Hey Everyone,

We often associate China’s Generative AI leadership with DeepSeek or Alibaba Qwen. But for all the press we get in the west about OpenAI or Google’s new AI products, China BigTech like Tencent, Baidu and ByteDance are also working hard with LLMs.

In 2025, ByteDance is expected to spend $12 Billion on AI chips and AI Infrastructure. ByteDance, the maker of TikTok is already one of the world’s best consumer AI app makers, long before ChatGPT rolled around. In 2024, ByteDance, the parent company of TikTok, reported a 29% increase in revenue, reaching $155 billion.

One of my favorite ChinaTech writers has to be of Recode China AI Newsletter. After a five year stint at Baidu, he now has a new gig but few realize he was one of the best Tech journalists at Synced back in 2018 for nearly 3 years.

ByteDance is not being left behind in reasoning models in 2025 either, regarding Seed-Thinking-v1.5, an upcoming large language model (LLM) designed to advance reasoning performance across both science, tech, math, and engineering (STEM) fields and general-purpose domains. This may have even caused DeepSeek to update its R1 reasoning model this week. While DeepSeek’s story is well known by now, ByteDance’s prowess in LLMs is not well understood by western audiences. Neither for that matter is ByteDance’s prolific app and social commerce empire.

China by the end of 2025 will be the leader in Open-Weight LLMs

Most recently, ByteDance has open-sourced Bagel. Bagel is a multimodal AI model that accepts both text and images as input. The open-source VLM features a total of 14 billion parameters, out of which seven billion remain active at a time.

✨ Key Features

-

You can use both images and text together in one prompt

-

Retains visual context throughout the conversation

-

Understands spatial layouts for navigation

-

Its “thinking mode” enables chain-of-thought reasoning across modalities

🤖 Model Design and Training

-

BAGEL 7B uses a special architecture with multiple expert networks and two image encoders.

-

One encoder captures image details, the other captures meaning and structure

-

Advanced editing and reasoning emerge later as the model continues training

💎 Image Editing and Other Abilities

-

Changes image styles while keeping key details consistent

-

Rotates objects in 3D and fills in missing parts of images

-

Predicts future frames for videos using motion understanding

🧠 Access and Availability

-

You can run BAGEL on 4×16GB GPUs or fine-tune it with LoRA variants

-

Weights, code, and scripts available on GitHub under Apache 2.0

-

Public demos available on Hugging Face

BAGEL is licensed under the Apache 2.0 license.

Let’s get into Tony’s analysis and deep dive on ByteDance in AI.

-

If you want to support me finding and showcase emerging writers in AI and get full-access to my best work, don’t hesitate to support:

-

If you know someone that might want to understand ByteDance’s AI ecosystem, why not share the piece?

TikTok’s Parent ByteDance Quietly Builds Its AI Empire

AI is a battle that TikTok’s parent company can not afford to lose.

By , April, 2025.

Works by Tony Peng

-

China’s AI Looks Vibrant, but It’s Fundamentally Chaotic, Scientist Warns

-

DeepSeek Reveals New Training Method Ahead of DeepSeek-R2 Release

-

💻Is Manus the ‘DeepSeek Moment’ for AI Agents or Just a Claude Wrapper?

When people outside mainland China think of ByteDance, they think of TikTok—an app that propelled short video into omnipresent popularity and placed ByteDance at the heart of U.S.-China tensions.

But here’s what you don’t hear much about: ByteDance’s AI. Unlike other Chinese tech giants like Alibaba and Baidu, whose AI models are often open-sourced or well-publicized, ByteDance rarely courts global media attention to boast about its models. Yet, behind the scenes, ByteDance has built some of the most sophisticated LLMs and consumer AI apps in the world.

Why don’t we talk about it more? Partly because ByteDance is deliberately cautious. AI is geopolitically sensitive terrain. For a company with a global footprint facing scrutiny from both Washington and Beijing, flying under the radar might be strategic.

But it’s also about how the global AI narrative is shaped. In the West, we track the rise of OpenAI, the wildness of xAI, and Google’s innovation. Even among Chinese firms, DeepSeek and Alibaba have made headlines with their open-source LLMs. ByteDance’s models, however, are closed-source. Their flagship AI products mostly remain in China, while global equivalents often lack brand recognition.

This story explores ByteDance’s quieter, deeper transformation into one of the strongest—and possibly most underestimated—AI players in the world.

How ByteDance Rose as an AI Giant

ByteDance has always been an AI company, even if it didn’t always act like one.

Long before ChatGPT became the buzzword of the year, ByteDance integrated machine learning into the DNA of its most successful product, TikTok (Douyin as the Chinese version). The famed recommendation algorithm powering endless scrolling demonstrated ByteDance’s deep comfort with data, user behavior modeling, and content personalization. ByteDance has been doing AI for years, just not in ways typically celebrated by the AI community.

Their AI Lab, launched around 2016, primarily supported company applications. Before 2023, the Lab’s NLP (Natural Language Processing) group had around 100 members, led by Li Hang, Head of Research at ByteDance. Only a small team of ten people researched large language models (LLMs).

But everything changed in late 2022 when OpenAI launched ChatGPT, sparking global experimentation and triggering shockwaves in the Chinese tech industry. By early 2023, Baidu released ERNIE Bot, Alibaba dropped Qwen, and startups like Moonshot AI and MiniMax entered the fray.

ByteDance was late. By mid-2023, while others showcased chatbots and APIs, ByteDance had little to show. It wasn’t until August that ByteDance released its first LLM, Skylark (云雀 Yunque in Chinese), months behind rivals. Its flagship chatbot, Doubao, debuted the same month but underwhelmed, reaching only 1.3 million daily active users by November, compared to ChatGPT’s 300 million weekly users.

At an all-hands meeting in early 2024, CEO Liang Rubo was blunt. The company had been “sluggish,” as rivals surged ahead with foundation models.

Our organization’s reaction to new opportunities has been sluggish, lacking the sharpness of startups. Our technology review, conducted at the company level every six months, only started to seriously discuss GPT in 2023, while most successful LLM startups were founded between 2018 and 2021.

