is still in its early days. Meeker goes through a few examples, but one of the most fascinating is that she shows data that Waymo (Google X self-driving car spinout) has now exceeded Lyft in market share in San Francisco.

That’s incredible. But it still has a long way to go until it takes Uber’s lunch. (Or, more seriously, probably will just be on Uber’s platform like it is in certain markets like Austin already).

If you need another datapoint on AI in the real world being somewhat nascent, look no further than Ukraine’s Operation Spider Web.

In my own piece on it, I explain why this is a Big Deal that likely changes the entire global landscape forever. That includes impacts on global shipping (because of shipping containers), but potentially the invalidation of trillions of dollars of legacy weapons caches that are now essentially sitting ducks against similar attacks. Russia’s strategic bombers, the Tu-95s, got hit hard. They may be old, but they’re still part of Russia’s nuclear umbrella. It’s crazy that some drones went in and wrecked so much havoc on them.

As Noah Smith points out—this could happen with Chinese drones attacking US military resources as well. Categorically, it’s broadly the same thing.

That’s one single attack so far and the first of this kind. Many don’t realize that there already have been AI-powered drones autonomously killing people in Ukraine (again, I mention this in my piece above), but this demonstrates that our traditional understanding of how war plays out is now totally out of date.

Technology, and AI in particular, now takes center stage for who controls the most hard power in the world. That’s partly why, after all, Anduril and Meta recently announced their partnership in XR.

Still Early Innings

Are we in a bubble? That’s perhaps more a question of sentiment and idiosyncratic factors than anything else. We could see the dollar collapse and interest rates skyrocket with continuous questions about US bond auctions (note, Japan recently had a bond auction crisis too) and a bunch of other factors that externally “prick” the bubble. Costs of investment could rapidly exceed the ability of companies to service, and we could have a collapse that way.

But in terms of pure cycle, my read is that we’re still somewhat early. ChatGPT and consumer applications have surged with never-before-seen rapidity in market penetration—but even there, applications are still in their nascent stages.

I don’t think you can say that even developer tools—one of the more “older” areas of AI application—like Cursor or Aider or Replit, are mature by any means.

Real-world AI applications are still at their very starting phases, with both amazing and scary things happening in physical models, world models, and robotics.

See here for a deep dive on the state of robotics in this publication.

Everyone can have their own opinions, but at least based on what I’m seeing, we’re still in the potential—and realized—power of AI still exceeding what we expect it can do.

Other Stuff (though I think you have it all)

Bio

-

James Wang is a partner at Creative Ventures, an early-stage, deep-tech venture fund that has invested in AI, synthetic biology, and advanced materials since 2016. He was formerly part of the core investment team at Bridgewater Associates and did a stint at X, Google’s moonshot innovation lab.

-

He is a board director for numerous AI, healthcare, and robotics companies, including Picnic Works, Oncoustics, and C.Light Technologies. James holds a master’s in computer science from the Georgia Institute of Technology and an MBA from the University of California, Berkeley. He is the author of the Substack newsletter, Weighty Thoughts, and is the author of the book “What You Need to Know About AI” coming out later this year.

Read More in AI Supremacy