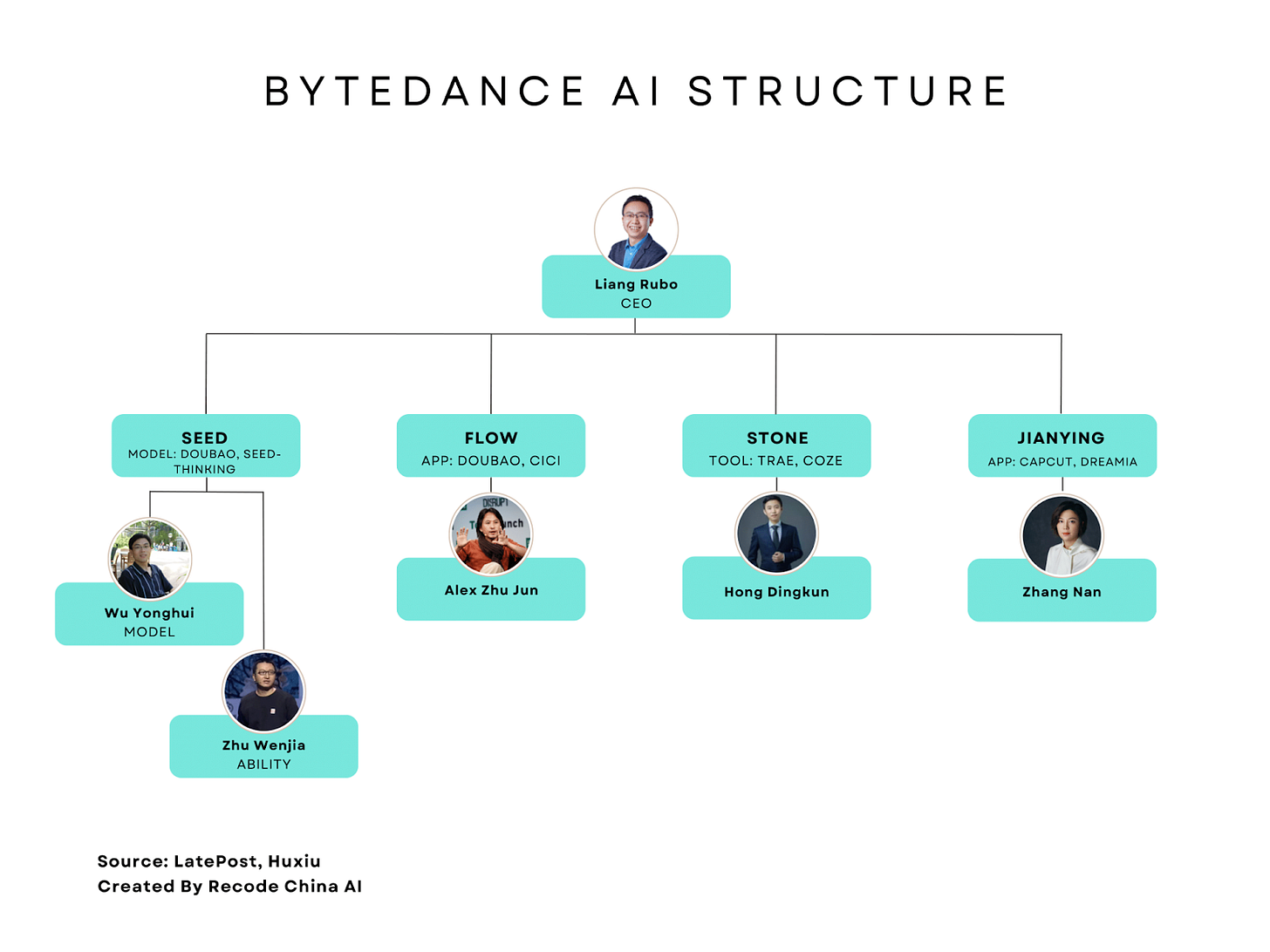

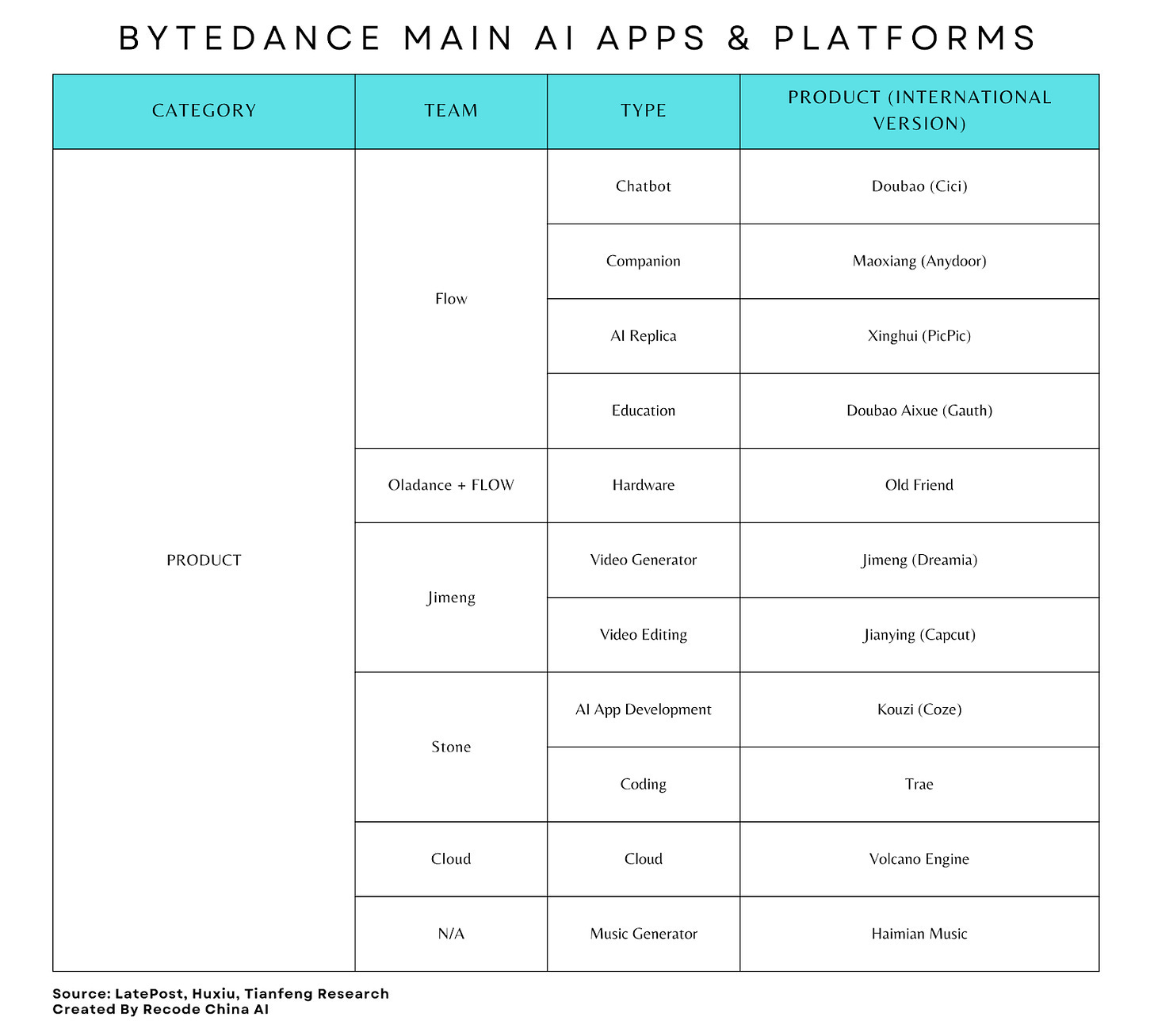

Since late 2023, ByteDance accelerated. A dedicated AI division called Flow was established, equal in stature to core units like Douyin. Flow quickly split into three units: application team Flow, foundational model team Seed, and infrastructure and tooling team Stone.

By 2024, ByteDance moved at breakneck speed. They committed to building AI entirely in-house, from LLMs to image and video generators. ByteDance rebranded Skylark to Doubao in May 2024, pricing Doubao Pro at RMB 0.8 (~$0.11) per million tokens, significantly cheaper than industry standards. In September, ByteDance released video generators PixelDance and Seaweed, capable of complex, sequential motions in short videos.

Second, they leaned into what they already did best: Apps. As China’s undisputed “app factory,” ByteDance had a massive number of elite product managers. They turned models into sticky, usable, viral experiences. Doubao may have started slow, but its user experience quickly pulled ahead. It integrated with search, offered personality-driven AI characters, and worked across tasks with ease. Using the TikTok playbook, ByteDance has created international versions for nearly all its AI apps—from Doubao and Cici to Kouzi and Coze, its AI app development platform.

Third, they used their ecosystem to dominate distribution. Douyin, the household short video platform in China, became a growth engine for ByteDance’s AI apps. ByteDance reportedly spent RMB 1 billion ($150 million) promoting Doubao across its app network, converting users at scale. By November 2024, Doubao reached almost 60 million monthly active users, unquestionably topping China’s AI app leaderboard.

Supporting this growth was an influx of talent. ByteDance aggressively recruited engineers and scientists, attracting top industry figures such as a principal scientist from Alibaba and a co-founder of 01.AI, an AI startup led by Lee Kai-Fu, by offering competitive salaries and clear long-term vision.

Founder Zhang Yiming played an active, not passive, role in driving this strategy. He reportedly read the latest research daily, met with global AI experts, and personally directed the company’s AI initiatives. Zhang and other key executives view AI as a battle that it cannot afford to lose.

The results followed. ByteDance ramped up its presence at academic conferences, publishing fundamental research and co-authoring with institutions like Peking University. At NeurIPS 2024 — arguably the Olympics of AI — ByteDance won the Best Paper award.

By 2024, it appeared the war for China’s AI future was over. ByteDance was swallowing the market whole. With its model improving rapidly, its app ecosystem thriving, and its momentum in multimodal AI — ByteDance was, by all appearances, winning.

However, the emergence of DeepSeek disrupted this narrative. Already recognized by Chinese AI researchers, the Hangzhou-based startup largely remained under the radar globally until December 2024 and January, when it introduced its latest foundation model DeepSeek-V3 and reasoning model R1. The response was explosive. Without extensive PR campaigns or sophisticated app interfaces, DeepSeek Chat quickly became a global phenomenon, rapidly becoming China’s most popular chatbot and achieving possibly the fastest user adoption in mobile app history.

This surge shocked ByteDance. After reportedly investing up to 80 billion yuan (~$11 billion) in AI in 2024, ByteDance found itself unexpectedly outpaced by a leaner, more open competitor. In response, an early 2025 all-hands meeting was convened, where CEO Liang publicly acknowledged the missteps. While Doubao remained successful and ByteDance’s models retained top-tier status, the company had again misread the market dynamics. Specifically, they had underestimated the strategic significance of test-time compute innovation—highlighted by DeepSeek’s R1, modeled after OpenAI’s o1, initially considered marginal by ByteDance.

To address this, ByteDance initiated a bold project named Seed-Edge, aimed at pushing the frontier of intelligence. This initiative redirected significant resources toward advanced AI research, exploring beyond Transformer architectures into new frameworks, complex reasoning systems, AI agents, and possibly even proprietary AI chips. It marked a decisive return to foundational ambition.

At the same time, ByteDance brought on Wu Yonghui, a respected expert from Google Brain, to lead their foundational AI efforts.

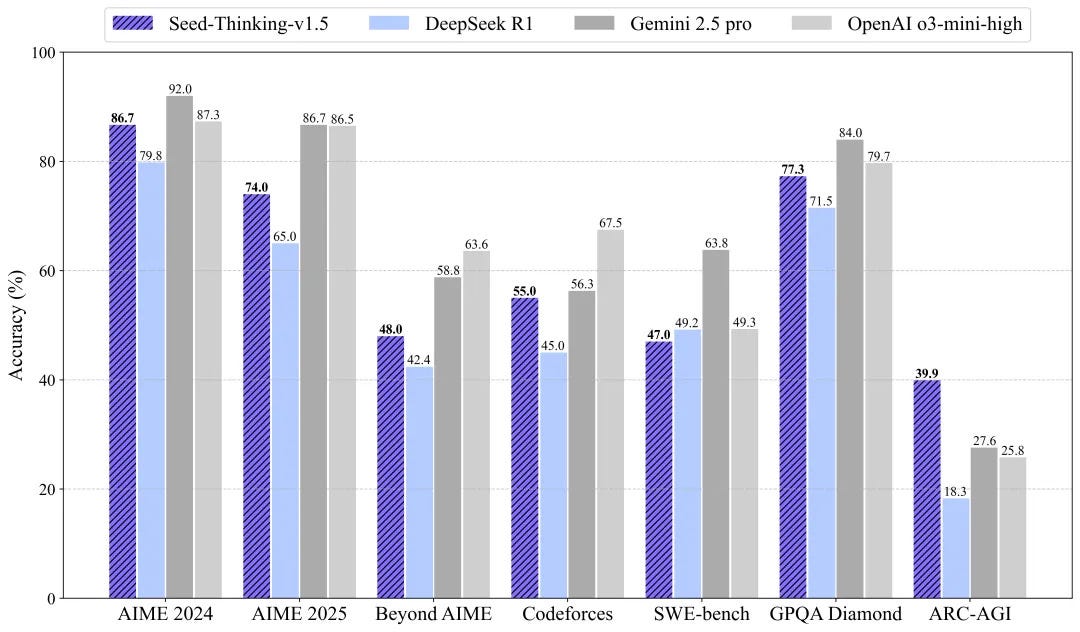

By early 2025, ByteDance was back in motion. They released Doubao-1.5-Pro, a new-generation foundation model with improved multimodalities and faster inference. They launched a separate reasoning model called Seed-Thinking-1.5 that outpaced DeepSeek-R1. They released their own coding assistant — a “Cursor”-style tool — and began offering API access to third-party developers. Reports even surfaced of ByteDance developing in-house AI chips, possibly to reduce reliance on Nvidia’s hardware and optimize for their own model architectures.

By early 2025, ByteDance had regained momentum. They introduced Doubao-1.5-Pro, a next-generation foundational model featuring improved multimodal capabilities and accelerated inference speeds. They also launched Seed-Thinking-1.5, a dedicated reasoning model surpassing DeepSeek-R1, and developed a coding assistant reminiscent of Cursor. Reports even suggested ByteDance was developing in-house AI chips, aiming to reduce dependence on Nvidia hardware and optimize performance for their unique model architectures.

Thus, while DeepSeek momentarily gained the spotlight, ByteDance remained fiercely competitive and deeply engaged in the ongoing AI battle.

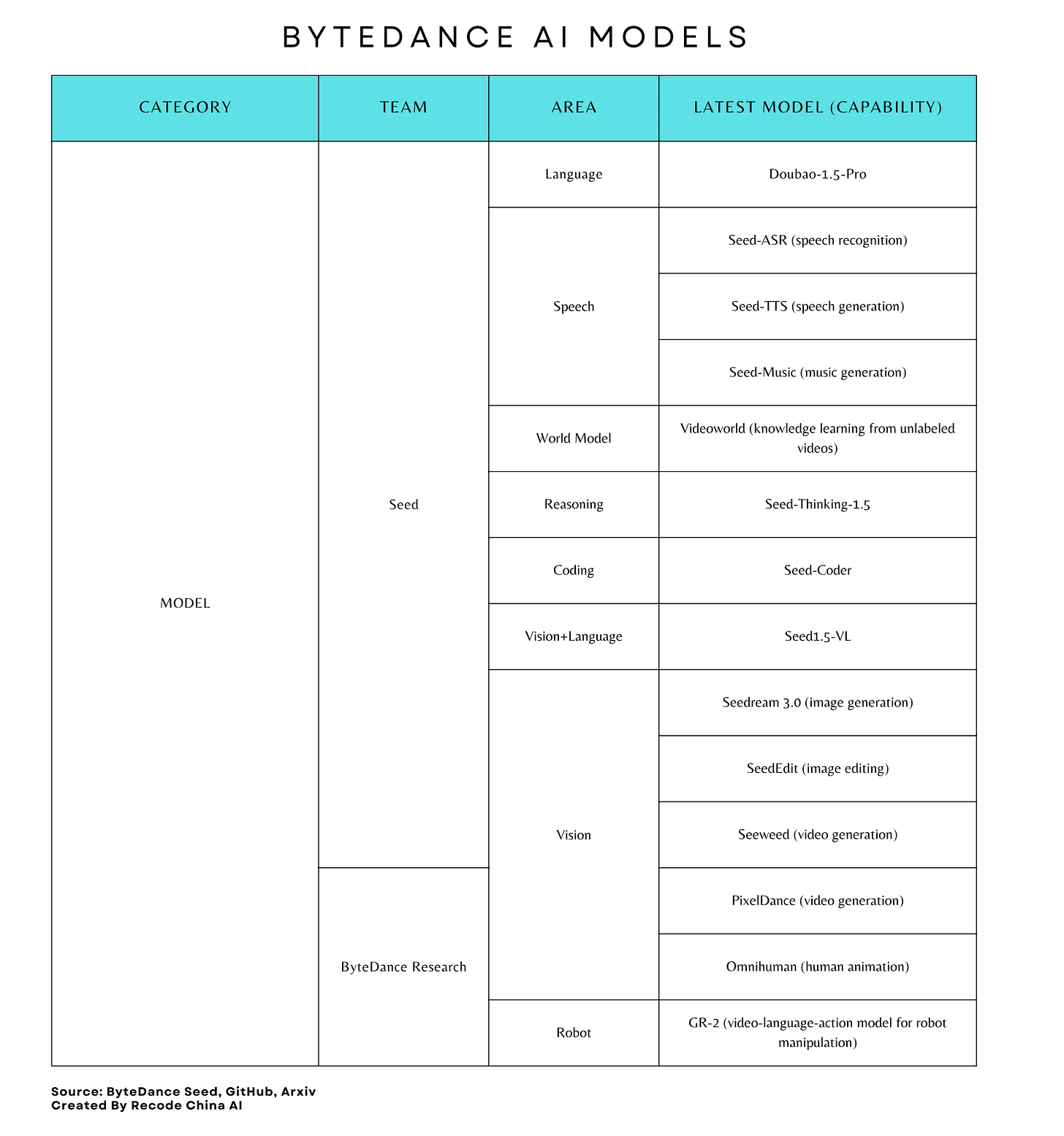

Below is an overview of ByteDance’s LLM offerings, AI applications, and related initiatives.

ByteDance’s AI Models

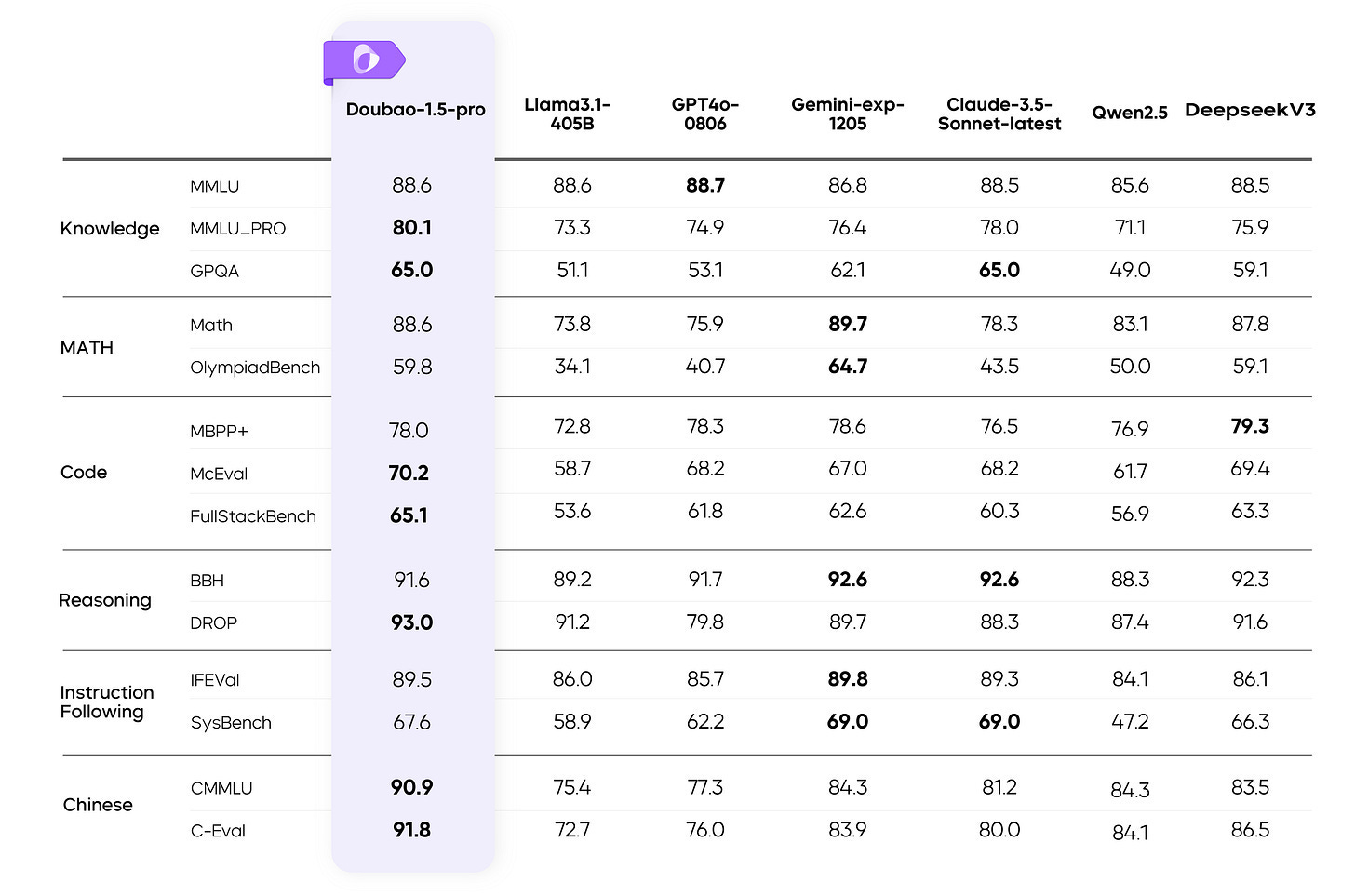

Doubao: Foundation LLMs

Named after a Chinese pastry, Doubao is ByteDance’s answer to GPT and similar models. Internally incubated throughout 2023 and formerly known as Skylark, Doubao officially launched in mid-2024 as a family of LLMs. It includes at least eight variants, from an entry-level Doubao Lite to the top-tier Doubao Pro which handles a massive 128,000-token context. Some versions specialize in speech recognition and “virtual character” generation.

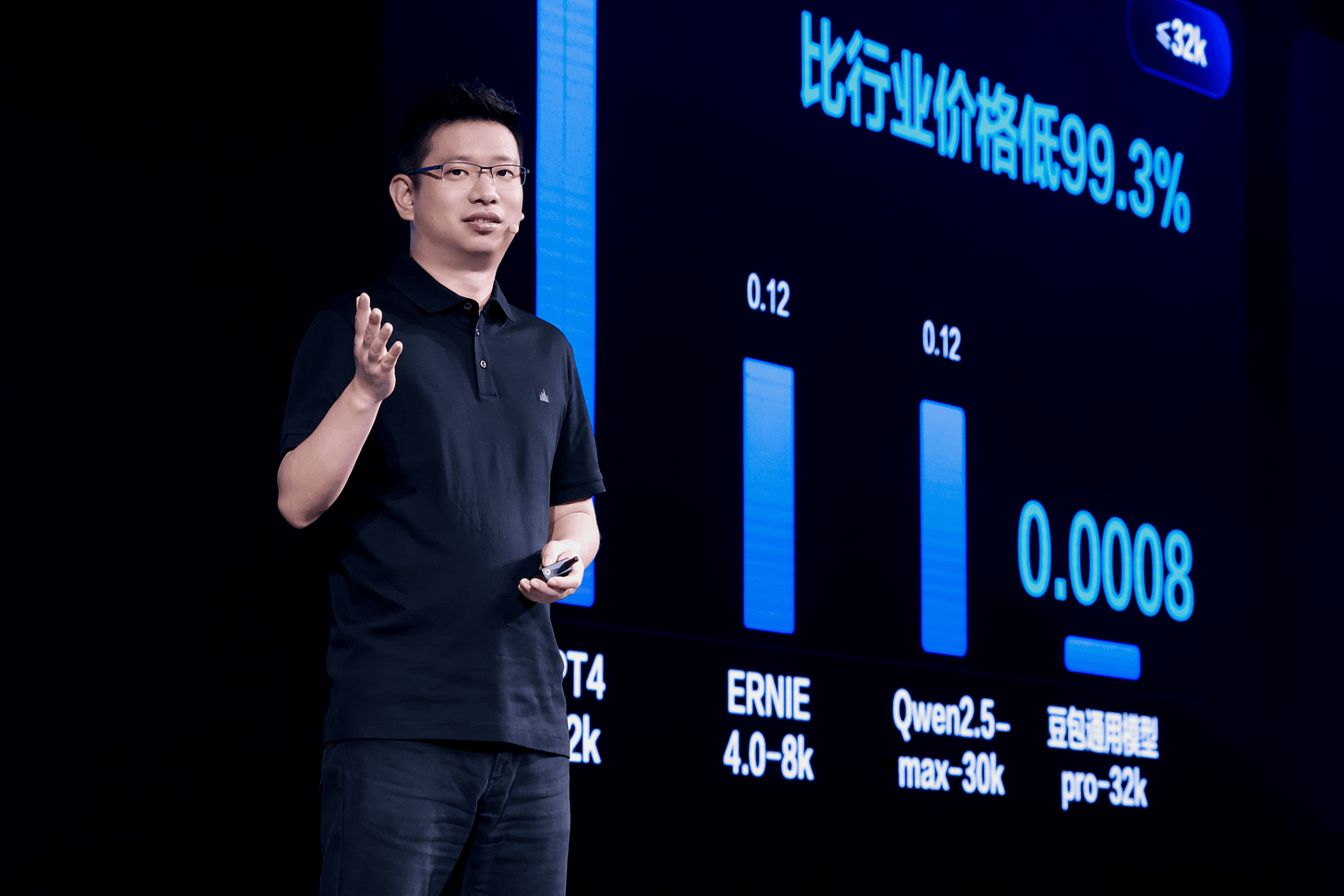

ByteDance positioned Doubao as ultra-low-cost to drive adoption. At launch, the company surprised rivals by pricing Doubao’s usage at just RMB 0.8 per million tokens—99.8% cheaper than OpenAI’s GPT-4 pricing. Even Baidu and Alibaba’s models cost 150 times more per token. This aggressive pricing triggered a price war in China’s LLM market and helped Doubao rapidly gain enterprise users.

By early 2025, ByteDance released Doubao-1.5-pro, an upgraded MoE multimodal model tuned for faster inference. The company claimed Doubao-1.5-Pro achieved scores on par with OpenAI’s GPT-4o model. ByteDance expanded the model’s context window to 256k tokens in some versions, targeting tasks requiring long documents, while keeping token costs astonishingly low (e.g. RMB 2 per million output tokens for a 32k context model). Notably, ByteDance emphasizes the model’s training on independently sourced data.

Seed1.5-VL: Vision-Language Model

Fresh off the boat in May 2025, Seed-1.5-VL is a vision-language foundation model developed by the Seed team, designed to advance general-purpose multimodal understanding and reasoning. It integrates a 532M-parameter vision encoder with a MoE language model comprising 20 billion active parameters. Despite its compact architecture, Seed-1.5-VL achieves SOTA performance on 38 out of 60 public vision-language benchmarks, demonstrating strong capabilities in visual comprehension, video understanding, and multimodal reasoning tasks. Notably, it excels in agent-centric applications such as GUI control and gameplay, outperforming leading multimodal systems like OpenAI’s CUA and Anthropic’s Claude 3.7.

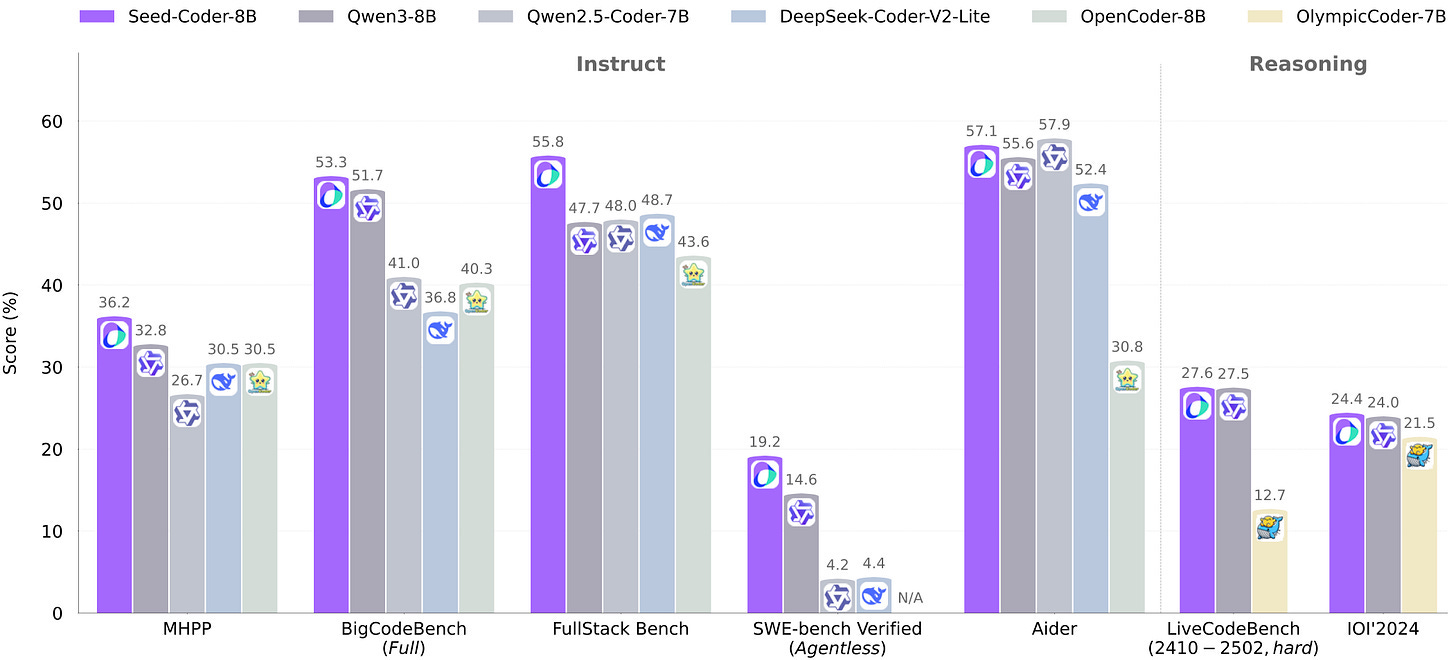

Seed-Coder: Open-Source Coding Models

While most of ByteDance models are close sourced, Seed-Coder is a family of open-source coding model. Designed for code generation, reasoning, and software engineering tasks, Seed-Coder comprises three 8-billion-parameter models: base, instruct and reasoning.

A notable feature of Seed-Coder is its “model-centric” data curation approach, where smaller LLMs are employed to automatically filter and select high-quality training data from sources like GitHub and code-related web content, reducing manual intervention. Benchmark evaluations indicate that Seed-Coder performs competitively among open-source models of similar size across various coding tasks.

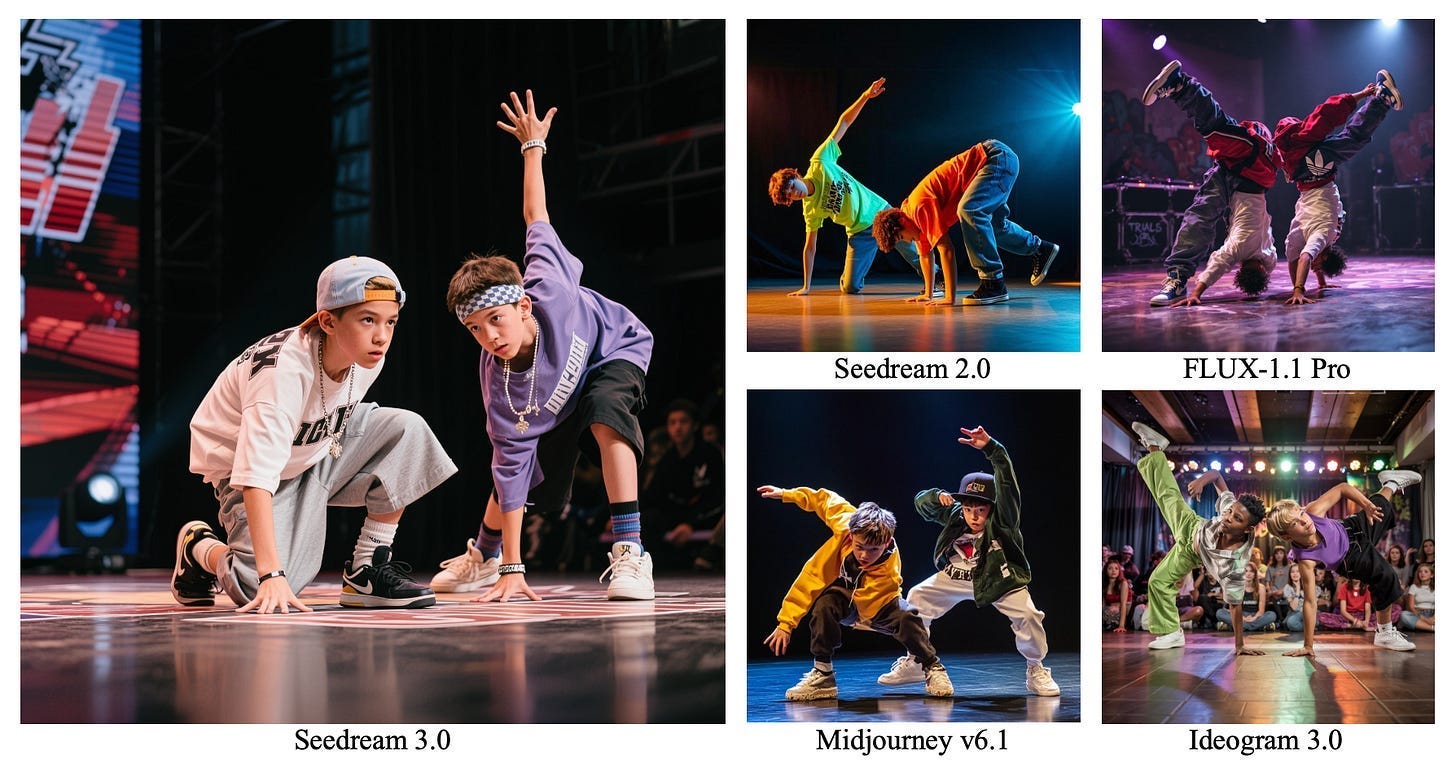

Seedream 3.0: Text-to-Image Model

ByteDance’s Seedream 3.0, launched in April 2025, is a bilingual (Chinese-English) text-to-image model that delivers high-resolution (up to 2K) images in approximately three seconds. It employs defect-aware training and dual-axis data sampling to enhance image-text alignment and aesthetic quality. The model achieves a 94% text rendering accuracy in both languages, excelling in dense typography and photorealistic portrait generation. Seedream 3.0 is integrated into ByteDance’s Doubao and Jimeng apps, and accessible via Volcano Engine APIs.

PixelDance & Seaweed: Video Generation

In video generation, ByteDance unveiled two text-to-video models in late 2024, as part of the Doubao family: PixelDance and Seaweed. PixelDance can synthesize high-fidelity 10-second videos from text or image prompts that can generate complex, sequential motion, while Seaweed extends the capability to 30-second clips. These models, available on Doubao chatbot, were among the first in China to bring video creation to a consumer-facing chatbot.

ByteDance’s research in visual AI went further with world-first experiments. In early 2025, its AI Lab open-sourced an experimental model called VideoWorld, which flipped the script on video generation. VideoWorld does not start from text prompts like DALL-E or Runway; instead, it learns from raw visual data alone. Trained on unlabeled video footage, VideoWorld became the first AI system to “recognize and understand the world through pure visual input… without relying on text or language models”.

For animating human subjects, ByteDance debuted OmniHuman-1 in February 2025, an end-to-end model that can transform a single static image of a person into a smooth, lifelike video sequence.

Seed-ASR & Seed-TTS: Speech

Doubao’s chatbot features real-time voice call capabilities that sound remarkably close to humans, and behind that experience are two advanced speech models: Seed-TTS and Seed-ASR.

Seed-TTS is a family of large-scale autoregressive models designed to generate speech that closely mirrors human naturalness and expressiveness. It supports zero-shot voice cloning, allowing the synthesis of speech in a specific speaker’s voice using only a brief audio sample. The model offers fine-grained control over vocal attributes such as emotion, tone, and speaking style.

Seed-ASR is an LLM-based speech recognition model developed using an audio-conditioned large language model (AcLLM) framework. It is trained on over 20 million hours of speech data and approximately 900,000 hours of paired ASR data, enabling it to accurately transcribe speech across various domains, languages, and accents. Seed-ASR supports Mandarin, 13 Chinese dialects, English, and seven other languages. Compared to other state-of-the-art ASR models, Seed-ASR achieves a 10% to 40% reduction in word or character error rates on public test sets.

Seed-Music: Music Generation

In 2024, ByteDance ventured into AI music and audio. ByteDance’s primary AI music generation model is Seed-Music, unveiled in September 2024. This model integrates autoregressive language modeling with diffusion techniques to produce high-quality, controllable music compositions. Seed-Music supports multimodal inputs, including text descriptions, audio references, sheet music, and voice prompts, allowing users to generate both vocal and instrumental pieces across various genres. Notably, it features zero-shot voice conversion, enabling the transformation of a 10-second voice sample into expressive singing performances. Additionally, Seed-Music offers post-generation editing capabilities, permitting users to modify lyrics and melodies directly within the generated audio. The model is accessible through ByteDance’s Doubao app and Volcano Engine API, catering to both novice creators and professional musicians.

Seed-Thinking-v1.5: Complex Reasoning

To catch up with OpenAI’s o1 and DeepSeek R1, ByteDance released The Seed-Thinking-v1.5 model in April 2025, which is explicitly geared for complex reasoning in domains like mathematics, coding, and scientific problem-solving. It combines multimodal inputs with logical inference, allowing it to “associate and think about what it sees like a human”. On challenging math competitions, this vision-enhanced LLM matched OpenAI’s latest mini-o-model performance and demonstrated strong coding ability.

To operationalize this, the company rolled out the OS Agent toolkit — essentially an agent development platform bundled with specialized models and tools. A notable component is UI-TARS, a GUI agent model that can observe a computer or phone interface and manipulate it like a human user. UI-TARS combines visual understanding, logical planning, and UI element interaction, overcoming the limits of scripted automation by using AI to adapt to on-screen changes. This empowers a new class of agents that, for example, could plan a travel itinerary and actually book tickets end-to-end, clicking through apps and forms autonomously.

AI Apps and Platform

ByteDance has been aggressively turning its AI research into products on multiple fronts, from a ChatGPT-style chatbot and a social media app filled with AI-generations, to cloud APIs and developer platforms, ByteDance has rolled out AI-powered offerings on multiple fronts.

Doubao: China’s Hottest AI Chatbot in 2024

Launched publicly in August 2023, Doubao, sharing the same brand name with ByteDance’s LLMs, has become a blockbuster AI chatbot in China. Much like OpenAI’s ChatGPT, Doubao provides conversational answers and realtime voice calls in both Chinese and English, but ByteDance supercharged it with multimodal capabilities and the backing of its social platforms.

Users can not only chat in natural language, but also ask Doubao to understand and create picture, generate digital avatars, or even produce music clips. Multimedia generations can be shared on Doubao’s social community in a cottage scroll format, a built-in feature OpenAI is mulling.

Linked with ByteDance’s massive content base, Doubao has made its self an AI search engine rivaling Baidu. Its AI-generated answers are backed by either Douyin’s short video or Toutiao’s news. Recent research shows Doubao’s deep research accuracy achieves SOTA among Chinese chatbots.

Doubao is not without controversies. In May 2024, users reported finding Doubao-generated articles directly on Google. There were once reportedly over 15 million Doubao-generated pages on Google. Doubao also allows users to share their conversations as static web pages, which can then be indexed by search engines. Most of these pages have been removed.

By March 2025 Doubao amassed about over 116 million monthly active users, only eclipsed by DeepSeek’s 194 million MAUs. Industry rankings showed Doubao as the #1 AI app for Chinese consumers by 2024. Its western counterpart is called Cici.

Volcano Engine: AI Cloud Platform

On the enterprise side, ByteDance’s primary vehicle is Volcano Engine, its cloud and AI services arm comparable to Microsoft Azure and Alibaba Cloud. Volcano Engine commercialized many of ByteDance’s AI models as on-demand APIs or platforms for businesses and developers. When Doubao LLM launched for enterprise use in May 2024, it was offered via Volcano Engine at rock-bottom prices. The result was a huge uptick in usage as the daily token calls reached 12.7 trillion (over 100× growth since May 2024).

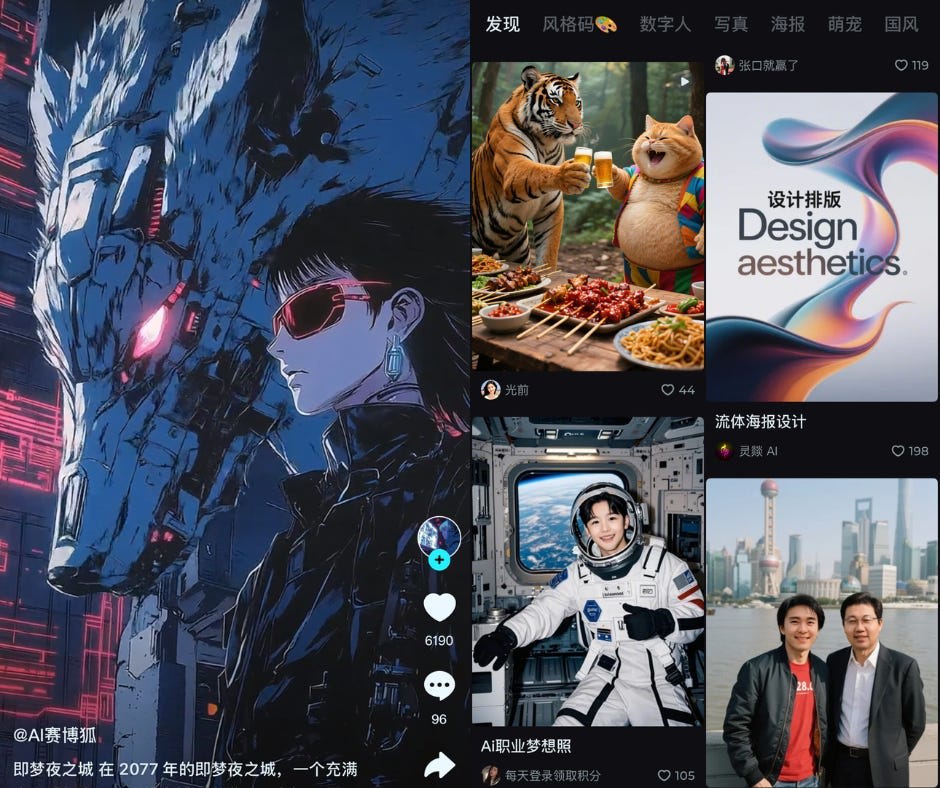

Jimeng: TikTok of the AI Era

Despite Doubao’s impressive growth, ByteDance discovered by 2024 that user engagement metrics such as session duration and message frequency have plateaued, mirroring trends seen in other chatbots, Chinese local media reported. ByteDance views chatbots as a transitional phase in AI development and views Jimeng (known as Dreamia in the West) as the “TikTok of the AI era.”

Jimeng is a generative AI platform that offers AI-powered image and video creation tools. Developed by ByteDance’s Jianying (known as CapCut in the West) team, Jimeng allows users to transform text prompts into visual content like Sora. Jimeng has a video scrolling feature reminiscent of TikTok’s signature vertical feed. It allows users to swipe through a curated stream of AI-generated short videos.

Jimeng is available as a mobile application on both Android and iOS platforms in China. Its development is spearheaded by Kelly Zhang Nan, former CEO of Douyin, who has transitioned to focus on AI-driven initiatives within ByteDance. It operates on a subscription model, with plans starting at 69 yuan (approximately $9.65) per month, allowing users to generate a substantial number of images and AI videos monthly.

Coze: AI Dev Platform

ByteDance’s Coze is an AI chatbot and application development platform designed to enable users—regardless of programming experience—to create, customize, and deploy AI agents across various platforms. Launched in early 2024, Coze offers a user-friendly interface with drag-and-drop interface, allowing for the integration of advanced language models, including ByteDance’s own Doubao series, as well as models from OpenAI and Anthropic. The platform supports multimodal inputs and provides a suite of tools such as workflow builders, plugin libraries, and knowledge base management to enhance bot capabilities. Bots developed on Coze can be deployed across multiple social and enterprise platforms, including Doubao, Feishu (Lark), WeChat, Discord, Telegram, and Slack.

Entering into 2025, Coze launched Coze Space, which is designed to facilitate development of AI agents. Built on Doubao LLMs, it supports the Model Context Protocol (MCP), and enables seamless integration with applications like Lark (Feishu) and Amap. The platform introduces an “Expert Agent” system capable of handling tasks ranging from answering queries to executing complex assignments. These agents can deconstruct user inputs into subtasks, autonomously utilize tools such as browsers and code editors, and produce comprehensive outputs like reports and presentations.

Gauth: Popular AI Homework App

Gauth, formerly known as Gauthmath, is an AI-powered educational app developed by ByteDance’s subsidiary, GauthTech. Launched in 2020, it offers students instant solutions to math problems by allowing them to snap a photo of a question and receive step-by-step explanations. The app covers a wide range of subjects, including algebra, calculus, geometry, physics, chemistry, and biology, and provides 24/7 access to human tutors for complex queries.

Gauth has gained significant popularity worldwide. By April 2025, the app’s website, gauthmath.com, received approximately 14.44 million visits per month, with the U.S. accounting for about 26% of the traffic . Additionally, Gauth became the second most-downloaded education app for Apple iOS devices in the US, just behind Duolingo.

Ola Friend: AI Earbud

Ola Friend is a pair of open-ear wireless earbuds introduced in October 2024. It marks the company’s foray into AI-powered wearables. Designed to function as a personal audio assistant, these earbuds allow users to interact directly with the Doubao chatbot, without needing to access their smartphones. By simply saying the wake word “Doubao Doubao,” users can engage in tasks such as language translation, practicing English, listening to music, or seeking information. Priced at 1,199 yuan (~$170), the Ola Friend earbuds are currently available exclusively in China.

AI Chips & Infrastructure

To support its AI ambitions, ByteDance made massive investments in computing infrastructure, particularly high-end chips. Training LLMs and serving AI features to millions is compute-intensive, and ByteDance has been racing to secure enough silicon—both through purchases and custom R&D—to stay ahead.

In January 2025, a Financial Times report revealed that ByteDance planned to spend an astounding $12 billion on AI infrastructure in 2025 alone. About $5.5B was earmarked just for buying AI chips within China, doubling its chip spend from the previous year. The remaining $6.8B was set aside for overseas expansion of AI capacity, mainly to procure advanced NVIDIA GPUs for training foundation models. In fact, ByteDance has become NVIDIA’s largest Chinese customer, having purchased an estimated 230,000 GPUs (mostly H20) in 2024.

ByteDance isn’t stopping at buying off-the-shelf chips; it’s also co-designing custom AI processors. In mid-2024, Reuters reported that ByteDance is collaborating with U.S. chipmaker Broadcom to develop an advanced 5-nanometer AI chip tailored to its needs. The chip, a custom ASIC, is designed to comply with U.S. export curbs (which target sub-14nm tech for China) and will be fabricated by TSMC in Taiwan. Analysts saw this as ByteDance’s proactive move to control its AI hardware destiny, much like Google’s TPU or Amazon’s custom AI chips.

Given ByteDance’s scale—comparable to Google or Meta in user reach—its drive to develop a self-reliant supply of AI chips is seen as both an offensive and defensive strategy for the years ahead.

Last Words

ByteDance wasn’t just one of the strongest AI companies in China. ByteDance was positioning itself, once again, as a global contender — quieter than OpenAI, more product-driven than Anthropic, more integrated than any other Chinese player. And with massive resources, top-tier talent, and a recommitment to AI research at the highest level, ByteDance’s next chapter was already underway.

Editor’s Addendum

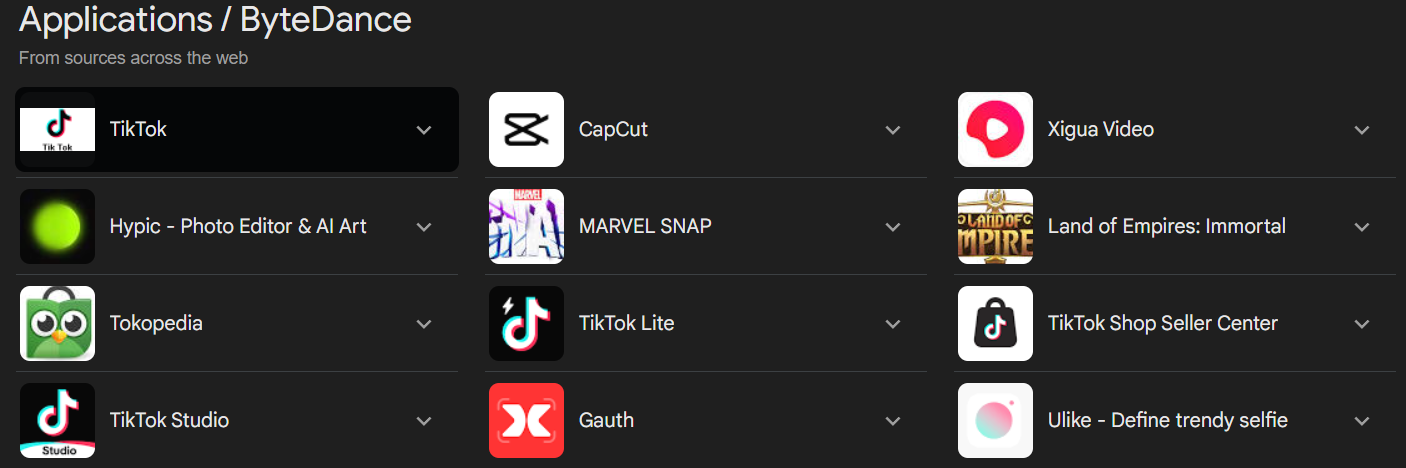

ByteDance’s consumer app ecosystem is wide ranging from entertainment, to social media, E-commerce, education and gaming.

-

Official list of apps.

ByteDance likely to overtake Meta in 2026

ByteDance is more than just the Meta of China. If Generative AI hurts Search Advertising, ByteDance like Amazon are among the most in line to profit from the disruption, not just OpenAI.

ByteDance expects to generate roughly $186 billion in revenues in 2025, up 20% from 2024, per Bloomberg. That puts it just shy of Meta’s forecasted $187 billion, underscoring how quickly the Chinese tech firm has become a global force.

One of the main reasons ByteDance has a solid trajectory is that it’s more diversified than just being a digital advertiser which leaves both Google and especially Meta vulnerable should their cash-cow ever falter. Meta’s fate of their potentially anti-competitive acquisitsion of Instagram and WhatsApp now rests with a single judge.

ByteDance didn’t acquire apps to become great, they built and scaled them. Before ChaGPT went viral ByteDance was easily the best at doing this in the entire world. They have made and scaled so many apps, most of them with a significant AI component, many of them no longer around. They had serious forays into gaming and VR, not always with success. Now they are a more mature company with reasonable investments in Generative AI. It increasingly looks like China will be the main exporter of Open-source and affordable AI models, tools and cost-efficient Enterprise AI for the world as the U.S. takes a more closed-source and expensive approach to profiting from their leadership.

Read More in AI Supremacy